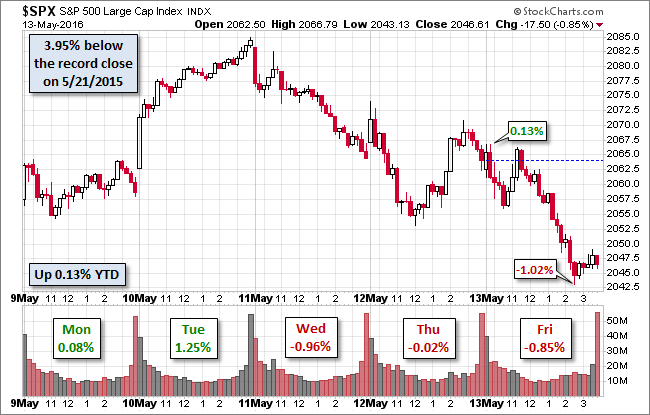

Despite better-than-expected April Retail Sales and a conspicuous uptick in Consumer Sentiment, US equities had a bad day Friday. Our benchmark S&P 500 opened fractionally higher and hit its 0.13% intraday high in the opening minutes. It then fell to its modest morning low, rebounded into the shallow green and then sold off more aggressively to its -1.02% intraday low shortly before the final hour.

A slight drift higher subsequently trimmed the closing loss to -0.85% for the day and -0.51% for the week, the third consecutive weekly decline. At its intraday low, the index briefly dropped into the red year-to-date.

As for the old "sell in May" adage, after nine sessions, the index is remains near the flat line at -0.06% for the month.

The yield on the 10-year note closed at 1.71%, down four basis points from the previous close and eight bps from the previous weekly close.

Here is a snapshot of past five sessions in the S&P 500.

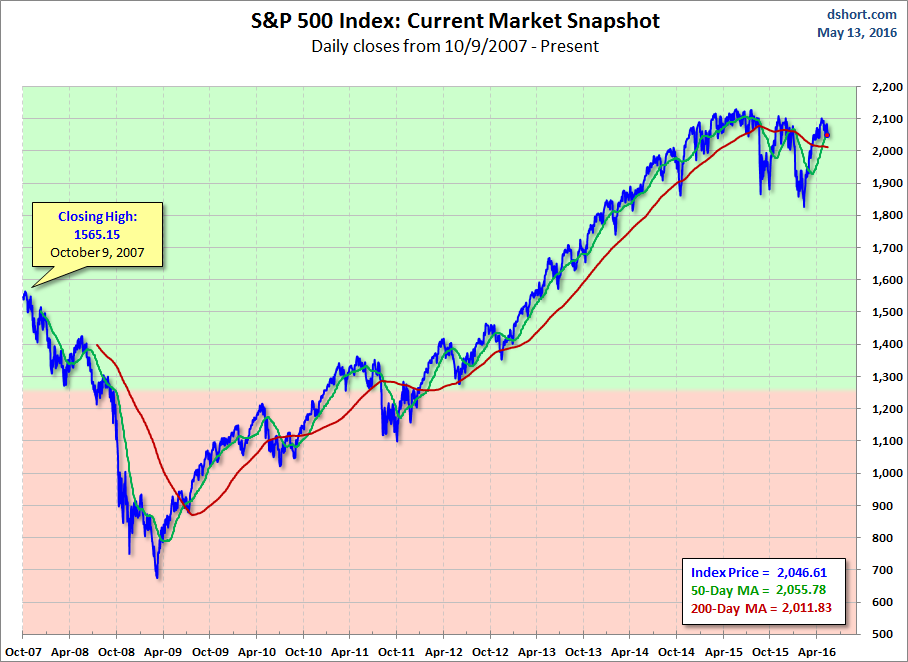

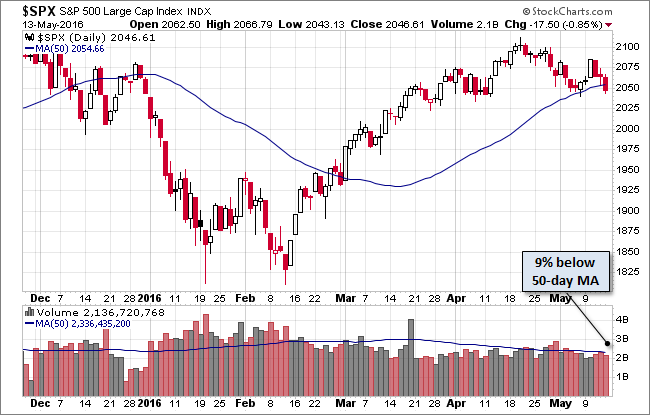

Here is a daily chart of the S&P 500. At Friday's close the index has fallen below its 50-day moving average. Trading volume was unremarkable.

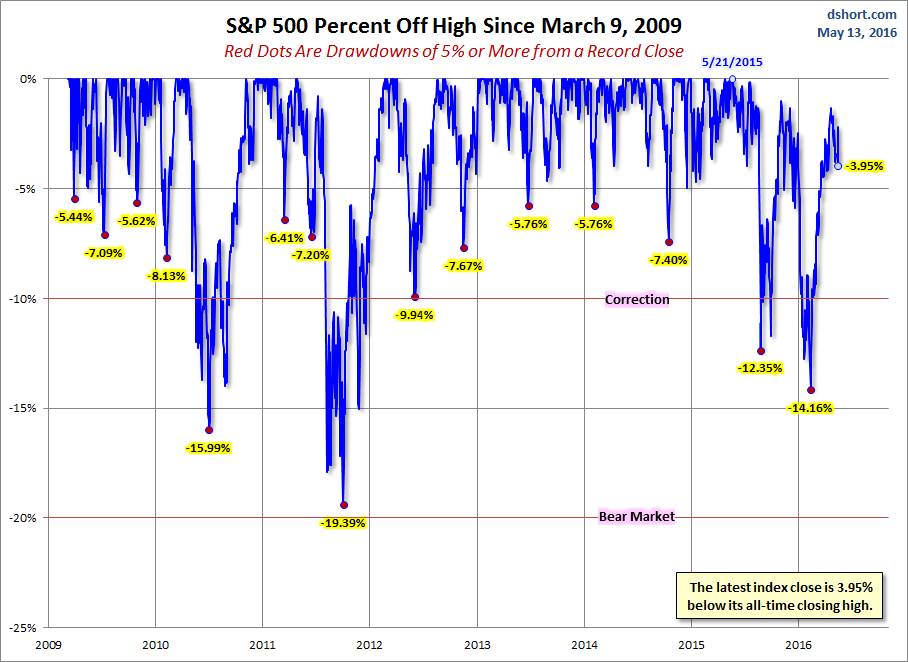

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

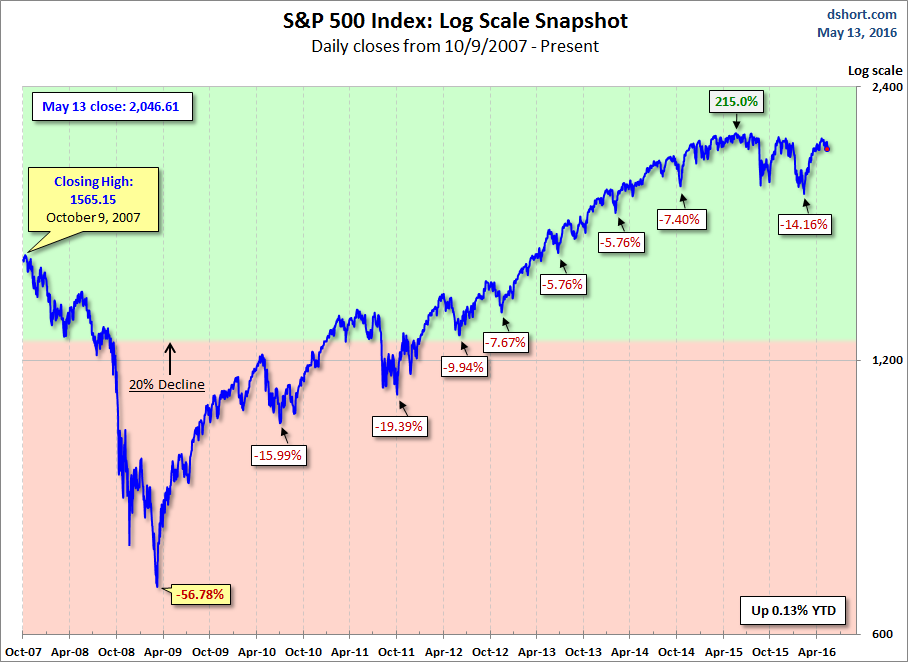

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

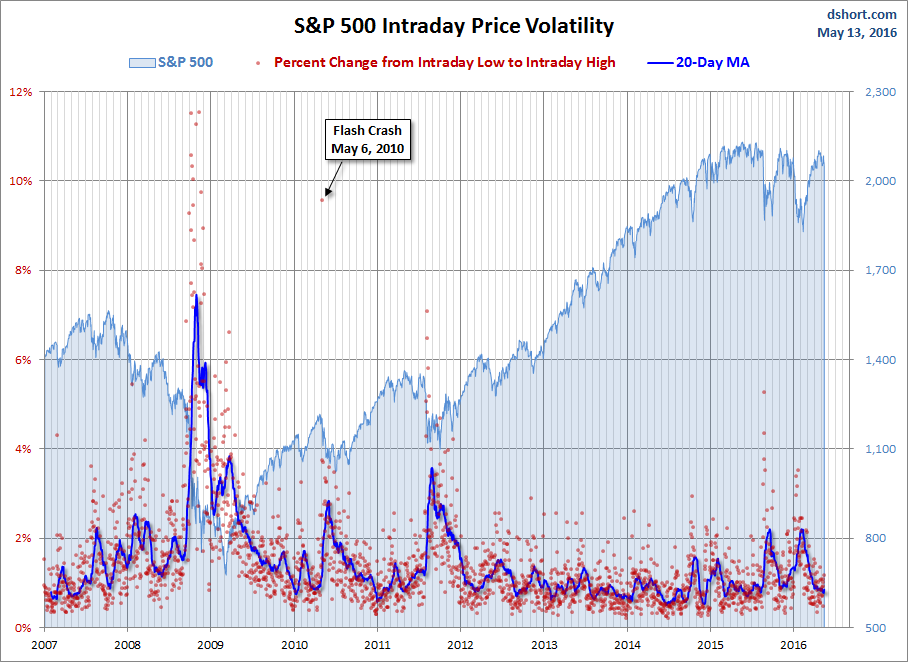

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI