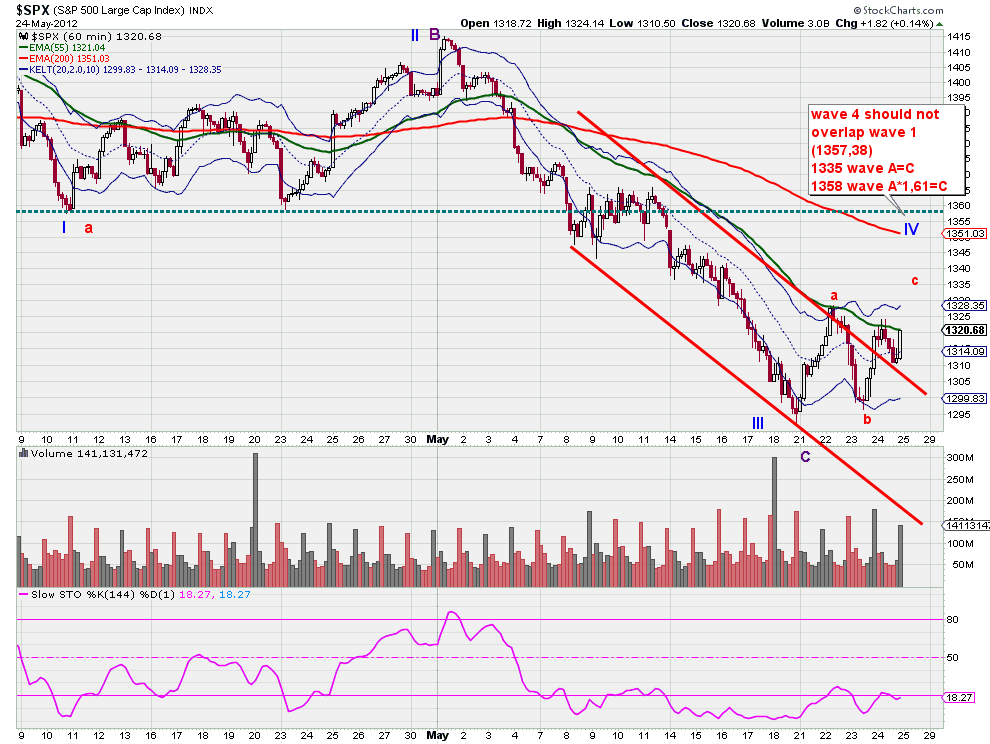

S&P having bottomed around the 1300 area, has made a double bottom 1291-1295 and is moving back up to test last high of 1328. The downward sloping channel from 1415 has been broken. For me the move from 1415 has ended. So what now?

Bullish scenario: S&P has finished 3 waves down from 1422 and starts now a new upward wave to break the highs and go towards 1510.

Bearish scenario: S&P has finished 3rd wave down from 1422 and will now make a 4th corrective wave. This wave should not overlap low of 1st wave (1357,38). Targets for the end of wave 4 are 1335 where A=C or near 1358 where A * 1,61=C.

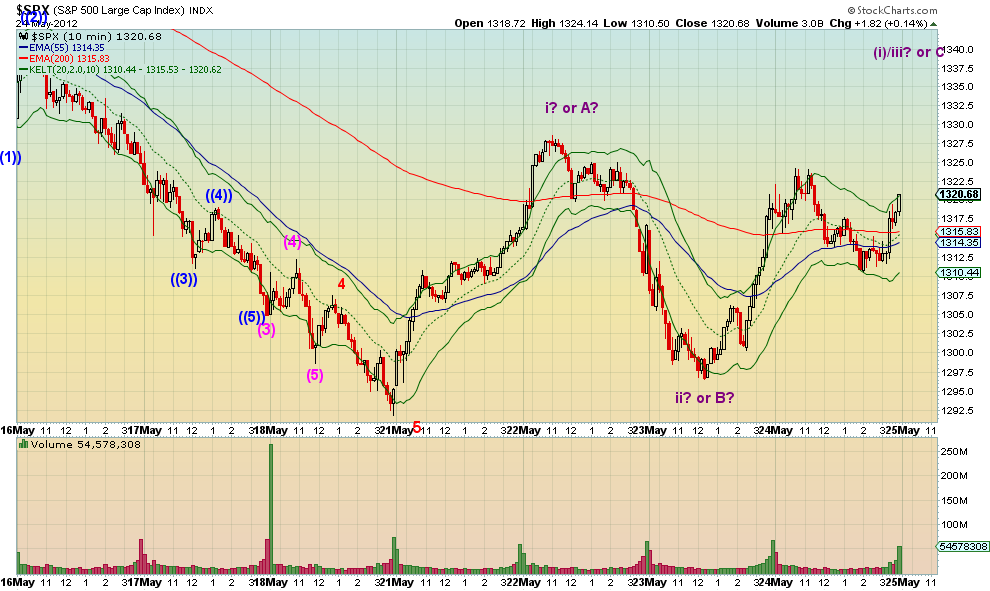

Looking at a smaller time frame we noticed last time the possibility that if the low of 1291 was not broken, the last up move could be counted as a 5 wave up and a new upward move would follow. The market looks like it is ready now to break that high (1328) after the double bottom. Again the form of the rise will strengthen one of the two scenarios. For me I like to keep things simple. So if I don't see 5 clear waves up or down I will not choose sides. In pre market things look certain that 1328 will be broken upwards.

Concluding, the index is moving upwards according to plan and will soon clarify if this is a new up move or another upward correction.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

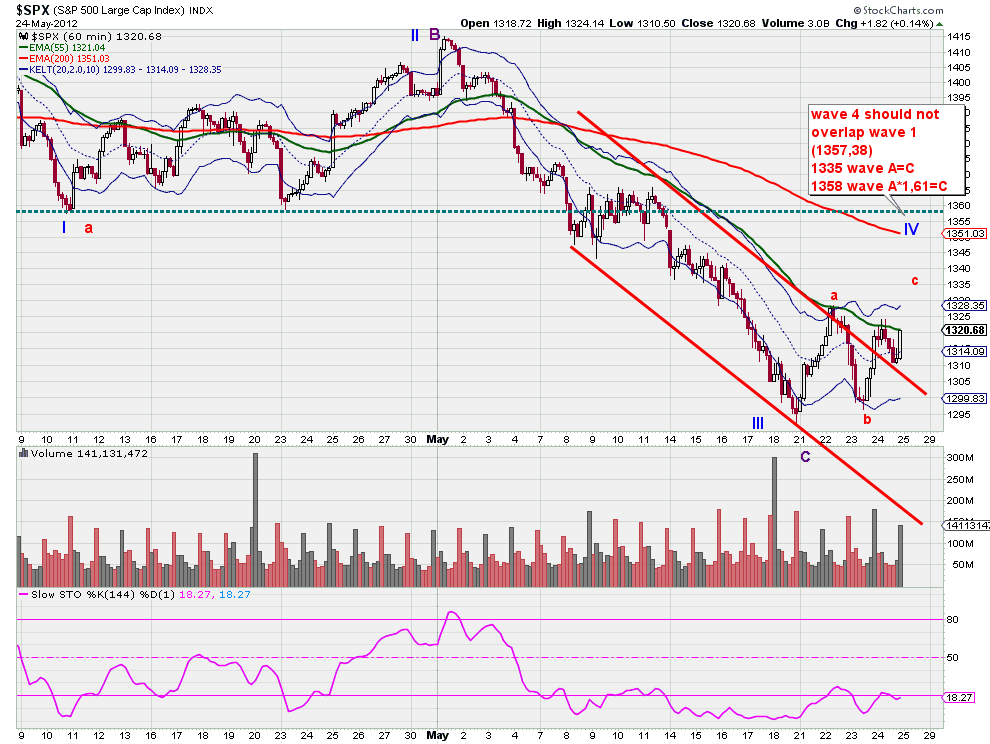

Bullish scenario: S&P has finished 3 waves down from 1422 and starts now a new upward wave to break the highs and go towards 1510.

Bearish scenario: S&P has finished 3rd wave down from 1422 and will now make a 4th corrective wave. This wave should not overlap low of 1st wave (1357,38). Targets for the end of wave 4 are 1335 where A=C or near 1358 where A * 1,61=C.

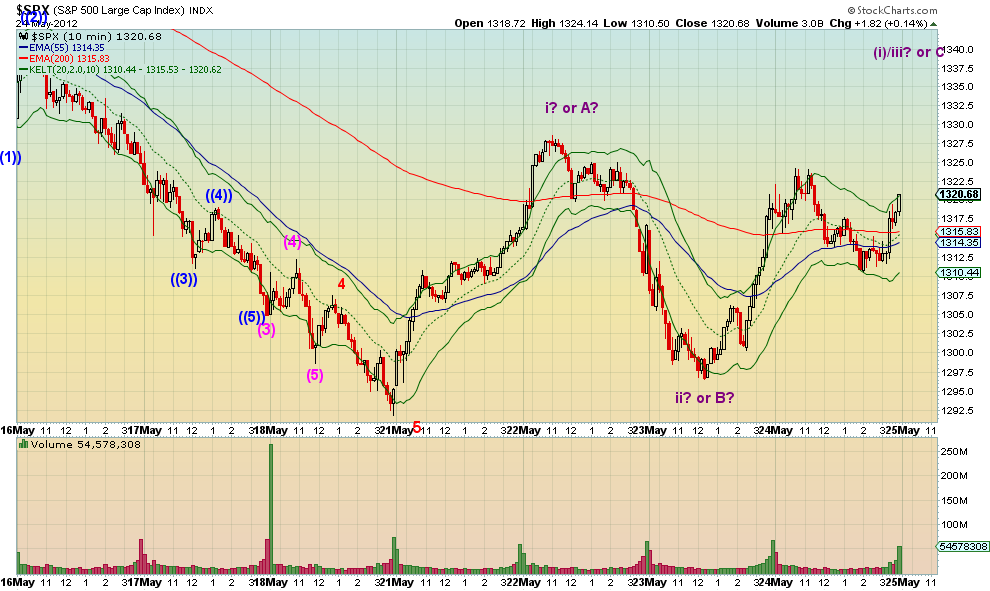

Looking at a smaller time frame we noticed last time the possibility that if the low of 1291 was not broken, the last up move could be counted as a 5 wave up and a new upward move would follow. The market looks like it is ready now to break that high (1328) after the double bottom. Again the form of the rise will strengthen one of the two scenarios. For me I like to keep things simple. So if I don't see 5 clear waves up or down I will not choose sides. In pre market things look certain that 1328 will be broken upwards.

Concluding, the index is moving upwards according to plan and will soon clarify if this is a new up move or another upward correction.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.