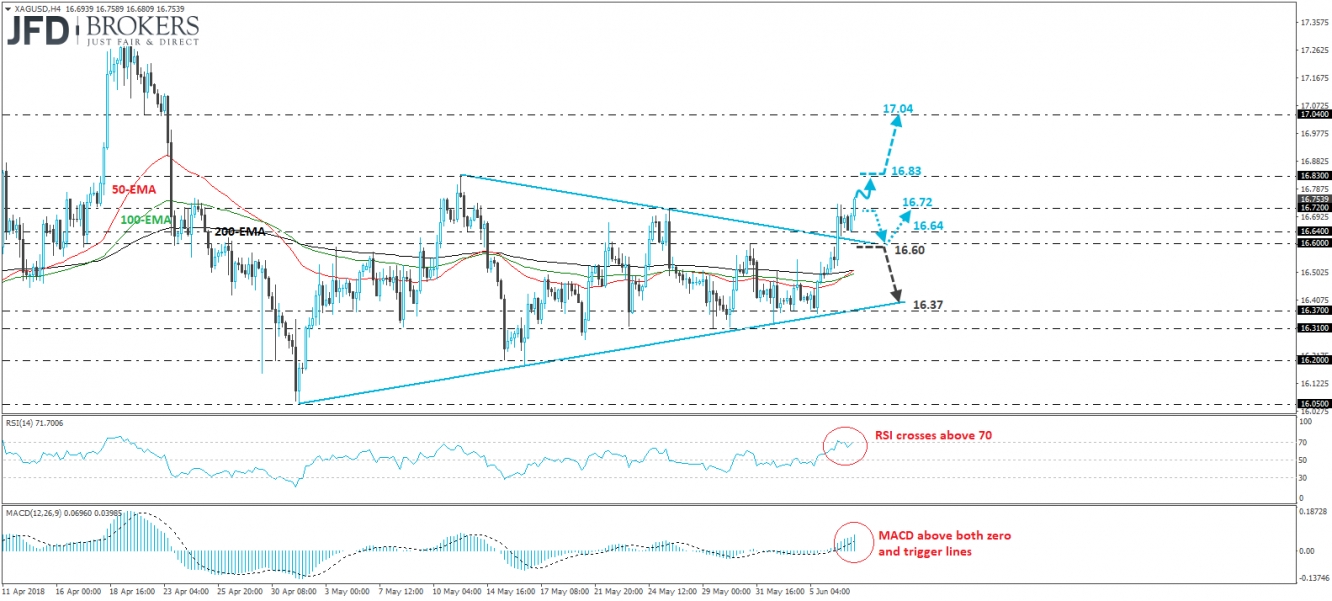

Silver surged yesterday, breaking above the upper bound of a symmetrical triangle that had been containing the price action since the beginning of May. Today, during the European morning, the white metal continued trading north and managed to overcome the 16.72 level, a resistance marked by the peak of the 25th of May. Thus, having all these in mind, we believe that the short-term outlook has now turned positive.

We would expect the break above 16.72 to open the way towards the 16.83 hurdle, defined by the high of the 11th of May and if the bulls prove strong enough to overcome it, then we may see them setting the stage for the 17.04 territory, marked by the inside swing low of the 20th of April.

Our short-term oscillators detect upside momentum and corroborate our view. The RSI turned up again and just poked its nose above its 70 line, while the MACD, lies above both its zero and trigger lines, pointing up.

On the downside, a dip back below 16.72 could pave the way for the 16.64 or the 16.60 support zones, but even if this is the case, as long as the price would be trading above the upper bound of the aforementioned triangle, we would still see a decent likelihood for a rebound. We would like to see a clear dip below 16.60 before we abandon the bullish case. Such a dip would bring the metal back within the triangle and could turn the outlook back to neutral.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.