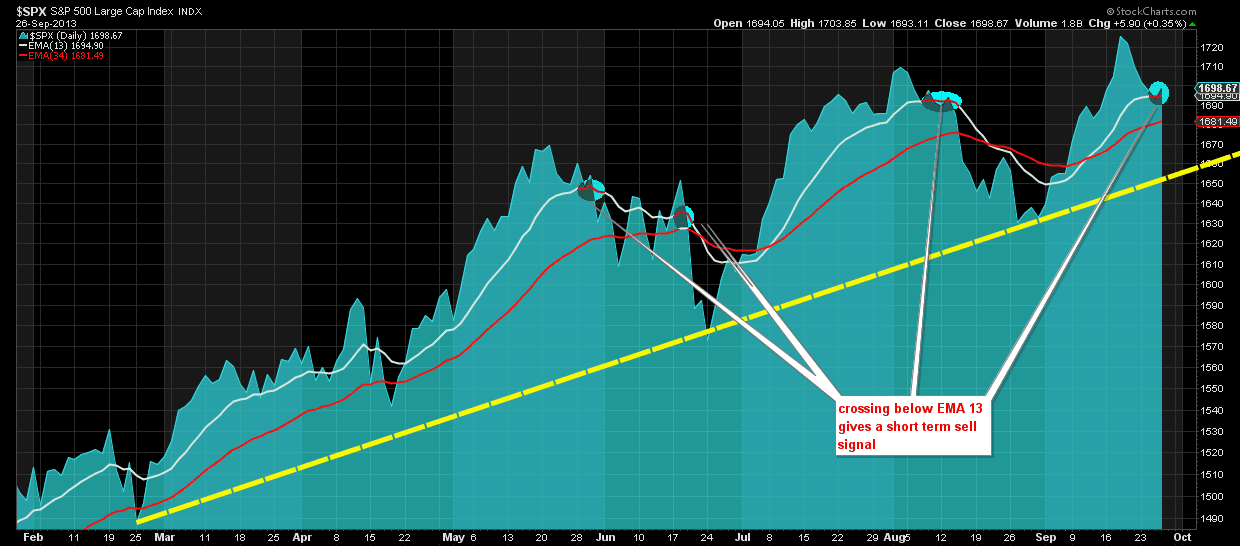

S&P (SPX) according to our Elliott wave analysis has completed wave A down and is now in the process of making wave B up towards 1710-15. The fact that we label this move that started at 1730 as a correction is only because the chances are slightly in favor of this bullish scenario. Although this is our first choice we do not believe that it is worth entering long at this price levels. The bearish scenario and all my personal trades are presented to our subscribers only. Moving on now to our wave count, as we mentioned in a previous post, the entire upward move from 1627 to 1730 is confirmed over and complete. The first leg down for our bullish scenario is just wave A. This is depicted in the chart below.

Our target for S&P as mentioned in our last post is 1666 (61,8% Fibonacci retracement). Our first target of 1688-90 has been achieved and we now believe it is time for a small bounce towards 1710. This bounce should take two days to develop and then we should see from next Tuesday or Wednesday a new downward move as wave C towards 1678 or 1666.

The weekly view in S&P is for the time being saved from signalling a sell. The EMA has not been crossed and therefore we should wait for the confirmation as support at 1690-95 is held and it seems a bounce is more probable now than a break of support. As per our wave analysis, we expect prices to make a moderate upward move and then re-test and break the 1690-95 support level.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI