Bitcoin price today: hovers at $114k after steep losses on tariff, economic fears

It looks liked today, initially at least, that the market would be roaring to the upside and while it is still up a substantial amount, it hasn't held on much to the gains except for what it started the day with. So really there hasn't been any action out of the market today, and the perfect opportunity to make today a 2-3% rally for SPX was totally wasted with the Janet Yellen testimony.

Instead we are with oil dropping, and the favorable action taken by the European central bank overnight not even lasting a full day's worth.

Of course there is still time left to the trading session today and the market could still rally, but as it stands right now, the rally seems very uninspiring.

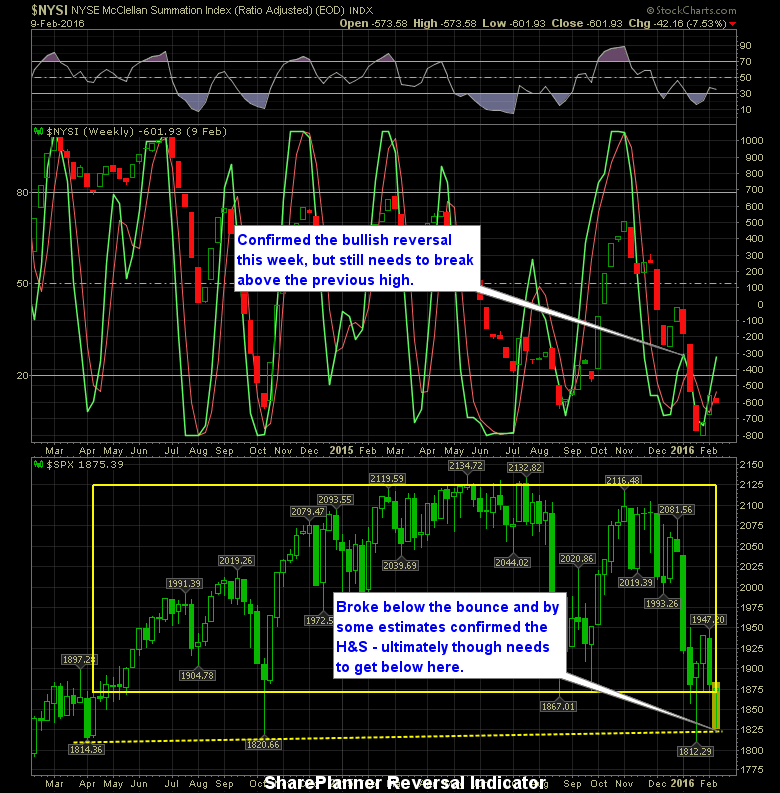

Now what should we make of the Weekly SharePlanner Reversal Indicator?

You'll see that it is just about ready to trigger a bearish reversal which is the exact opposite of what is happening on the Weekly Time Frame where it has already triggered a bullish reversal. Yes, it is confusing, and not everything in trading is suppose to be clear cut, otherwise everyone would be trading and everyone would be profitable.

So what do I make of this?

First, I am going to need to see more confirmation on both time frames, on the daily, I need to see the reversal actually happen before determining anything else about it, and on the weekly (below) I need to see it not only hold the current confirmation but make a move above the previous high, and establish a higher-high. If that happens, there will be a little bit more clarity on the market's direction going forward.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI