Asia stocks: S.Korea rises past Trump tariff threat, Australia flat ahead of RBA

Before the market opened, the big news was the March Industrial Production report, which disappointed to the downside. The weak data didn't faze the market. The S&P 500 surged higher in the opening minutes and traded sideways until the early afternoon, when it rose again to a trading range that included its 0.77% intraday high. Some selling in the final 30 minutes trimmed today's gain to 0.51%, which, coincidentally, is only 0.51% from its record close on March 2nd.

Now, back to that Industrial Production report. We now have data for Q1. What would the Fed's Industrial Production look like if we used the BEA's preferred way of calculating quarterly GDP -- the compounded annual rate of change? Q1 Industrial Production was down 1%, the first contraction since the first quarter of the last recession.

But no worries. The Fed will make adjustments to the Q1 IP data in the months ahead, which may well rachet the annulized rate higher.

Today the yield on the 10-year Note closed at 1.91%, up one bp from the previous close.

Here is a 15-minute chart of the past five sessions.

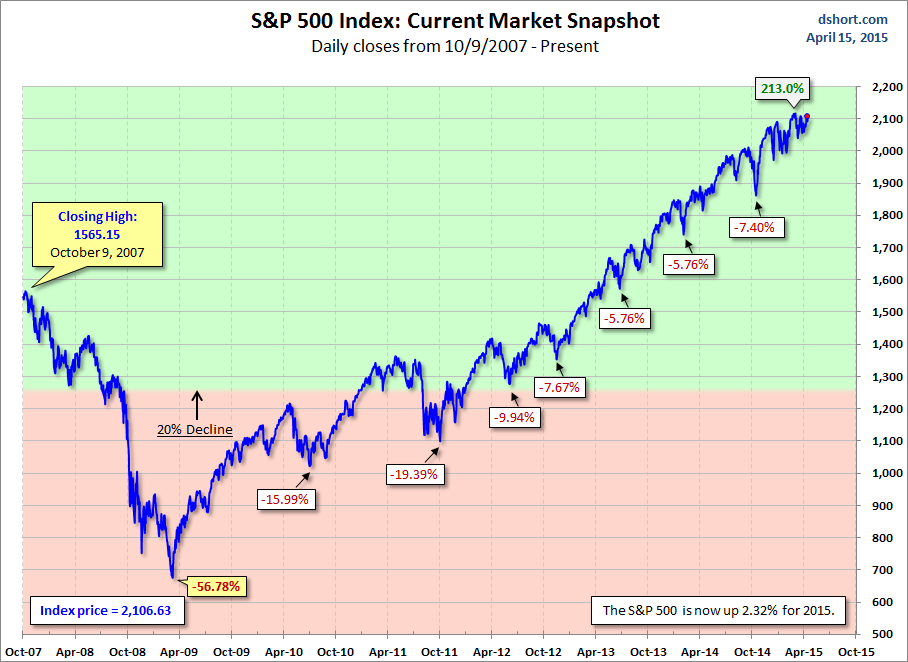

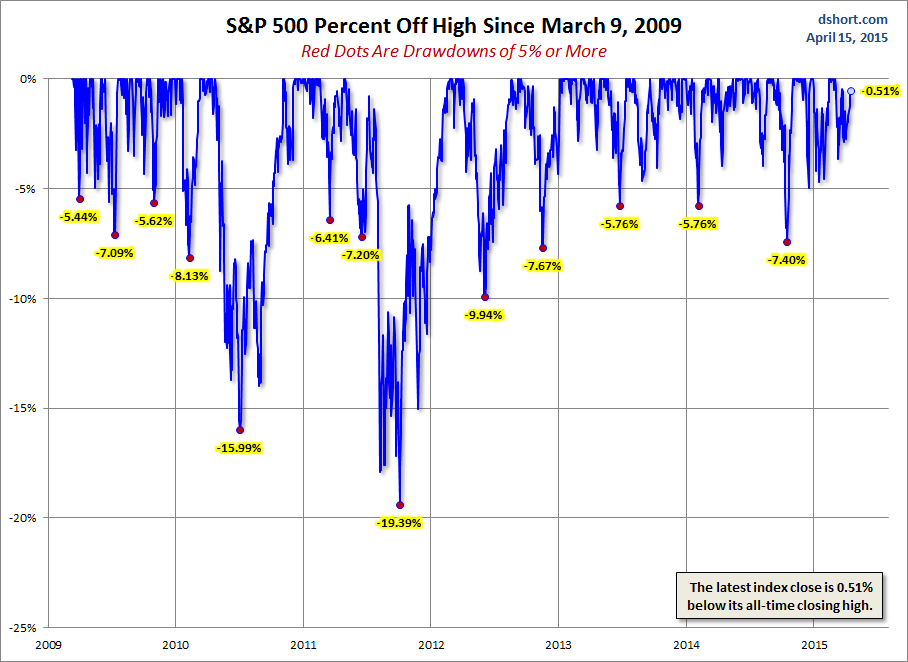

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.