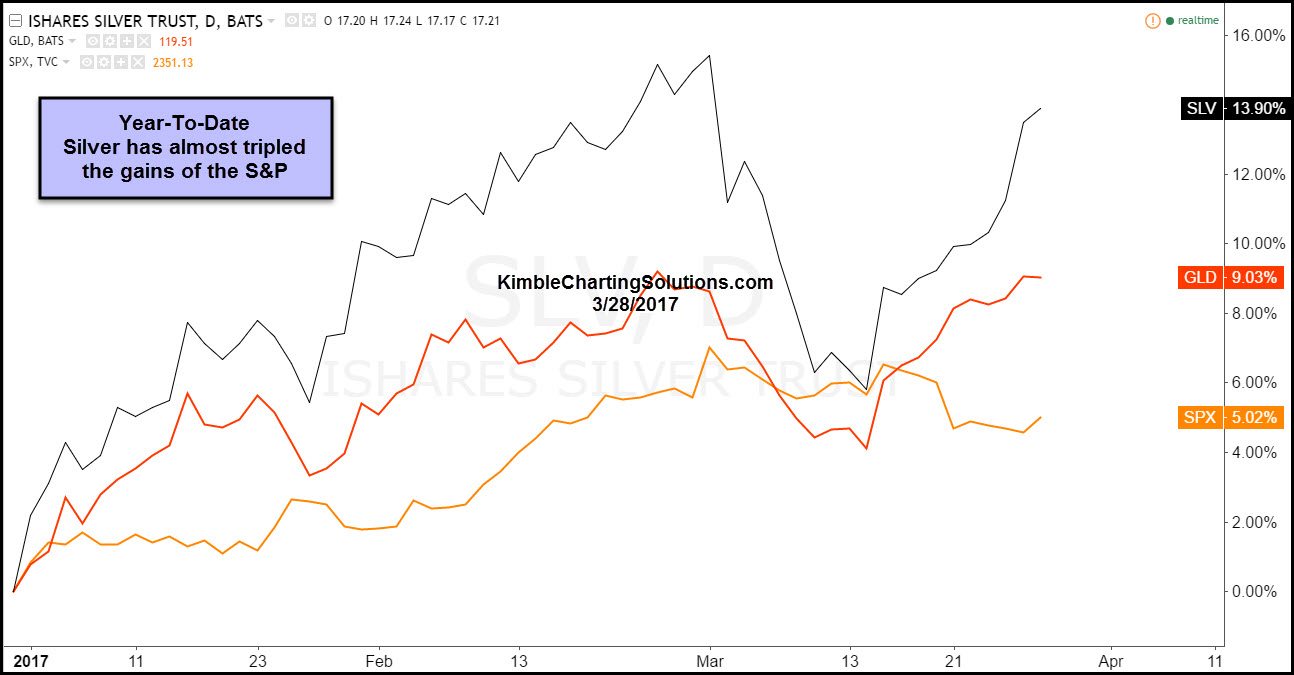

Below looks at silver, gold and the S&P 500 year to date. Metals and miners are off to a good start in 2017. Even though the stock market has received a good deal of attention this year, metals have done even better. Is 2017's performance so far the start of something even bigger for silver and gold?

It’s been a long time since buy-and-holders have experienced a bull market in silver. How long has it been? Silver has created a series of lower highs since 2011. Silver's trend remains down and has a chance to break this important down trend.

Below looks at the silver:gold ratio over the past 10 years. Last summer, the ratio hit the top of falling channel (A) and failed to breakout. When it couldn't breakout, gold, silver and the miners turned weak.

Over the past 9 months, the ratio has created a series of lower highs and higher lows, forming a narrowing pennant pattern that is nearing completion at (1). The end of this pennant pattern is happening as the top of the pattern represents the top of the 6-year falling channel.

If silver's bear market ends, keep a very close eye on what happens at (1). Premium and Metals members have played miners to the long side since 12/27/16. Even though gold and silver have done well, miners have done even better.

GDX is nearing falling resistance, similar to the ratio above. Members are pulling up stops on our miners positions as the ratio above is testing one of the most important resistance/breakout tests in years. If the silver:gold ratio manages to do what it hasn't done in 6 years -- breakout -- it would be bullish all around for silver, gold and the miners.