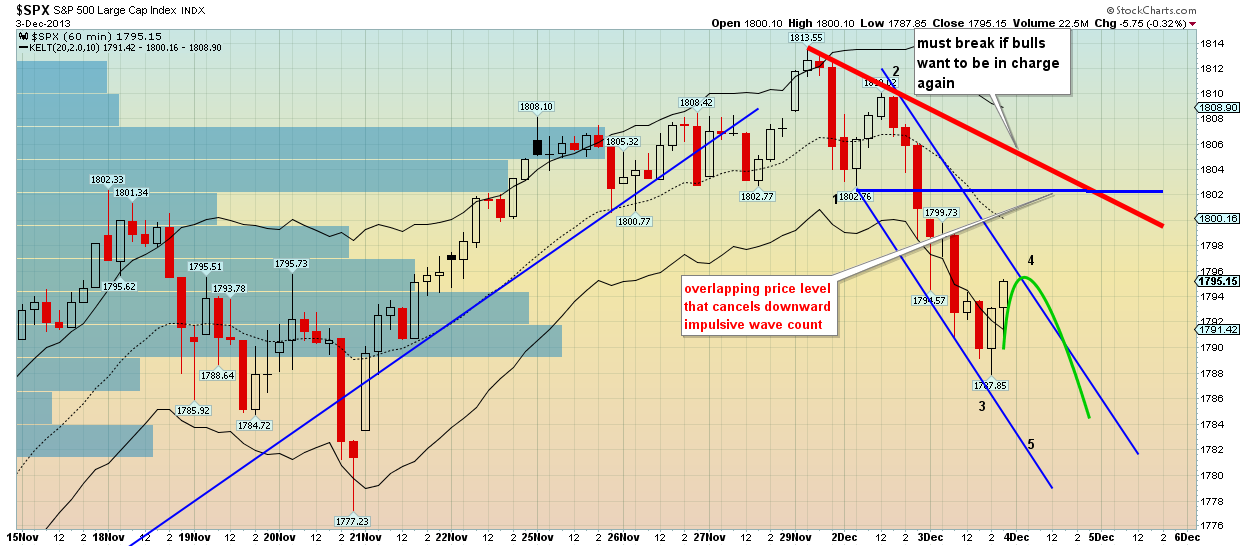

The S&P has broken its short-term support at 18000 and the rising wedge formation has given a sell signal. The upward move from 1646 seems complete and a tradeable corrective move is at its beginning. Prices are falling in an impulsive pattern and are looking to find support at lower levels. Prices have unfolded 3 waves down from 1813,55 and it is very possible to see wave 4 and 5 during today’s session. The downward sloping blue channel shows the possible wave 4 area and the blue horizontal line at 1802 shows the price level where our wave count is invalidated as price action becomes overlapping.

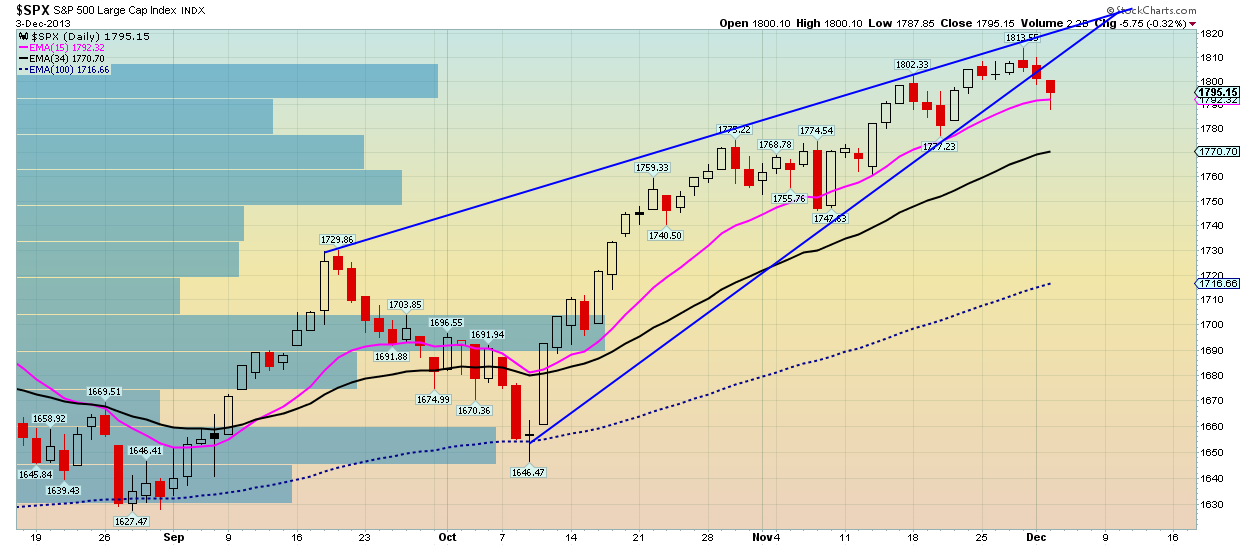

The daily chart shows us that prices have closed right above the 1790 support, but we feel that there is more downside to be expected. Short term resistance is found at 1802 and 1810, while support is found at 1778-82 and then at 1740-50.

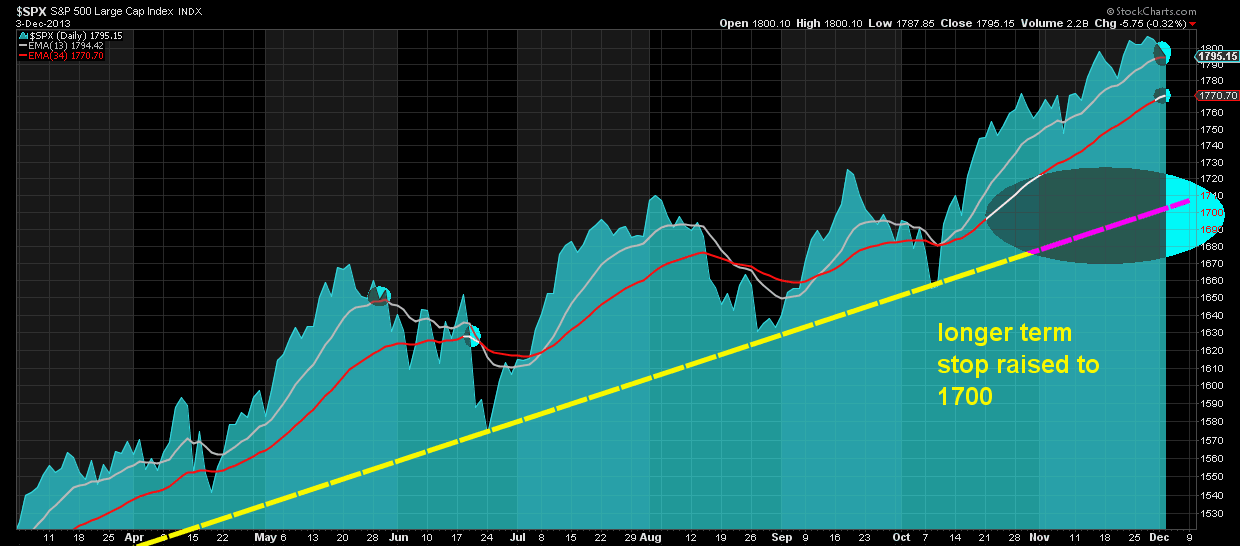

Prices have reached our first sell trigger as shown in the chart below. We expect for this trigger to be enabled today and prices to fall towards 1778-82. The decline will complete 5 waves down and what we believe just wave A of the corrective move that started at 1813,55. Breaking above the high will only cancel our wave count. We believe that a selling opportunity will come once prices complete wave B up.

The opportunity to sell with 1740-50 target will come only if certain criteria are met by the market. We have to be patient to wait and see how the current wave unfolds and how the expected wave B up behaves.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI