Bitcoin price today: dips to $108.2k on tariff woes, Trump’s shifting deadline

Sentiment And Fund Flows In Perspective

Since shortly after the election in November last year, the market (S&P 500 Index) has moved higher by over 11%. This move has confounded some as the year end fiscal cliff was around the corner and could have certainly derail further market advances. As I wrote in September in answer to a client's question regarding the market, polls were projecting an Obama win and expectations were Congress would let the country go over the cliff. If the cliff was averted, I noted this could be positive for the market as the market was expecting worse.

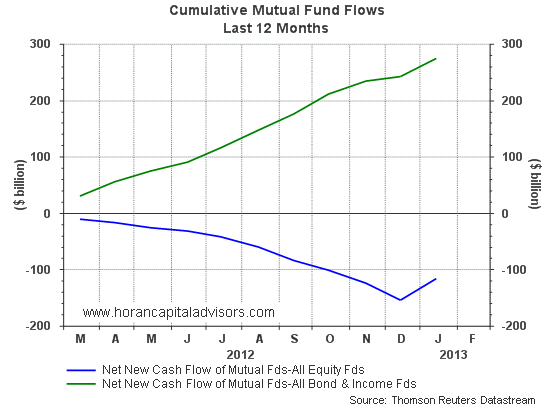

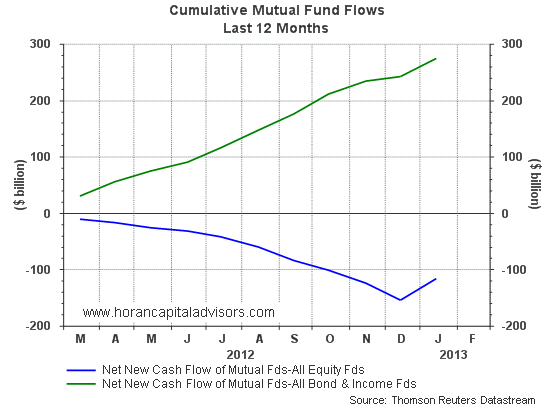

I have noted in several earlier posts about investors allocating more of their investment dollars to fixed income or bond investments versus stocks over the last four years. This has occur in spite of the fact stocks have been a far better performer than bonds during this time frame. So far this year though the financial media has noted that investors have poured record amounts of investment funds into stocks. My first thought is investors are now buying stocks after a four year period when stocks have outperformed bonds. One potential concern as it relates to individual investor sentiment is they tend to make incorrect investment calls at market turning points. So are we really seeing investors choosing stocks over bonds now?

As the blue line in the below chart shows, equity fund flows did turn positive in January. However, the bond fund flows (green line) are also positive. What appears to be occurring is investors simply moving out of cash and into both stocks and bonds.

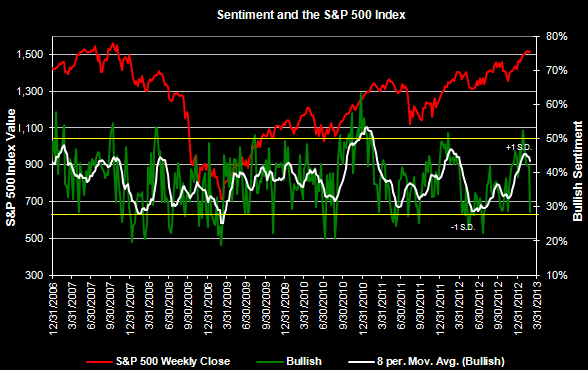

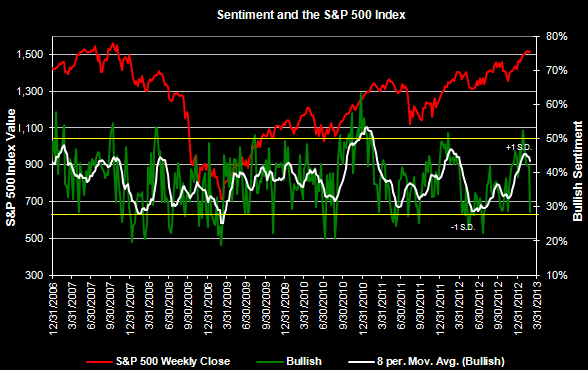

It does seem investor skittishness remains high as well. In last week's American Association of Individual Investor sentiment survey, it was noted that bullish sentiment fell 13.4 points to 28.4%. This lower level of bullish sentiment is one standard deviation from the longer term average. This also resulted in the bull/bear spread equaling a negative 8.2 percentage points. Investor sentiment does tend to be most accurate at extreme levels.

Lipper also reported last week:

"There was one big change, however, equity mutual funds and equity ETFs as a group suffered their first week of net redemptions in the last ten weeks, as investors took some of their hard-won profits off the table out of fear that they might be in jeopardy in a deteriorating investment climate. All told, these investors pulled a net $900 million out of stock mutual funds and ETFs, although they injected $4 billion of new capital into taxable bond funds as well as $300 million into municipal bond funds (their ninth straight week of net inflows) and $3.6 billion into money market funds, a traditional safe haven in times of volatility or anxiety...The most recent weekly period was the first time in eight weeks that equity ETFs experienced net outflows, as investors pulled out some $3.8 billion."

At the end of the day investors do not seem overly bullish (actually far from it) and they do seem under invested in equities as a whole due to a cautious positioning ahead of the election and fiscal cliff. So long as companies can deliver on earnings and Washington actions (or inaction) do not derail the economy, the market could grind higher near term although it will likely be volatile. An important near term resistance level is the 2/19 S&P close of 1,530.

Since shortly after the election in November last year, the market (S&P 500 Index) has moved higher by over 11%. This move has confounded some as the year end fiscal cliff was around the corner and could have certainly derail further market advances. As I wrote in September in answer to a client's question regarding the market, polls were projecting an Obama win and expectations were Congress would let the country go over the cliff. If the cliff was averted, I noted this could be positive for the market as the market was expecting worse.

I have noted in several earlier posts about investors allocating more of their investment dollars to fixed income or bond investments versus stocks over the last four years. This has occur in spite of the fact stocks have been a far better performer than bonds during this time frame. So far this year though the financial media has noted that investors have poured record amounts of investment funds into stocks. My first thought is investors are now buying stocks after a four year period when stocks have outperformed bonds. One potential concern as it relates to individual investor sentiment is they tend to make incorrect investment calls at market turning points. So are we really seeing investors choosing stocks over bonds now?

As the blue line in the below chart shows, equity fund flows did turn positive in January. However, the bond fund flows (green line) are also positive. What appears to be occurring is investors simply moving out of cash and into both stocks and bonds.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

It does seem investor skittishness remains high as well. In last week's American Association of Individual Investor sentiment survey, it was noted that bullish sentiment fell 13.4 points to 28.4%. This lower level of bullish sentiment is one standard deviation from the longer term average. This also resulted in the bull/bear spread equaling a negative 8.2 percentage points. Investor sentiment does tend to be most accurate at extreme levels.

Lipper also reported last week:

"There was one big change, however, equity mutual funds and equity ETFs as a group suffered their first week of net redemptions in the last ten weeks, as investors took some of their hard-won profits off the table out of fear that they might be in jeopardy in a deteriorating investment climate. All told, these investors pulled a net $900 million out of stock mutual funds and ETFs, although they injected $4 billion of new capital into taxable bond funds as well as $300 million into municipal bond funds (their ninth straight week of net inflows) and $3.6 billion into money market funds, a traditional safe haven in times of volatility or anxiety...The most recent weekly period was the first time in eight weeks that equity ETFs experienced net outflows, as investors pulled out some $3.8 billion."

At the end of the day investors do not seem overly bullish (actually far from it) and they do seem under invested in equities as a whole due to a cautious positioning ahead of the election and fiscal cliff. So long as companies can deliver on earnings and Washington actions (or inaction) do not derail the economy, the market could grind higher near term although it will likely be volatile. An important near term resistance level is the 2/19 S&P close of 1,530.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI