Stock market today: S&P 500 slips as Trump’s tariff salvo sours sentiment

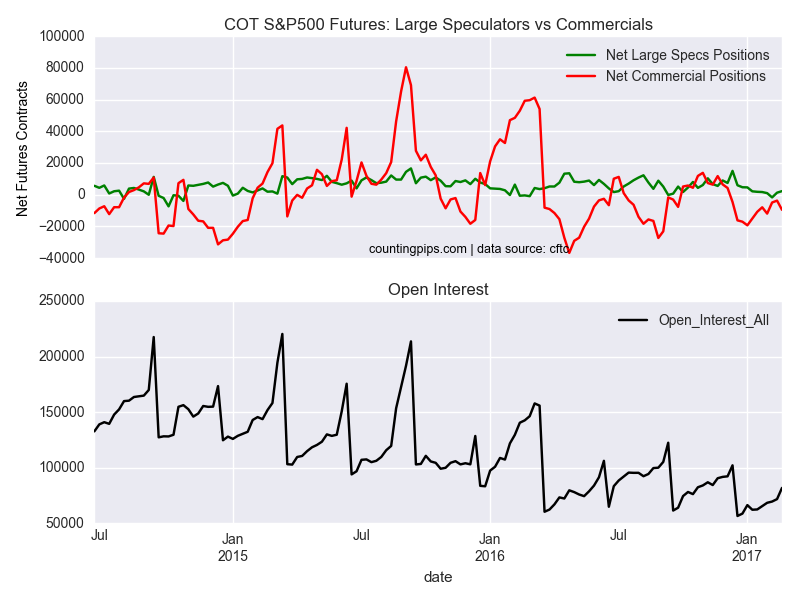

S&P500 Non-Commercial Positions:

Large speculators and traders slightly increased their net positions in the S&P500 stock futures markets last week and pushed their bullish bets higher for a second week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 futures, traded by large speculators and hedge funds, totaled a net position of 2,285 contracts in the data reported through February 21st. This was a weekly gain of 996 contracts from the previous week which had a total of 1,289 net contracts.

Speculative positions are now in bullish territory for a second straight week after dipping into a small bearish position on February 7th at -1,688 contracts.

S&P500 Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -9,516 contracts last week. This is a weekly change of -5,808 contracts from the total net of -3,708 contracts reported the previous week.

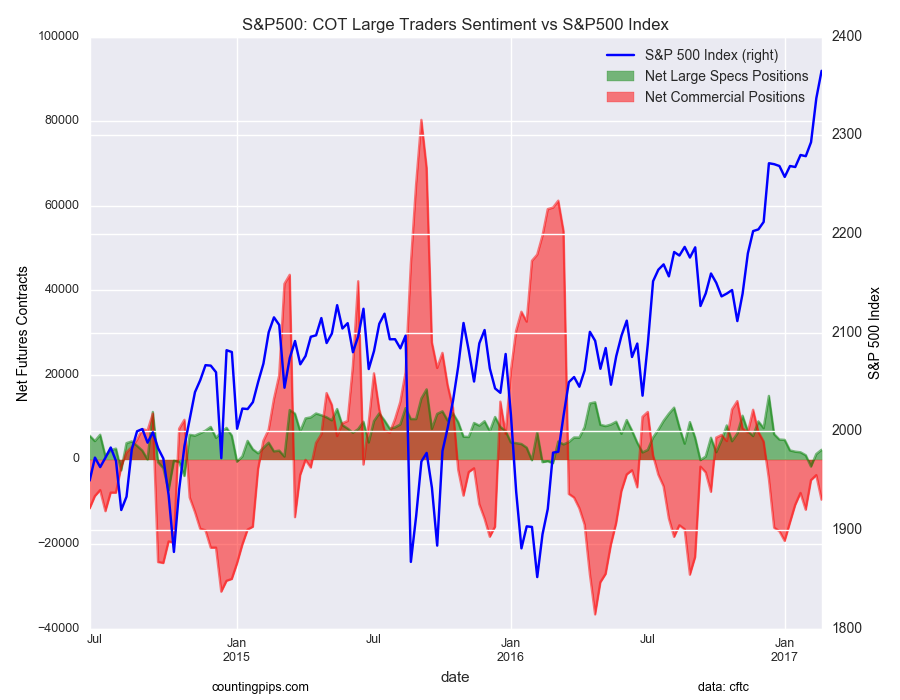

S&P500 Stock Market Index:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the S&P500 index closed at approximately 2365.37 which was a change of 27.79 from the previous close of 2337.58, according to market data.