Trump slaps 30% tariffs on EU, Mexico

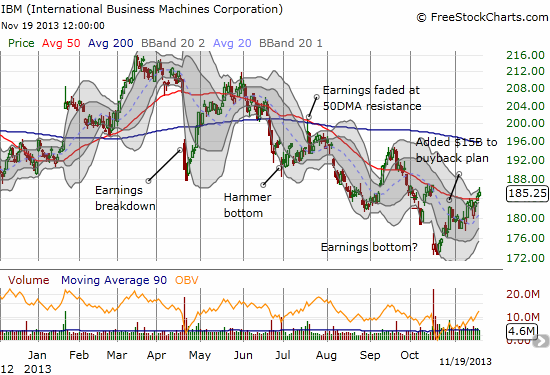

I last reviewed International Business Machines (IBM) on July 1st of this year. At the time, the stock printed a near picture-perfect bottoming pattern (see chart below) that over-extended the stock. The bottom play lasted about two weeks before the stock’s 2013 downtrend regained control. The stock then flipped 180 degrees as it made a near picture-perfect failure at resistance at the 50-day moving average (DMA).

Fast forward four months and the stock has pretty much followed its 50DMA downward. However, the current retest of this resistance is “different” this time.

IBM fell 6.4% after it reported earnings in October, yet sellers never managed to get follow-through. I took the cue and jumped on some call options. When the stock soared a week later on news of yet another big buyback, I sold (added $15B to create a massive $20B kitty). It looked like good timing as the stock drifted downward for another week or so, reversing those gains in the process. However, now, IBM has pushed higher yet and managed to close above its 50DMA.

While mild, I think the current breakout is important. I am sure there are plenty of IBM bears who have tried to fade IBM post earnings expecting follow-through. Indeed, shares short in IBM are now at a 2+ year high (although this only represents 1.8% of float). I think they will be very disappointed for at least the remainder of the year because IBM suddenly looks like a very cheap stock for anyone scouring the market for something to “comfortably” buy. If it were a small cap, it would be a candidate for the “January effect” trade where the downtrodden and under-performing stocks of the year tend to pop going into or in January as bargain hunters swoop in.

In a market full of high-flying, highly charged, expensive, momentum tech stocks, IBM is the elderly statesman plodding along certain its best days are still ahead. The stock is down 3.2% for the year, making it an extremely poor performer relative to the market (a sure candidate for Dogs of the Dow!). It pays a 2.1% annual dividend and trades at a modest 10.3 forward P/E, 12.8 trailing P/E, and 2.0 price-to-sales. Throw in the buyback and your average bargain-hunting bottom-fisher will forgive a few blemishes on an earnings report and an otherwise ominous downtrend. The big bugaboo from IBM’s last earnings was a $1B miss on revenues, marking a third consecutive quarter with a revenue miss. IBM has generated declining revenues six quarters in a row. IBM reaffirmed its guidance for 2013, but clearly that was not enough to mollify investors and traders at the time.

At least two technical obstacles stand in the way of the budding post-earnings recovery. I already pointed out the downtrend now marked by the 50DMA. IBM has also closed its post-earnings gap down. Sellers could step in here, relieved to get a second chance to jump through the escape hatch. If IBM manages to push on anyway, I think it will easily be good to go for a test of 200DMA resistance sitting around $195.

I think IBM is a simple and “easy” trade. The downside risks are not nearly as high as most high-flying tech stocks that are all the rage right now. Note how many have been slammed the past few days as IBM has inched higher. IBM has experienced several beatings this year that I suspect have squeezed out a good number of sellers. I have added this stock to my list of “cheap recovery stocks” to buy when conditions appear ripe to do so (like a follow-through past the October earnings gap down).

Be careful out there!

Full disclosure: no positions

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.