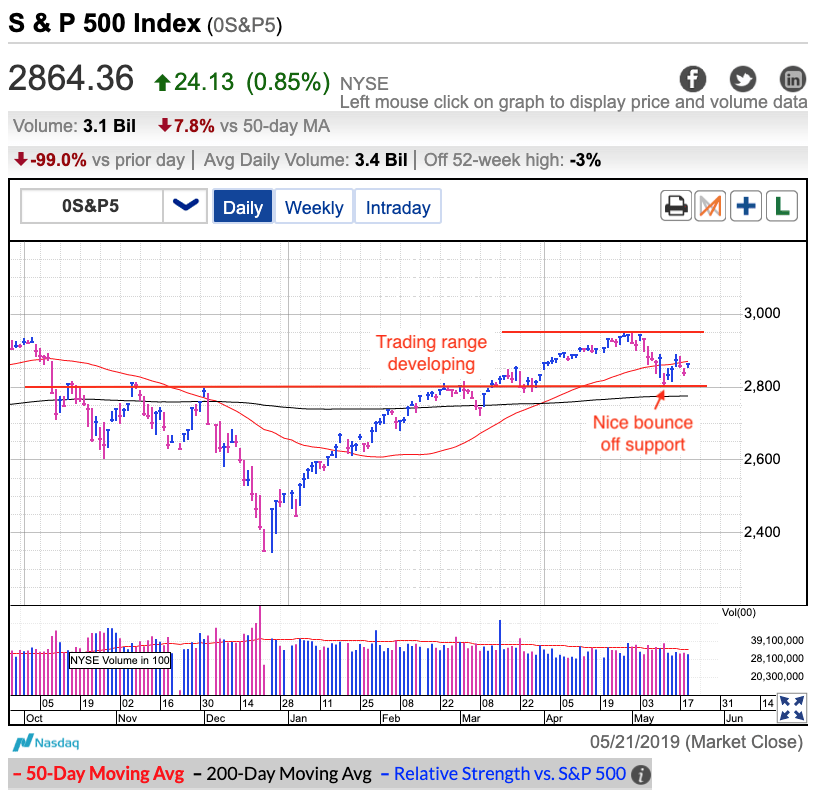

The S&P 500 is recovering from this month’s trade war swoon. Prices bounced off 2,800 support last week and are attempting to retake the 50dma.

As bearish as the headlines appeared, the market has been holding up remarkably well. Crashes from unsustainable levels are breathtakingly quick. This is the third week since Trump escalated the trade war and so far prices are only down a couple of percent. If this market was fragile and vulnerable to a collapse, we would have tumbled a lot further by now.

Quite simply, a market that refuses to go down will eventually go up. As long as we continue holding 2,800 support, the situation is constructive. Eventually headlines will let up and at this point, the only thing we need to rally back to the highs is less bad news.

That said, Memorial Day is just around the corner and we are quickly approaching the summer trading season. Big money managers are heading off to their cottages and that means less buying.

A market that refuses to go down combined with lethargic summer demand is the perfect recipe for a trading range. 2,800 support is the lower bounds and last month’s highs near 2,950 is the upper edge. Until further notice, a move to the lower end of this range should be bought and a rally to the upper end should be sold.

Most people know markets trade sideways more than they go up or down, yet every time they approach the lower end of a range, people cannot help but be overcome by feelings of doom and gloom. The same happens at the upper end, except this time people are counting all the money they will make as prices keep racing ahead. Unfortunately, these reactions end in people buying the highs and selling the lows.

It’s been a great year and it only makes sense prices will stagnate for a while as we consolidate recent gains. Stick with your favorite long-term investments. But over the next few months, the best money will be made swing trading a rangebound market. Currently, we are on the upswing following last week’s bounce off support and the next move is still higher. But rather than get greedy when we return to the highs, takes some profits and get ready to do it again.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI