The stories relating to Monday’s stock market action will focus on the sell-off that happened after an exhuberant rise overnight that coincided with Larry Summers' withdrawing his name from consideration as Federal Reserve Chairman. All markets did sell off eventually, but if you look a little closer some were stronger than others.

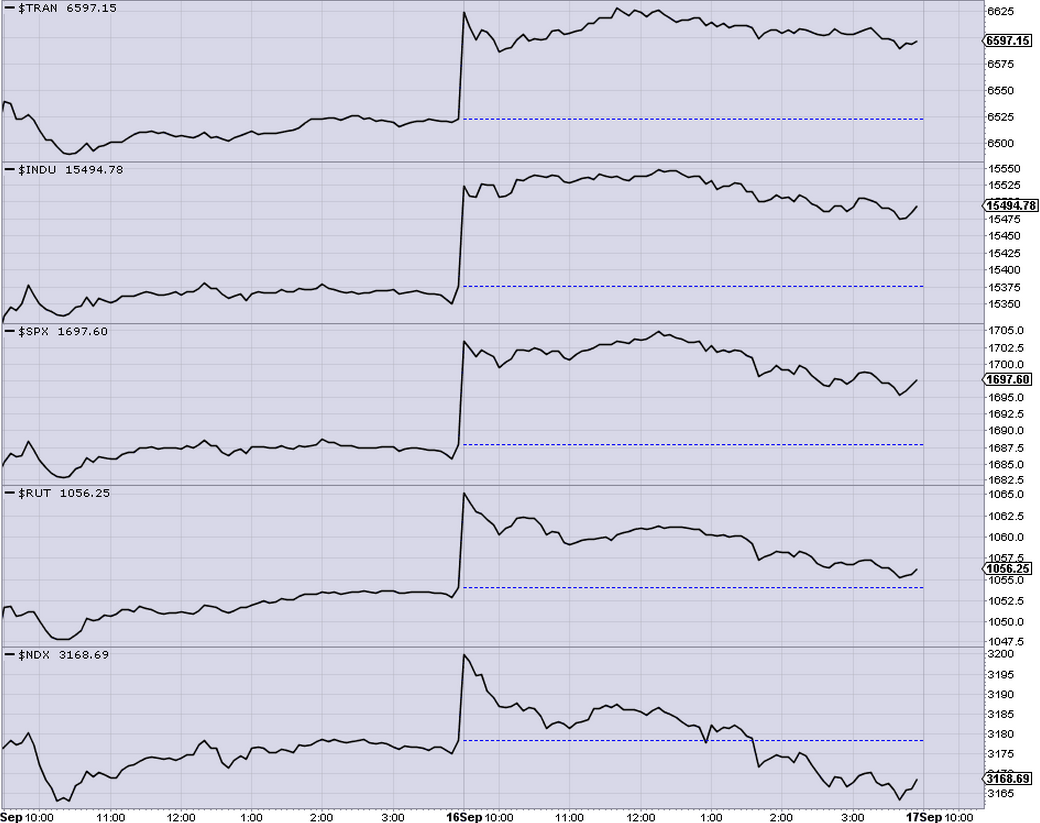

Below is a two plot of the 5 minute price action in 5 major market indexes, the Dow Jones Industrials (DIA), Dow Transports (IYT), S&P 500 (SPY), iShares Russell 2000 Index, (IWM)) and Nasdaq 100 (QQQ). All show the Summers bounce.

But contrast the differences in the price action from there. The Nasdaq 100 at the bottom started heading lower immediately and by 1:30 was negative on the day. While the Dow Jones Industrials and Transports held pretty steady and finished with good gains on the day.

In fact, the more the index was focused on large cap names the better it did Monday. This is particularly interesting for a couple of reasons. First, there has been much made of the Dow generals not making new higher highs as the smaller cap indexes have. Monday was in a way some catch up for them. With the Nasdaq 100 and Russell 2000 leading the latest leg higher, perhaps this is the start of a rotation back towards the large cap names. Only time will tell, but it may pay to keep your mind open to the possibility.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.