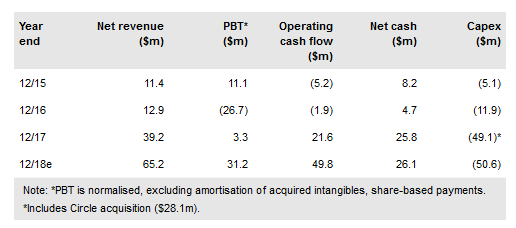

SDX Energy (LON:SDX) has reported FY17 results, which reflect the positive impact of the late January 2017 acquisition of Circle Oil’s Egyptian and Moroccan business, strong netbacks and Egyptian receivable recovery. Netback, defined as sales net of operating expense and government royalties, stood at $28.9m and compares with our estimated $26.4m. Cash at year-end 2017 stood at $25.8m and has since grown to $30.6m as at 28 February 2018 after a further $6m in backdated receivables was recovered. We recently published a detailed update on our view of Moroccan gas sales and group valuation, which stands at a core NAV 58.3p/share and RENAV of 65.6p/share.

13.5mmboe 2P reserves: A 45% increase in 2P reserves includes the revision of South Disouq contingent resource to reserves (net 21.3bcf and 0.11mmbbls). We would expect a further upwards revision for Morocco in 2018, on completion of SDX’s nine-well programme, which has delivered five commercial discoveries from seven wells to date.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI