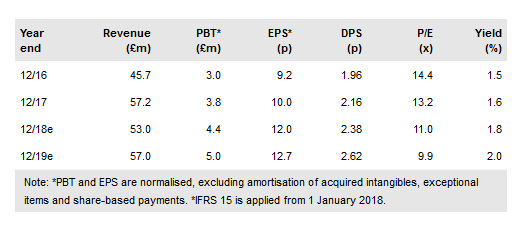

Scisys Plc (LON:SSY) posted strong FY17 results, with revenues rising by 25%, including c 9% organic growth and c 5% at constant currencies. The Space division stood out, generating 18% growth in both revenue and contribution. Operating profit (excluding associates) rose by 41% to £4.5m, partly benefiting from hedging arrangements, and the operating margin expanded by 90bp to 7.9%. The outlook is encouraging with the order book 41% ahead at a record £91.3m. We have cautiously maintained our profit forecasts, mainly due to the uncertainties relating to Brexit on the Space division, while our FY19 EPS eases on higher tax rate assumptions. Management’s goal to achieve £60m in revenues and double-digit margins within three to five years looks increasingly conservative, and we believe the stock looks attractive on c 10x our FY19e EPS.

FY17 results: Operating margin rose by 1% to 8%

Group revenues rose by 25% to £57.2m, including c 9% organic growth and a full year contribution from ANNOVA. Professional fees lifted by 28% to £48.0m, representing 84% of total group revenues, while the adjusted operating profit, excluding associates, jumped by 41% to £4.5m. Operating cash flow surged to £10.4m, bolstered by one-off factors, while free cash flow (FCF) was £8.6m (providing an FCF yield of 23%) and net debt reduced by £4.3m to £5.9m.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI