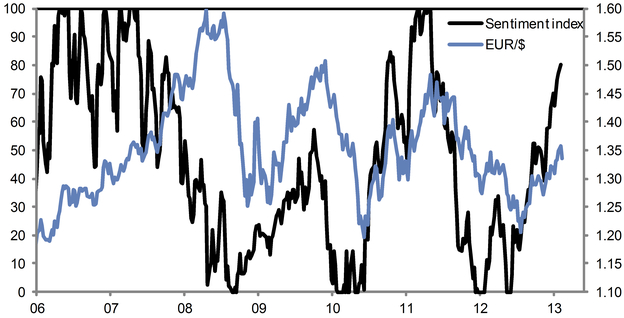

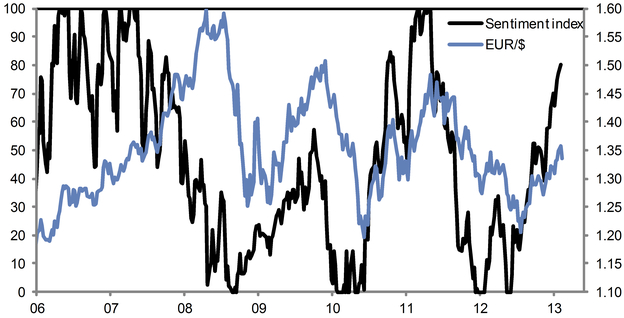

It's quite amazing how the world has changed in just a few months. Back in July traders were still piling into the short-euro trade. Nobody wanted to hear that it was becoming a "crowded trade" - after all the euro "can only go down". Since then these euro bears have endured pain, as the sentiment reversed sharply. The Goldman EUR/USD sentiment index, which is based on the CFTC statistics of speculative positions of futures traders, is moving deep into the bullish territory.

GS: - Net EUR long spec positioning continued to rise; at 80.4 percent our Sentiment Index (SI) is now at its highest level since May 2011

The fundamentals continue to support this position, with the ECB uninterested in pushing the euro lower. But the technicals will need to be watched closely for signs of overcrowding.

GS: - Net EUR long spec positioning continued to rise; at 80.4 percent our Sentiment Index (SI) is now at its highest level since May 2011

The fundamentals continue to support this position, with the ECB uninterested in pushing the euro lower. But the technicals will need to be watched closely for signs of overcrowding.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI