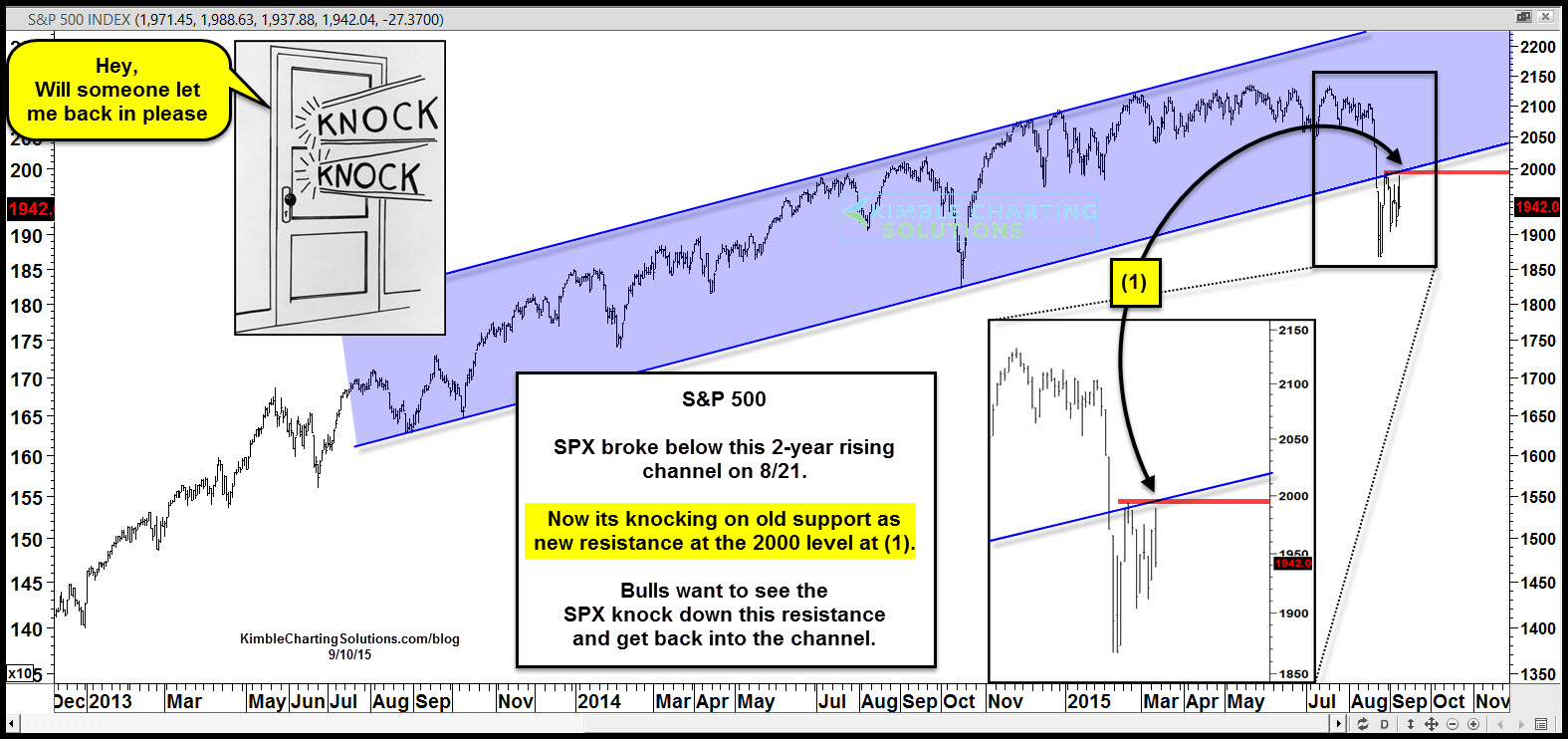

For the past couple of years, the S&P 500 has remained inside a uniform rising channel, highlighted in blue above.

On August 21 it broke below that channel, ending the two-year pattern.

After the break the S&P attempted rallies, knocking on the underside of old support as new resistance twice.

One of them happened on Wednesday, as the S&P 500 was up strongly for most of the day. It got real close to the underside of the channel, creating a reversal pattern commonly known as a bearish wick, near the 2,000 level at (1) above.

The 4-5 year rising channel trends are still play, yet the shorter-term, 2-year channel has now been broken to the downside.

The S&P is knocking on the underside of a new resistance channel. For it to continue higher, S&P 500 needs to first knock down resistance and get back above its 2,000 level.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.