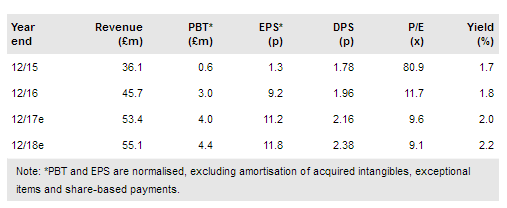

In an in line update, Scisys Plc (LON:SSY) reports that its order book grew by 4% over Q1, while net debt fell by £2.4m as at end-April. Cash flow was boosted by the receipt of overdue payments from the MOD and a tax credit from HMRC that were deferred from 2016. All business units have been performing well and we note that this year is likely to be more H2 weighted than is typical due to the acquired ANNOVA. Noting management’s goal to achieve £60m in revenues and double-digit operating margins within three to five years, we believe the stock looks attractive on c 9x our maintained FY18e EPS.

AGM trading update: Debt dips on cash generation

SCISYS says that FY17 “revenues and profits are comfortably on track to meet current guidance.” The order book has grown from £64.6m as at end December to £67.1m at end-March. £37.8m is deliverable after FY17 – this predominantly relates to the long-term BBC contract of ANNOVA, which was acquired at the end of FY16. In February, the Space division won €5.6m of contracts to deliver mission management and control software for two European space programmes. SCISYS is confident that it will be able to extend its footprint in the Galileo satellite navigation programme in spite of media speculation over the impact of Brexit.

Media & Broadcast has won a new £1.1m contract for BBC Wales and signed up its first French customer, RTL, which is an existing customer of ANNOVA. In April, the ESD division secured a place on the Metropolitan Police Solution Provider Framework, giving it access to contracts worth c £30m pa over four years. We note that framework contracts are not included in the group’s order book.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.