FY17 was a further year of change for Secure Trust Bank Plc (LON:STBS) as management completed the shift away from unsecured consumer loans and reduced the risk profile in motor finance. This restricted near-term profits but the pace of loan book growth has remained strong and looks set to feed into substantial earnings growth as the cost of risk subsides, more than offsetting the lower returns earned on lower risk lending. The shares have begun to respond to this prospect following the results, but the valuation suggests further upside.

FY17 results

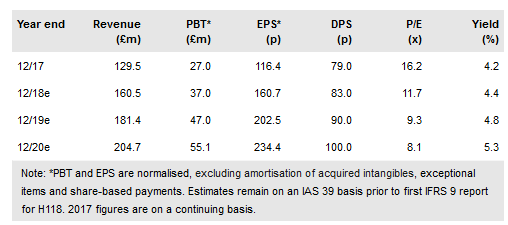

STB reported loan book growth of 27% to £1.6bn (ex-discontinued) with the largest increases being in real estate and retail point-of-sale lending. The bank has repositioned its balance sheet away from higher-risk lending, including unsecured consumer and sub-prime motor loans. Impairments were increased by provisions against the remaining sub-prime book and this, together with investment in new products and regulatory compliance, acted as a drag on 2017 profit, but even so, underlying, continuing profit was stable at £27.0m vs £27.3m. Capital ratios including the CET1 at 16.5% provide headroom for further growth in the loan book.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.