Asia stocks mixed amid tariff jitters; Japan tumbles on weak US jobs data

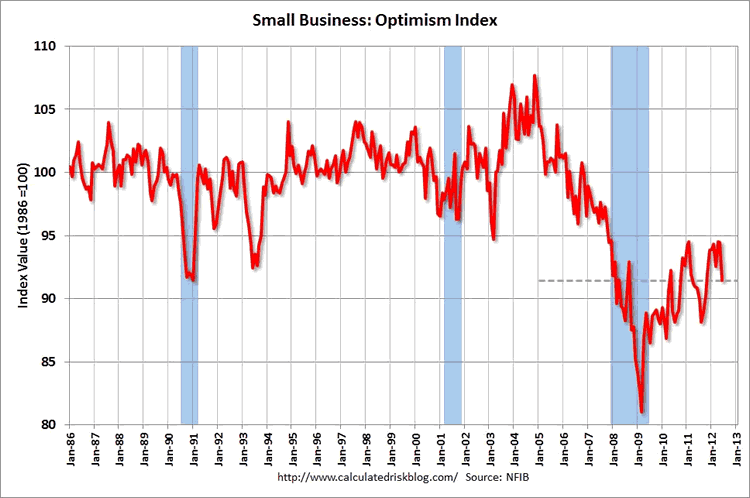

The National Federation of Independent Business (NFIB) reported that its optimism index declined to 91.4 in June from 94.4 in May, erasing the previous gains in 2012.

In a disappointing reversal of several months of slow but positive growth, June’s Index of Small Business Optimism dove three points, falling to 91.4. The decline is significant, and relinquished the gains achieved earlier this year. Only one of the ten Index components improved; labor market indicators and spending plans for capital equipment and inventories accounted for about 40 percent of the decline.

The following graph from Calculated Risk displays the long-term view of the small business optimism index.

Also notable, the job creation metric registered its first negative reading since December, indicating a weakening labor market and aligning closely with the recent deterioration in national employment data. Consistent with our outlook in March, we expect the overall deterioration in economic data to continue accelerating during the next several weeks as the US likely enters a new recession.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.