S&P 500: Nowhere To Go But Up

MrTopStep | Jun 02, 2014 11:01AM ET

U.S. stocks closed mostly higher on Friday, completing four straight months of advances for the S&P 500. The S&P gained 3.54 points or +0.20%, adding 2.1% in May for its largest monthly gain since February.

Backed by improvements in the economy due to an uptick in manufacturing and employment, the S&P has found itself in a place it has never been in before: continued low rates and nowhere to go but up.

The first week of June is packed with over 25 economic releases, 12 T-bill or T-bond announcements, ADP employment and the U.S. jobs report. We all know it’s a difficult environment for investing and that many of the talking heads continue to say the S&P can’t go higher.

We disagree. Sure the summer months are slower, but MrTopStep has been talking about that and the lower volumes for the last two months if not longer. After such a rough winter we think more families will be focusing on vacations than investing and buying stocks over the summer.

The Asian markets closed mixed overnight, and in Europe 11 out of 11 markets are trading higher. This week begins with a barrage of economic reports; there are a total of 25 economic reports, 12 T-bill or T-bond announcements or auctions, 3 fed governors speaking, the ADP numbers and Jobs Friday. Today’s economic and earnings schedule starts out with Chicago Fed President Charles Evans speech in Istanbul on central banking, Gallup US Consumer Spending Measure, PMI Manufacturing, ISM Mfg Index, construction spending and earnings from Conns Inc. (NASDAQ:CONN), Guidewire Software Inc. (NYSE:GWRE), Quiksilver Inc. (NYSE:ZQK), Krispy Kreme Doughnuts Inc. (NYSE:KKD).

Mutual Fund Monday up 7 in a row

- S&P futures have rallied for 7 weeks in a row, adding 107.5 points or +5.9%. The sequence has extended to 8 weeks twice since Jan 2004.

- S&P futures have closed higher 9 of the last 11 trading days.

- The S&P futures has closed higher 7 of the last 8 with the 1 down day only -0.10 handles.

- Mutual Fund Monday is back with the last 7 Mondays closing higher.

- 1900 area should be the first support, and the monthly pivot support is at 1880.

Everything is working in favor of the stock market right now. Let’s face it, in normal times after such a big run up the S&P should pull back, but this rally is anything but “normal.” In 35 years, I have never seen anything like what we are seeing today.

Our view is the S&P is extended, overbought and should pull back—but probably won’t. Sell the early rally and buy weakness or just wait for the S&P to pull back a little and buy it.

As always, please keep an eye on the 10-handle rule and please use stops when trading futures and options.

- In Asia, 8 of 11 markets closed higher: Shanghai Composite -0.07% , Hang Seng +0.31%, Nikkei 225 +2.07%.

- In Europe, 11 of 11 markets are trading higher: DAX +0.22% FTSE 100 +028%

- Morning headline: “S&P extends low-volume, low-volatility, low-breadth rally”

- Fair value: S&P -1.95, NASDAQ -0.62, Dow -13.41

- Total volume: 1.16mil ESM and 7.4k SPM traded

- Economic calendar: Chicago Fed President Charles Evans speech in Istanbul on central banking, Gallup US Consumer Spending Measure, PMI Manufacturing, ISM Mfg Index, Construction spending and earnings from Conn’s, Inc (NASDAQ: CONN), Guidewire Software, Inc. (NYSE: GWRE), Quicksilver, Inc. (NYSE: ZQK), Krispy Kreme Doughnuts, Inc. (NYSE: KKD).

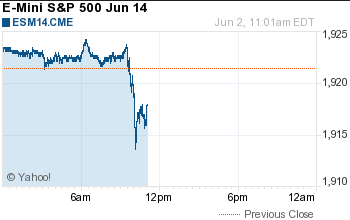

- E-mini S&P 500 1915.75-5.75 - -0.30%

- Crude Oil 102.15+0.02 - +0.02%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23081.65+71.51 - +0.31%

- Nikkei 225 14935.92+303.54 - +2.07%

- DAX 9924.76-18.51 - -0.19%

- FTSE 100 6855.37+10.86 - +0.16%

- Euro 1.3608

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.