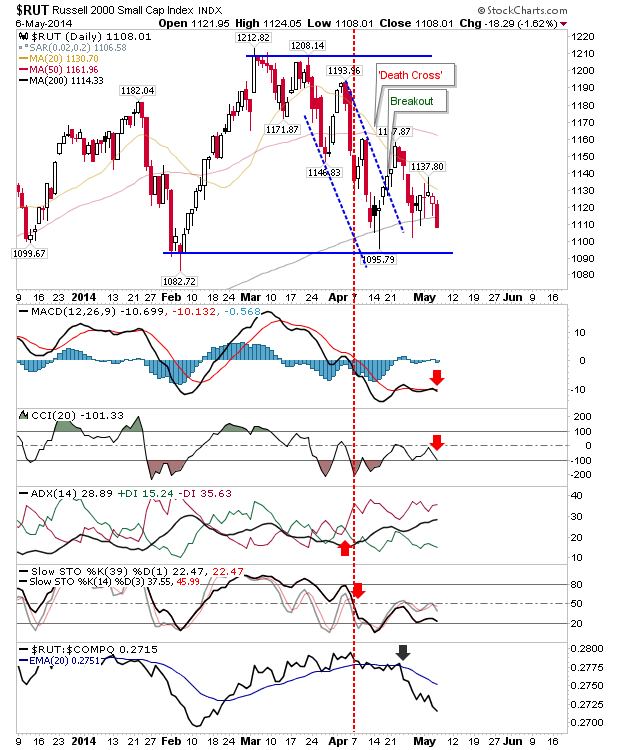

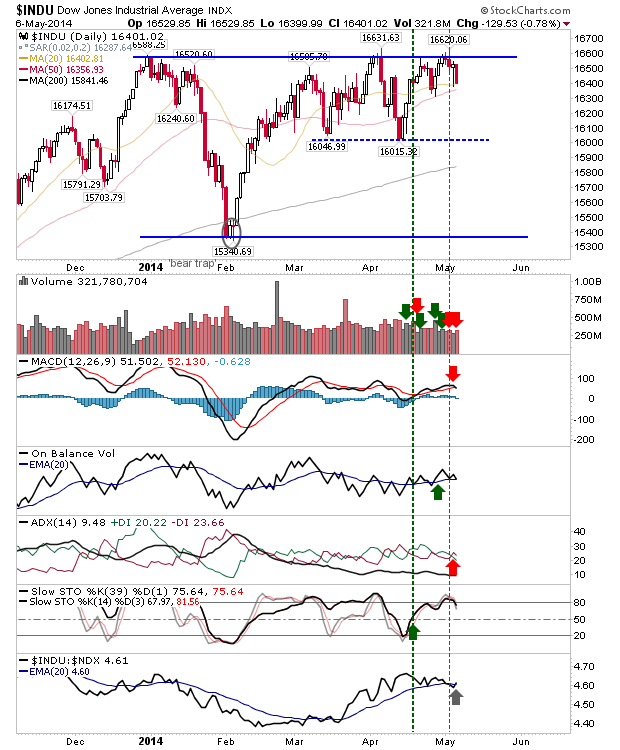

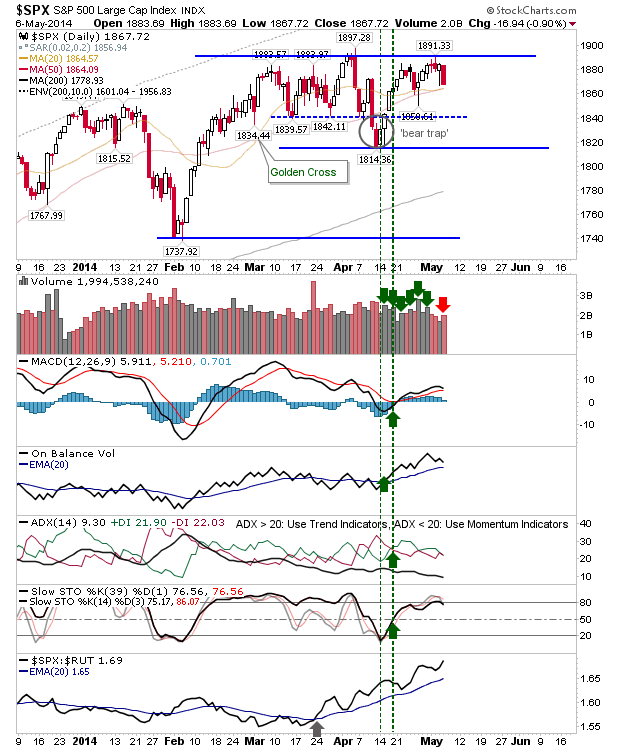

In the tug-of-war between bulls and bears, bears were able to make a substantial pull in their favour yesterday with the Russel 2000 undercut of the 200-day MA. However, bulls aren't defeated yet as they still have 20-day and 50-day MA support to lean on as part of potential breakouts for the S&P 500 and Dow, but their task has become a little more difficult after yesterday.

The finish in the Russell 2000 looked ugly, as the close was equivalent to the low of the day. The index has also struggled to mount a challenge on its (overhead) 20-day MA; an area of attack for shorts. The February swing low is still available for bulls to try and mount a defense, but demand will need to pick up sharply if it's to succeed. The Russell 2000 is also suffering from a significant flight of participants, noted by the sharp relative swing away from the index towards Tech and Large Caps, since the end of April.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI