Trump slaps 30% tariffs on EU, Mexico

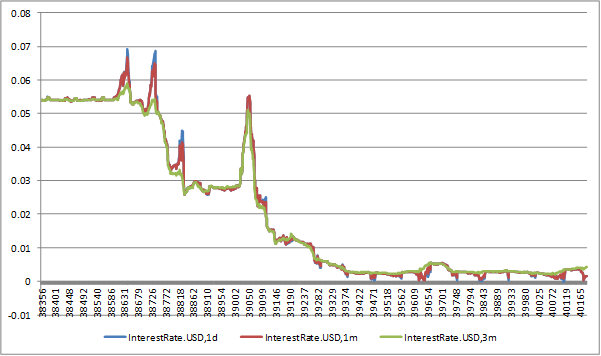

The dynamics of different parts of the term-structure often look quite different. Examine this graph, for instance (the x-axis is in Excel format dates, so from 4-Jan-2005 through 18-Dec-2009):

This graph superimposing 1d, 1w, and 3m rates shows that they are tightly grouped at the same level at any given time in the graphed period. All of the rates are clearly strongly influenced by administered Fed rates, indicated by the early flat section. The 3m rate is the smoothest, so the others can be regarded as occasionally straying from the 3m base before quickly being brought to heel.

The daily volatilities of the 1d and 1w rates, however measured, are not a good guide to longer-term volatilities. The 3m rate has undergone a regime change that induces a drift which is quite significant compared to daily volatility, and would have to be taken into account if measuring 3m daily volatility.

(I note in passing that the 1d and 2w excursions are not very random-looking, they have a fair amount of structure; there is an initial regime were small deviations are equally likely to be either higher or lower than the 3m rate, followed by a regime switch to a period when there appear to be large excursions exclusively to the upside, followed by another period of more symmetric deviations, followed finally by a fourth period in which all deviations are to the downside. The structural breaks or regime changes that I am claiming can be seen here can be very violent for some currencies, and pose significant problems in risk modeling.)

Looking at the graph, the target of mean reversion for 1d and 1w rates ought to be the current 3m rate, so that the 3m rate could be regarded as the driving process for this part of the curve. But the typical IR model does not support this feature: a given rate usually reverts to either a historical or an implied rate of the same constant-maturity tenor or of a given fixed maturity.

Guest post by Philip Koop (SunGard)

Philip discusses short-term rate dynamics in response to the post on treasury term structure volatility.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.