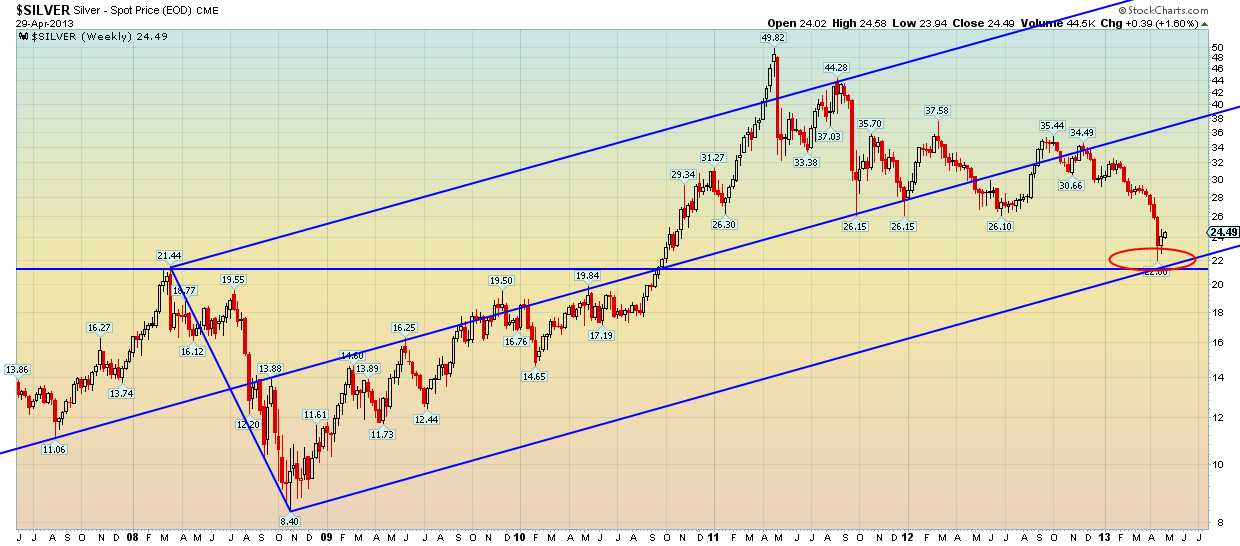

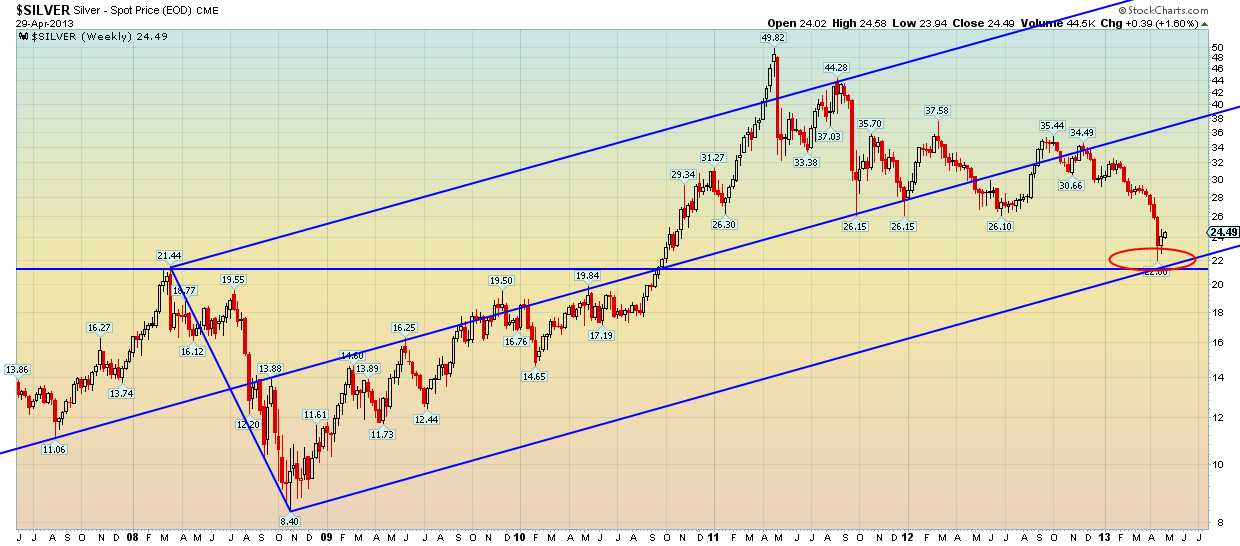

Last time we posted an analysis on Silver we mentioned the increased possibility that at least a short-term bottom was formed after the aggressive sell off pushed prices in two days from 26 to 22. The chart below is an update of the last post, where we noted the importance of the lower pitchfork support combined with the 2008 peak.

Those two details were the reason why prices bounced right back up towards 25.

The upward move from $22 is still considered as an upward correction. The pattern of the rise is still overlapping as there is no clear indicator of an impulsive move upwards. This overlapping pattern, as shown in the chart below, is very helpful for trading, as we can adjust our stops accordingly.

The first upward target has been achieved and it now only remains to be seen if buyers can break above the $25 resistance and try to reach the $26 area. The trend in Silver for the short term remains up, but we must be careful as the downward trend could resume soon.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Those two details were the reason why prices bounced right back up towards 25.

The upward move from $22 is still considered as an upward correction. The pattern of the rise is still overlapping as there is no clear indicator of an impulsive move upwards. This overlapping pattern, as shown in the chart below, is very helpful for trading, as we can adjust our stops accordingly.

The first upward target has been achieved and it now only remains to be seen if buyers can break above the $25 resistance and try to reach the $26 area. The trend in Silver for the short term remains up, but we must be careful as the downward trend could resume soon.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.