Analyst flags 9 bargain stocks in a ‘Black Friday’-style dip

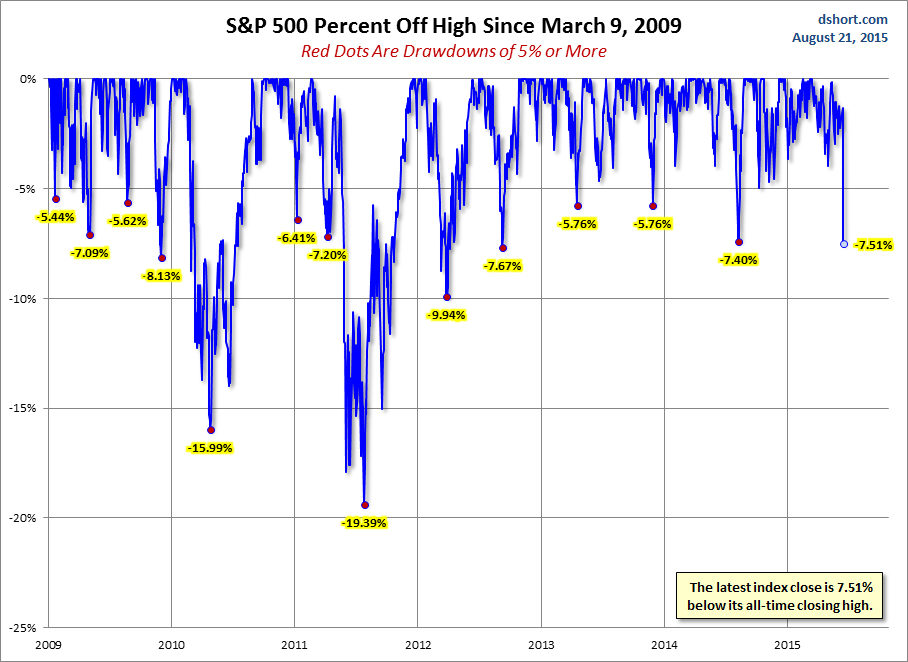

US equities took another beating today. The benchmark S&P 500 closed at its intraday low for the second consecutive day, down -2.11% yesterday and -3.16% today. The loss for the week is -5.77%. The index is in the red year-to-date, down -4.27%, and it is -7.51% off its record close on May 21st — about three quarters of the way to the conventional 10% correction.

The yield on the 10-year note closed the day at 2.05%, down 4 bps from yesterday's close.

Here is a snapshot of past five sessions:

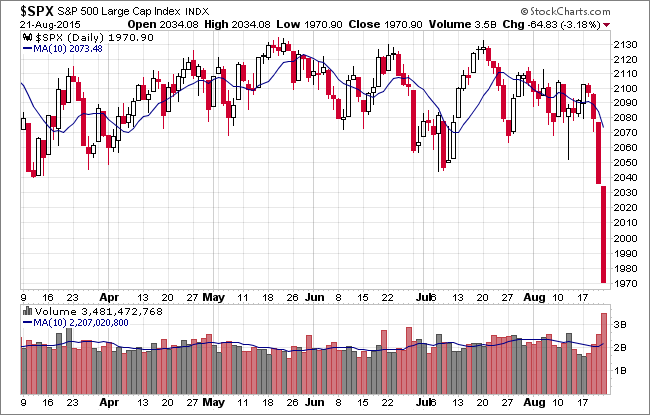

On a daily chart we see that volume has increased each day during this four-day selloff:

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough:

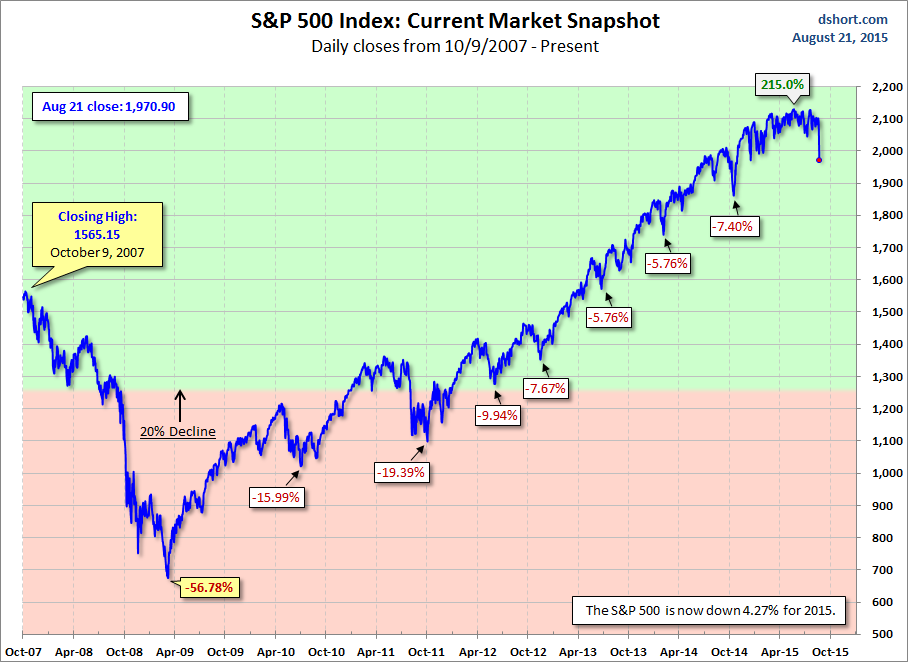

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 2 out of 3 global portfolios are beating their benchmark indexes, with 88% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?