Asia stocks: S.Korea rises past Trump tariff threat, Australia flat ahead of RBA

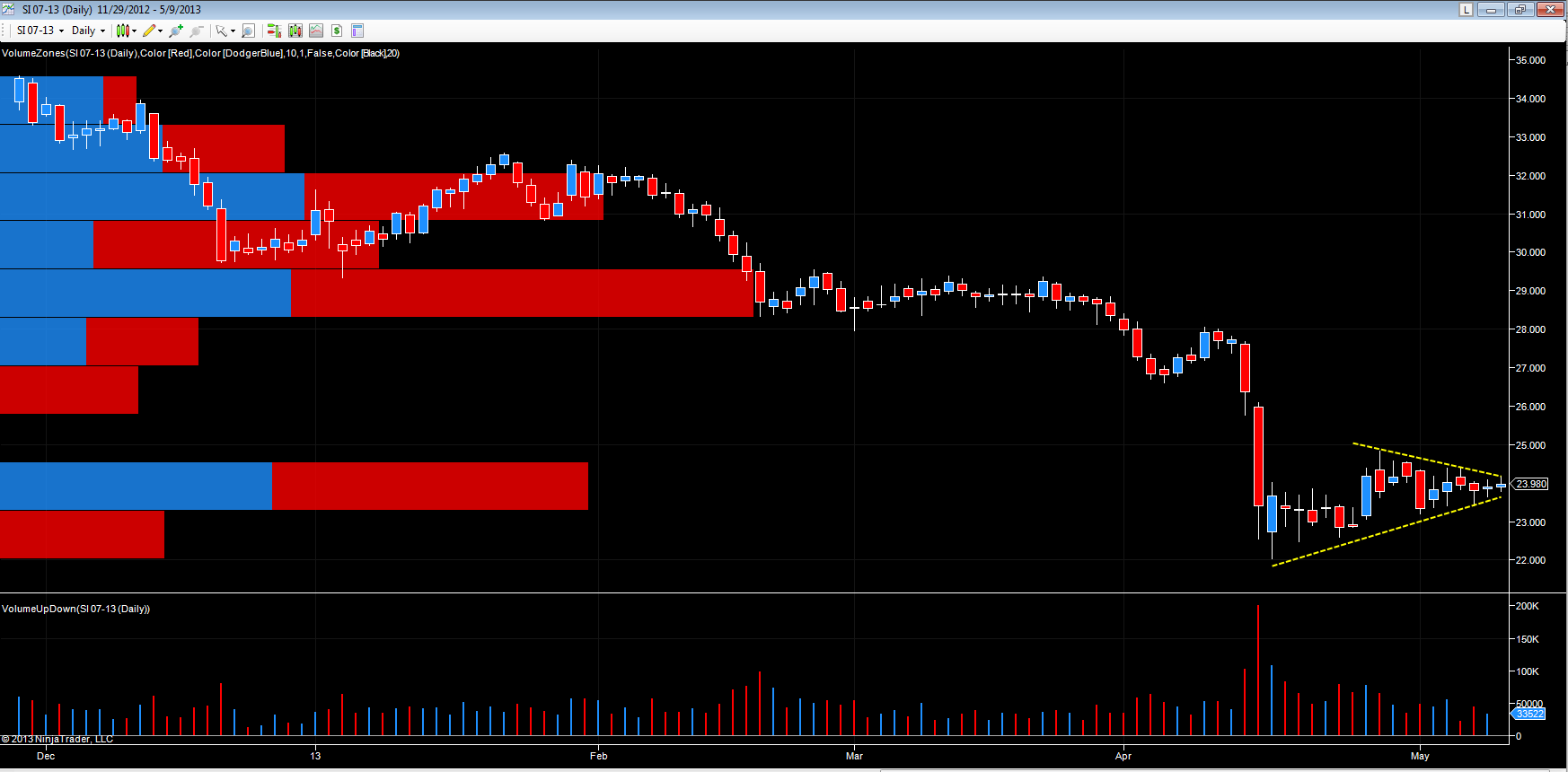

While gold has managed to struggle and claw it’s way higher following the sharp sell off in mid April, silver has remained waterlogged on the daily chart, trading in an ever tighter range, as the metal refuses to break out from the current narrow price band. Indeed, since late April silver is increasingly developing a pennant pattern as shown with the yellow dotted lines on the chart. The pattern is created as the higher lows to the downside, are matched with lower highs to the upside, creating this classic formation. As always, and as Wyckoff always stated, cause and effect go hand in hand. In other words, the longer the cause, then the greater the effect, and the question now is whether silver will breakout to the upside of the downside.

For option traders, this is one of the great patterns to trade, with a simple straddle, the strategy of choice. The longer this price action continues, then the more explosive will be the breakout when it occurs, and with the pennant formation, there is little in the way of market bias to give us any clues. Since the extreme volume of mid April, volumes for both up and down days have remained average or above, and with the price action, generally closing with a candle of indecision, the picture here is unclear at present. What is clear, is the depth of support and resistance now being built on the volume at price histogram in the $23.50 to $24.50 per ounce area, and this will now be key to any price breakout. A move higher will then have a solid platform in place below, and equally a move lower will then have a solid area of resistance above.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

As always, we have to be patient and wait, or implement a straddle strategy or similar to take advantage of any breakout, when it arrives. But timing is everything and remember, the longer we wait, then the greater the trend when it does break.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.