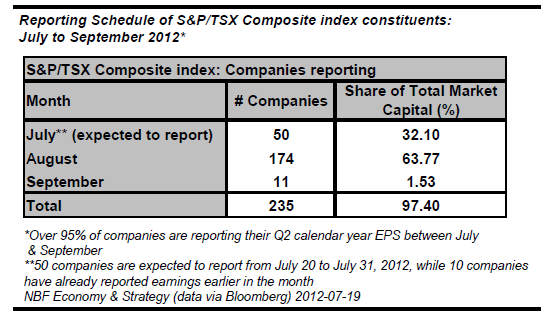

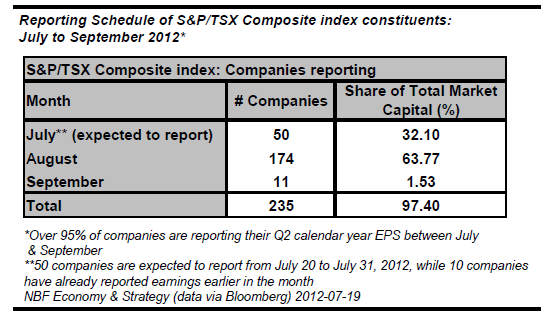

The Canadian S&P/TSX Composite index is entering another reporting season with 41 companies reporting earnings in the week ending July 27, 2012. 50 companies representing approximately 32% of S&P/TSX Composite market capitalization have yet to report in July followed by another 174 index constituents in August and 11 in September.

Earnings expectations

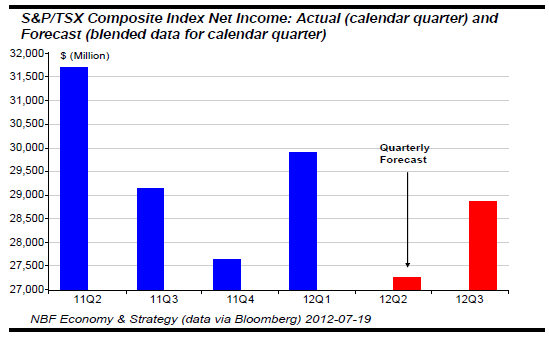

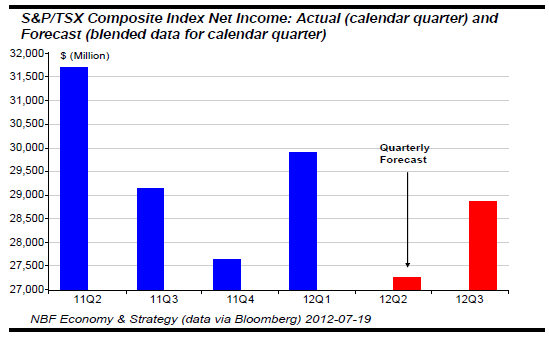

The S&P/TSX Composite index estimate of net income for the Q2 2012 calendar quarter is $27,260M which represents a growth rate of -14.0% (Qt/Qt-4). The estimate for the Q3 2012 calendar quarter is $28,876M, suggesting an annual growth of -0.9% (Qt/Qt-4).

Net income represents operating earnings excluding extraordinary items. All data is representative for current index members and only for those where comparable historical data and estimates are available.

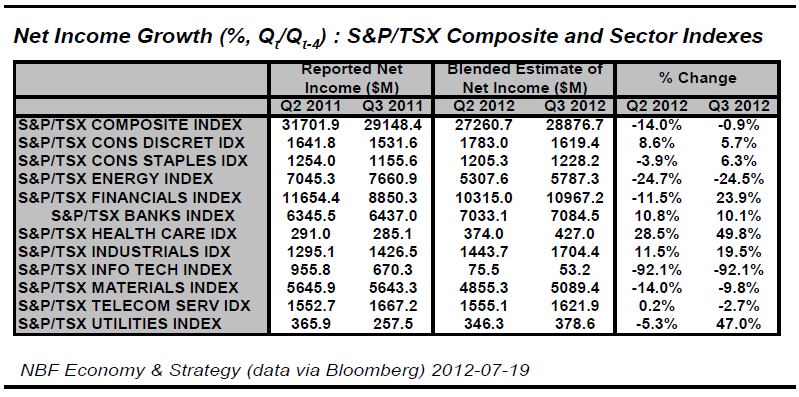

Earnings expectations by sector (GICS Level 1)

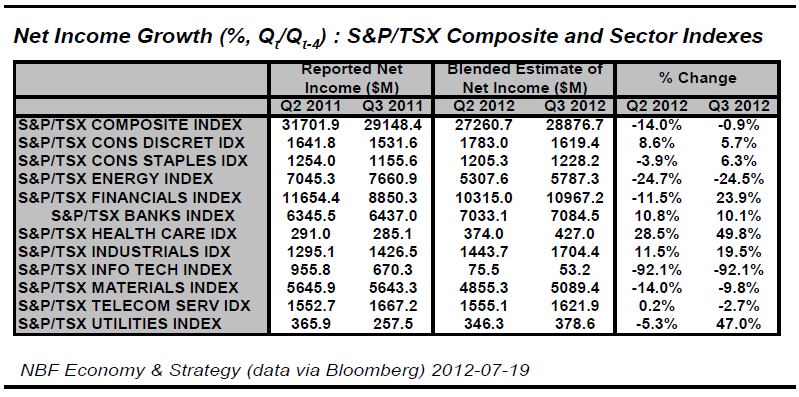

From a sector perspective Health Care (28.5%) and Industrials (11.5%) are expected to record the largest growth in net income for the Q2 2012 calendar quarter. The Information Technology (-92.1%) and Energy (-24.7%) sectors are expected to show the weakest growth over the respective period. Four of 10 sectors are expected to record an increase in net income when compared to net income reported for a comparable period one-year earlier.

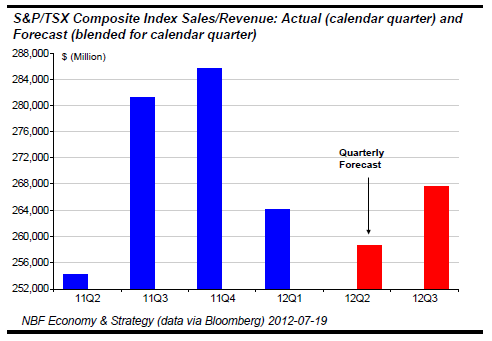

Sales/Revenue expectations

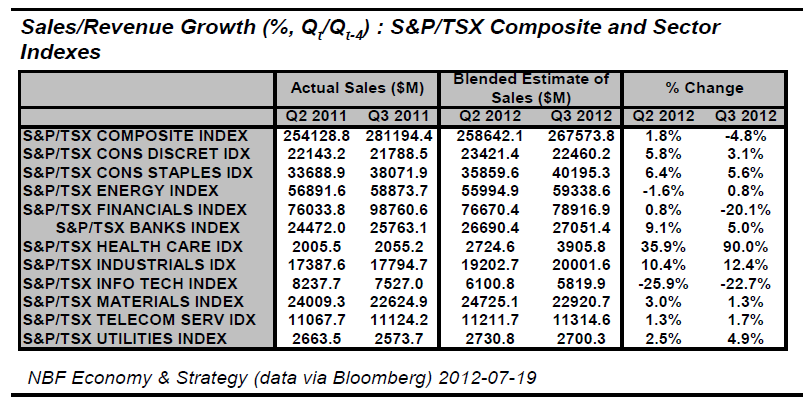

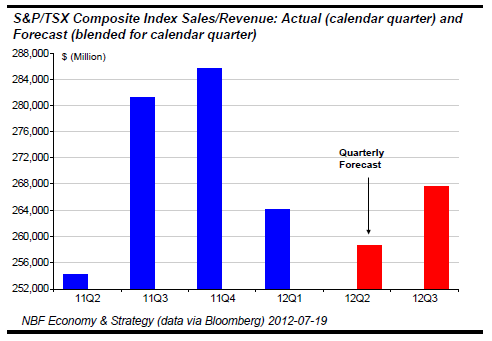

The S&P/TSX Composite index estimate of sales/revenue for the Q2 2012 calendar quarter is $258,642M which represents a growth rate of 1.8% (Qt/Qt-4). The estimate for the Q3 2012 calendar quarter is $267,574M, suggesting an annual growth of -4.8% (Qt/Qt-4).

Sales/Revenue expectations by sector (GICS Level 1)

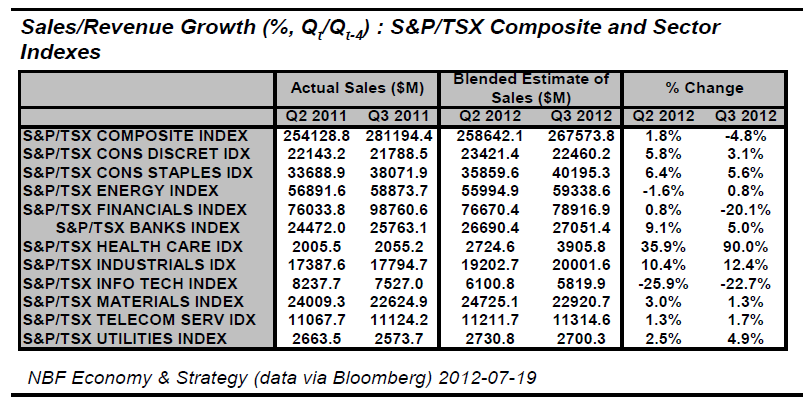

From a sector perspective Health Care (35.9%) and Industrials (10.4%) are expected to record the largest growth in sales/revenue for the Q2 2012 calendar quarter. The Information Technology (-25.9%) and Energy (-1.6%) sectors are expected to show the weakest growth over the respective period. Eight of 10 sectors are expected to record an increase in sales/revenue when compared to net income reported for a comparable period one-year earlier.

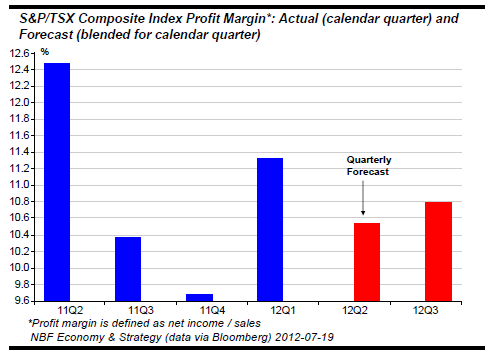

Profit Margin expectations

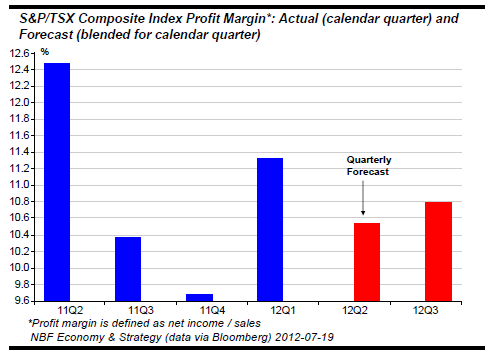

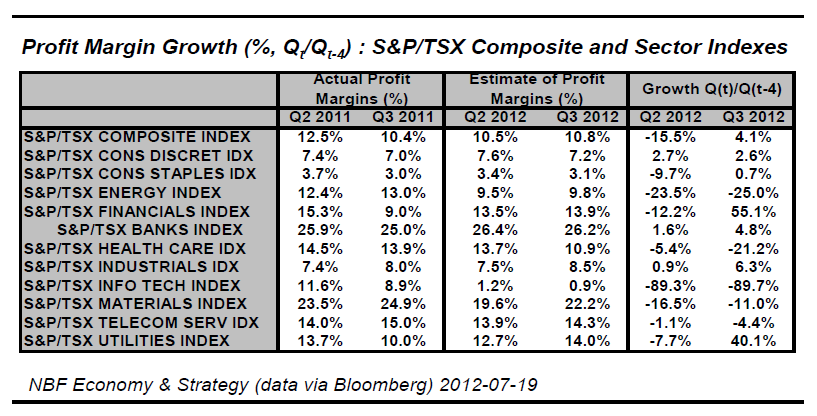

The S&P/TSX Composite index estimate of profit margin for the Q2 2012 calendar quarter is 10.5% which represents a growth rate of -15.5% (Qt/Qt-4). The estimate for the Q3 2012 calendar quarter is 10.8%, suggesting an annual growth of 4.1% (Qt/Qt-4).

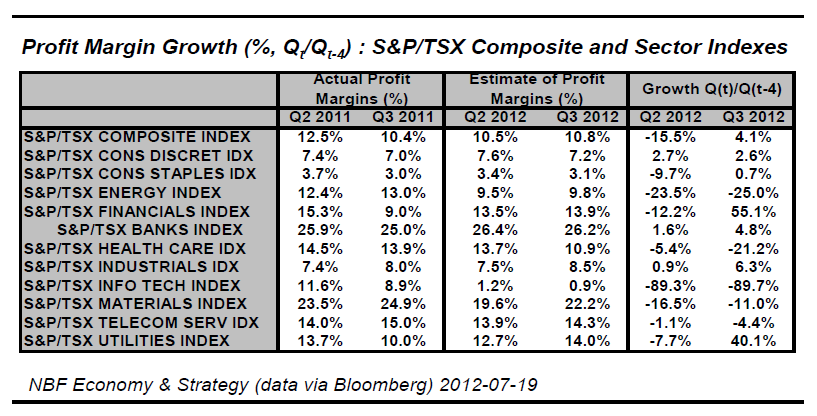

Profit margin expectations by sector (GICS Level 1)

From a sector perspective Consumer Discretionary (2.7%) and Industrials (0.9%) are expected to record the largest profit margin expansion for the Q2 2012 calendar quarter. The Information Technology (-89.3%) and Energy (-23.5%) sectors are expected to show the deepest profit margin contraction over the respective period. Two of 10 sectors are expected to record an increase in profit margins when compared to margins reported for a comparable period one-year earlier.

To Read the Entire Report Please Click on the pdf File Below.

Earnings expectations

The S&P/TSX Composite index estimate of net income for the Q2 2012 calendar quarter is $27,260M which represents a growth rate of -14.0% (Qt/Qt-4). The estimate for the Q3 2012 calendar quarter is $28,876M, suggesting an annual growth of -0.9% (Qt/Qt-4).

Net income represents operating earnings excluding extraordinary items. All data is representative for current index members and only for those where comparable historical data and estimates are available.

Earnings expectations by sector (GICS Level 1)

From a sector perspective Health Care (28.5%) and Industrials (11.5%) are expected to record the largest growth in net income for the Q2 2012 calendar quarter. The Information Technology (-92.1%) and Energy (-24.7%) sectors are expected to show the weakest growth over the respective period. Four of 10 sectors are expected to record an increase in net income when compared to net income reported for a comparable period one-year earlier.

Sales/Revenue expectations

The S&P/TSX Composite index estimate of sales/revenue for the Q2 2012 calendar quarter is $258,642M which represents a growth rate of 1.8% (Qt/Qt-4). The estimate for the Q3 2012 calendar quarter is $267,574M, suggesting an annual growth of -4.8% (Qt/Qt-4).

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Sales/Revenue expectations by sector (GICS Level 1)

From a sector perspective Health Care (35.9%) and Industrials (10.4%) are expected to record the largest growth in sales/revenue for the Q2 2012 calendar quarter. The Information Technology (-25.9%) and Energy (-1.6%) sectors are expected to show the weakest growth over the respective period. Eight of 10 sectors are expected to record an increase in sales/revenue when compared to net income reported for a comparable period one-year earlier.

Profit Margin expectations

The S&P/TSX Composite index estimate of profit margin for the Q2 2012 calendar quarter is 10.5% which represents a growth rate of -15.5% (Qt/Qt-4). The estimate for the Q3 2012 calendar quarter is 10.8%, suggesting an annual growth of 4.1% (Qt/Qt-4).

Profit margin expectations by sector (GICS Level 1)

From a sector perspective Consumer Discretionary (2.7%) and Industrials (0.9%) are expected to record the largest profit margin expansion for the Q2 2012 calendar quarter. The Information Technology (-89.3%) and Energy (-23.5%) sectors are expected to show the deepest profit margin contraction over the respective period. Two of 10 sectors are expected to record an increase in profit margins when compared to margins reported for a comparable period one-year earlier.

To Read the Entire Report Please Click on the pdf File Below.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.