Are DOGE layoffs set to resume?

Talking Points

- Silver/XAG/USD fall through support signals turning point.

- EUR/USD may push lower again; USD/CAD eyes inv H&S.

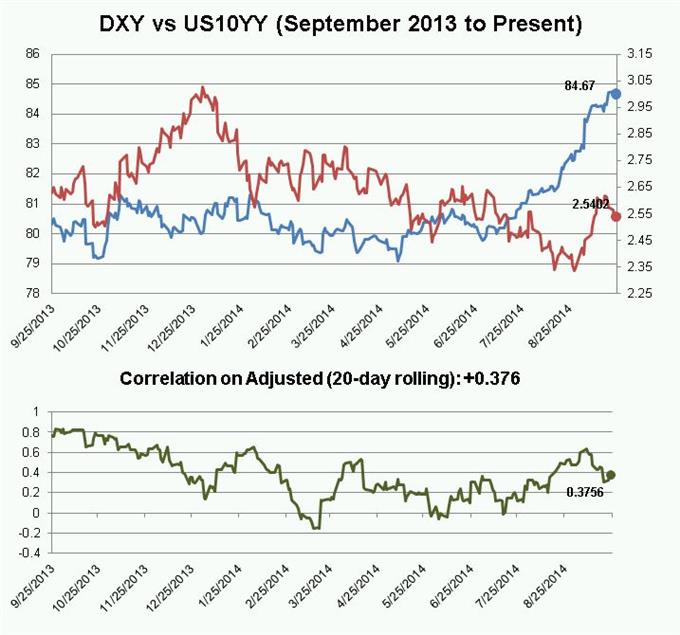

During August and early-September, the rise of US Treasury yields neatly coincided with an already-bullish landscape for the US Dollar, proving to be further fuel to the fire. Yet over the past two weeks, the greenback has persisted as a top performer while long-end US yields have come back in after their brief jump:

The 20-day correlation between the Dollar Index and the U.S. 10-Year yield has fallen from +0.632 on September 8 to +0.376 today. Evidently, given the US Dollar's continued elevation, yields are acting as a one way street for the greenback: higher yields help while lower yields have thus far been laughed off.

The attitudinal shift with respect to the US Dollar is apparent elsewhere. Even as US yields have generally remained lower in 2014 as evidenced by the flatter yield curve YTD, part of the reason has been the jump in short-term rates, not just lower long-term rates.

The recent breakdown in Silver coupled with signs of a market more willing to deal with a strong dollar while shrugging off what should be negative forces fits in with the market's evolving sentiment.

See the brief video above for what the technical breakdown in Silver means for the majors such as EUR/USD and USD/CAD over the coming days.

--- Written by Christopher Vecchio, Currency Strategist

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.