Could Silver be creating a topping pattern at current prices? Possible, still too soon to tell though!

The first chart looks at Silver Futures on a daily basis over the past 18-months. The rally since Mid-November reflects that Silver is testing highs of a few weeks ago at (1).

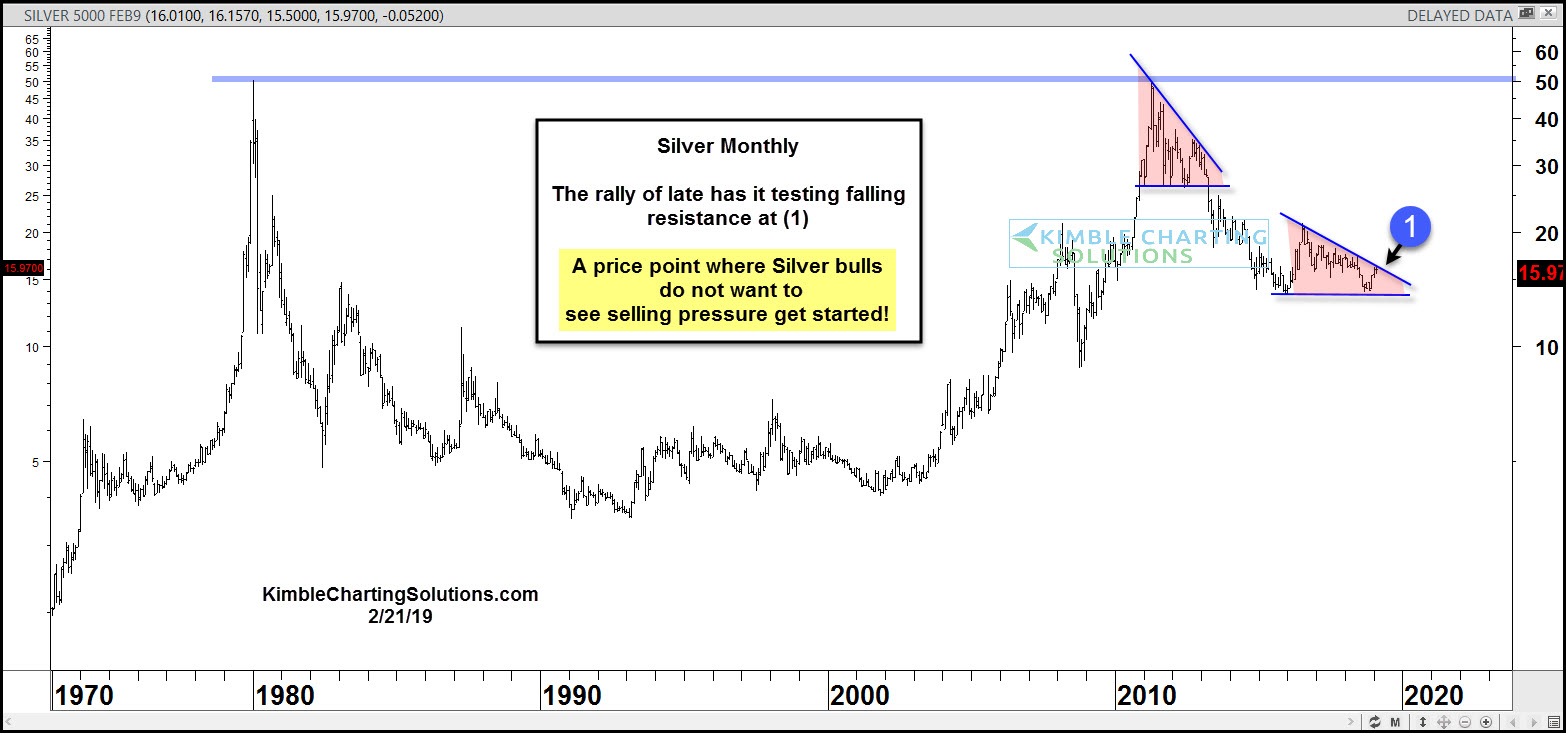

The chart below looks at Silver on a monthly basis over the past 40-years.

This long-term chart highlights that Silver peaked in 2011 at the same price as it topped in the early 1980’s.

The rally of late has it testing falling monthly resistance at (1), which could be the top of a descending triangle. Both of these charts reflect that Silver is currently testing very important levels on a daily and monthly basis.

Metals bulls would love to see a breakout from current levels. They would receive short-term concerning news if selling pressure gets started at current levels.

Keep a close eye on Silver here, as the current price point looks to be very important.