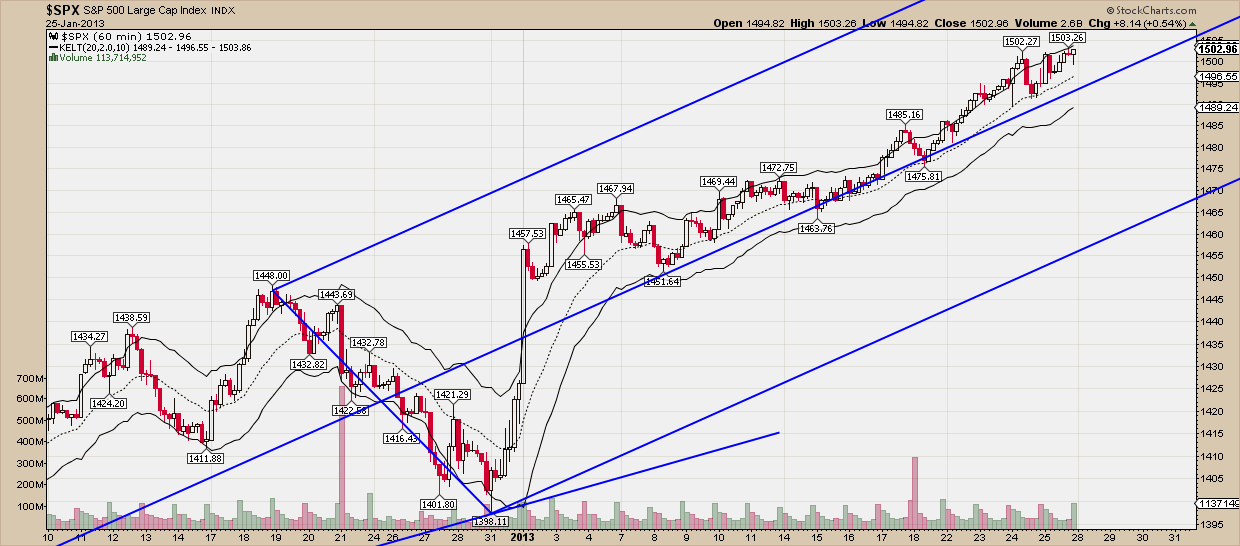

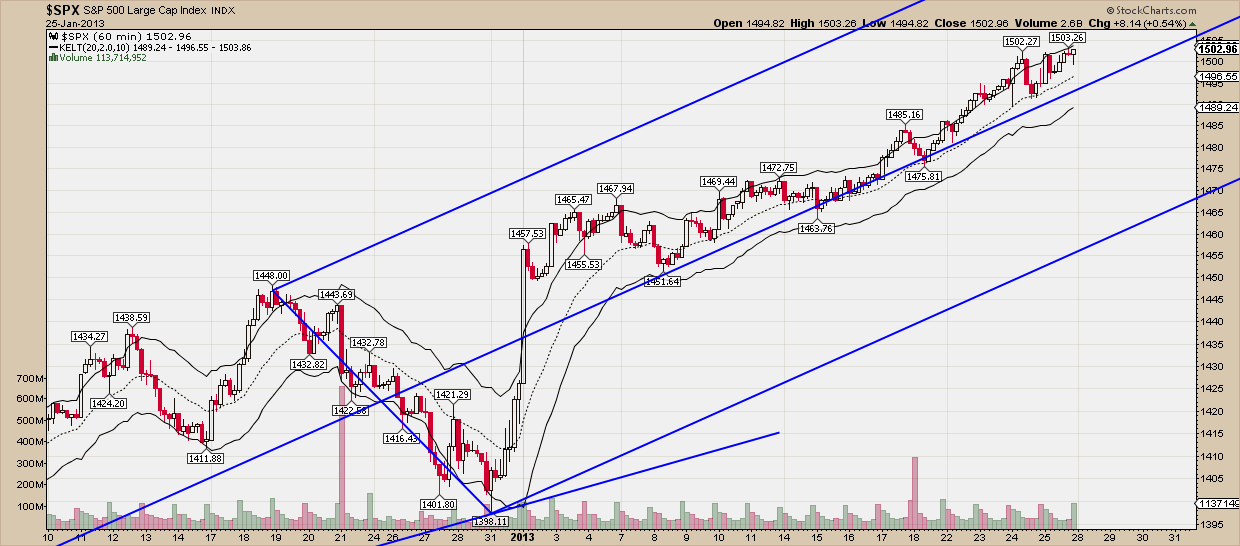

The S&P 500 managed to close marginally above 1500 maintaining the bullish trend. We believe that at this level, bulls should be extra cautious as we think it is more probable that prices will pull back at least towards 1475-60 area. There is no sign for such a developement yet if we look at the 60 minute chart below.

Short term trend will change if we see an hourly close below 1496 and then below 1489. Such a price action will indicate at least a short-term top. We would expect prices to make a correction towards 1475-60 area. Such correction is welcomed in order for the bullish trend to re-energize and push prices towards the all time highs.

Bottom line is that we remain positive with our finger on the trigger ready to cover long positions and why not take advantage of short positions.

Resistance in S&P is found at 1503 and then 1520. Intermediate to long term trend support is found at 1410-20.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Short term trend will change if we see an hourly close below 1496 and then below 1489. Such a price action will indicate at least a short-term top. We would expect prices to make a correction towards 1475-60 area. Such correction is welcomed in order for the bullish trend to re-energize and push prices towards the all time highs.

Bottom line is that we remain positive with our finger on the trigger ready to cover long positions and why not take advantage of short positions.

Resistance in S&P is found at 1503 and then 1520. Intermediate to long term trend support is found at 1410-20.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI