Stock market today: S&P 500 slumps as Trump tariff blitz triggers bloodbath

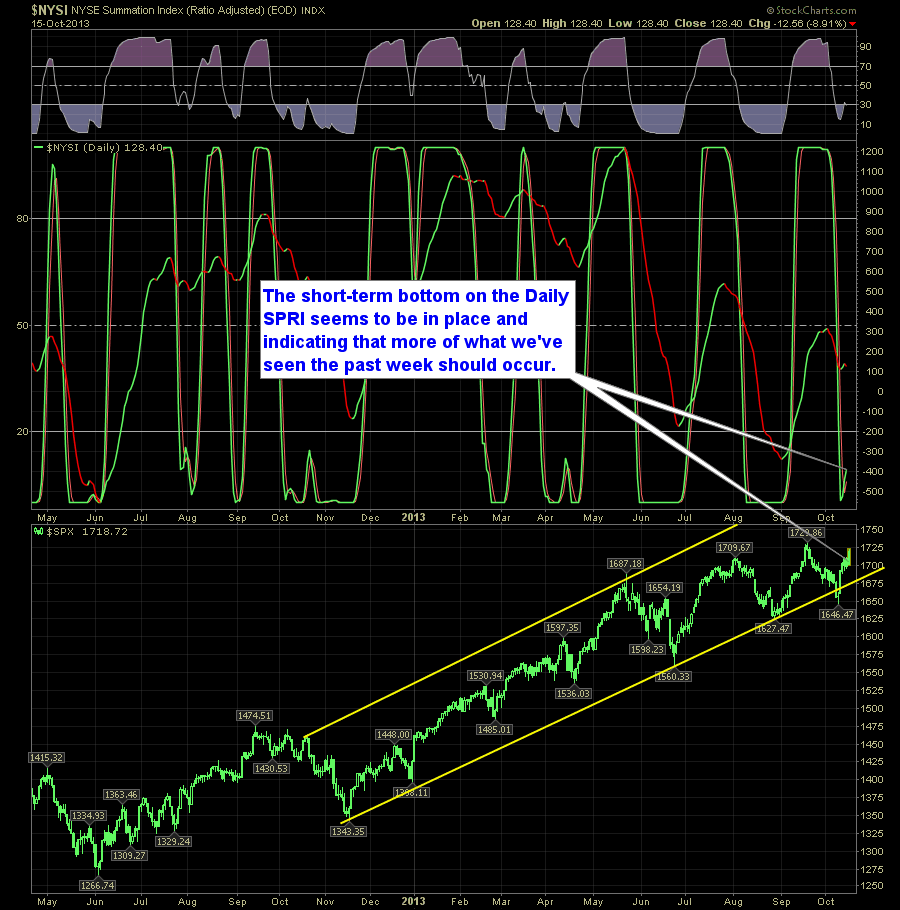

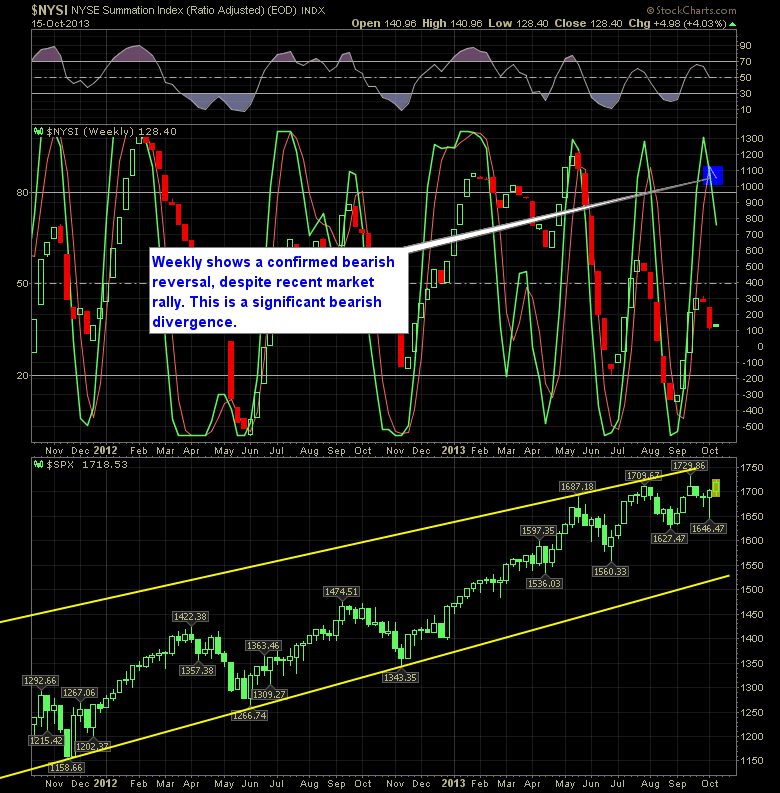

There is a discrepancy now between the daily and the weekly SharePlanner Reversal Indicator.

One would suggest that the weekly SPRI is a bearish divergence to the daily SPRI. But for now, I am following the direction of the daily SPRI:

The weekly suggests with the recent bearish confirmation of a reversal, that we should be trading short. However, the Weekly SPRI can handle a certain amount of bullishness in the short-term before it invalidates the signal that it is providing us with.

So for now I am taking the long side of the trade and following the daily SPRI, then following the weekly after the SPRI Daily reaches a peak.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.