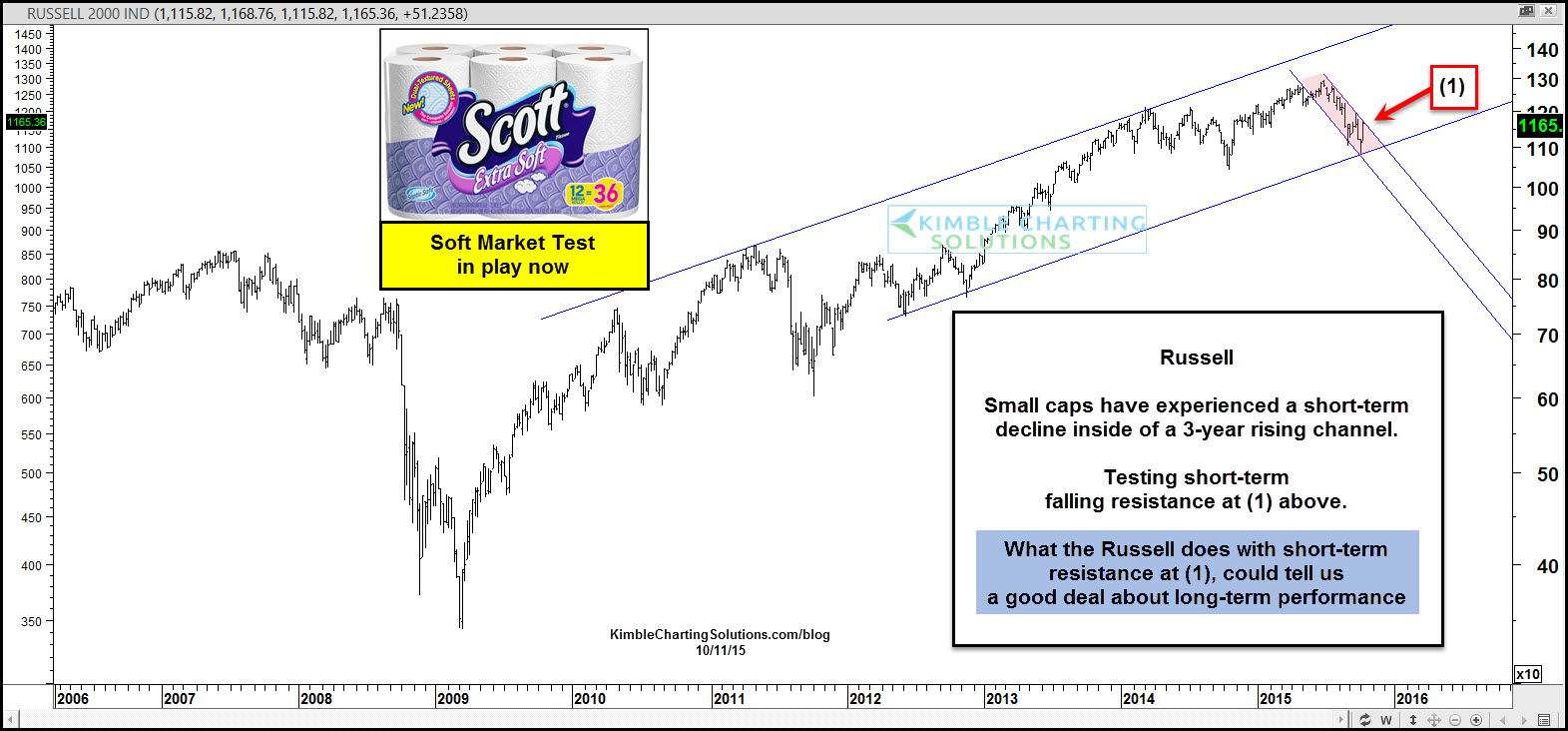

Like almost every index on the planet, small caps have experienced softness of late. The decline took the index down to rising channel support the week before last, where it created a reversal pattern (bullish wick) at support.

Last week's rally in stocks pushed the Russell 2000 to the top of its short-term falling channel at (1) above.

The long-term rising channel remains in play.

In my opinion, a big “softness test” is in play at (1). A breakout would be a plus, which would go a long way to saying the test of support was important.

If small caps fail to breakout above resistance at (1) and then break 3-year support, odds are high that the softness will continue.

I think both bulls and bears will be very interested in what happens at (1) over the next couple of weeks.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.