Silver strengthened as the US dollar fell and by now, the metal has returned to the level of the March maximum (18.00). Due to the absence of relevant macroeconomic events, investors continued to buy metals trying to take a lead from negative Friday data for USD. On Friday, the US Congress refused to vote on the cancellation of Obamacare, one of the main initiatives of President Trump. A failure in this important issue showed that it would be difficult for Trump to promote his ideas in Congress. This caused traders to sell USD and buy silver as a safe-haven asset. After testing resistance at 18.11, silver partially corrected, but its growth potential does not seem to be over.

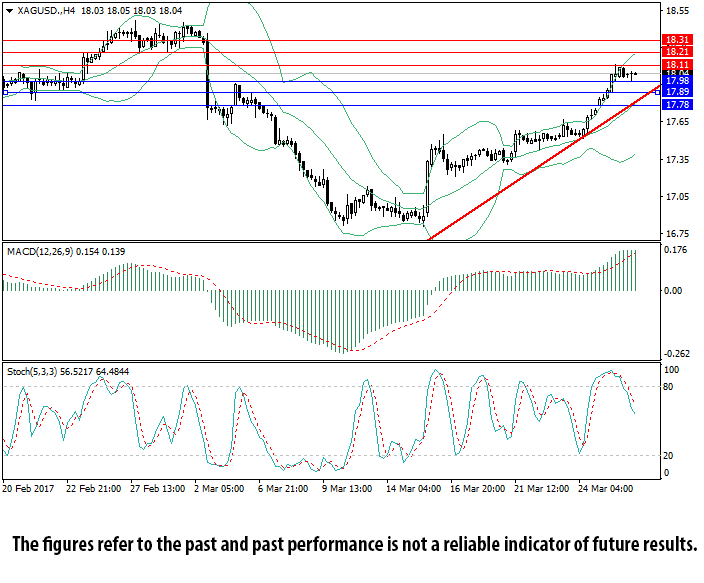

Technical indicators show that growth will remain, but there are also signs of a forming correction. Bollinger® Bands are directed upward and the price has broken through the upper band indicating the possibility of correction to the middle-band level (17.80). MACD histogram is located in the positive zone, however its volumes have slightly decreased, which is again a sign of correction. Stochastic left the overbought zone and is moving down. It will be possible to speak about an upward trend after the price consolidates above 18.21.

- Support levels: 17.98, 17.89, 17.78.

- Resistance levels: 18.11, 18.21, 18.31.