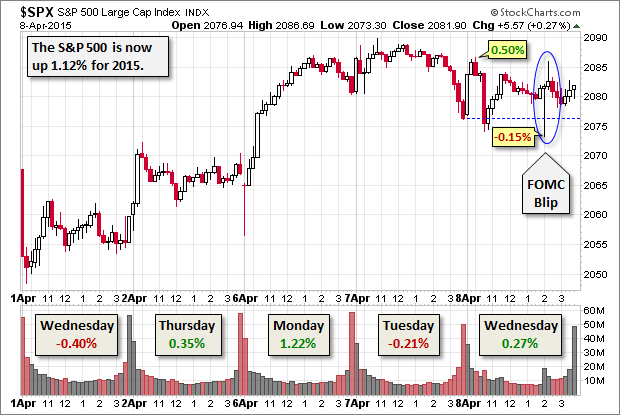

The big news today was the 2 PM release of the FOMC minutes for the meeting held on March 17-18. The fast trade frequently games these releases with some major volatility. Such was not the case today. The S&P 500 opened higher and hit its 0.50% intraday high about 30 minutes later. It did a quick late morning dip into the red, recovered, and then dropped to its fractional -0.15% intraday low a couple of minutes after 2 PM. But the Fed blip was short lived. The index returned to its general downward trend since yesterday's intraday high. As for Fed volatility, today's modest 0.65% range was at the 26th percentile of the 66 market days in 2015.

The FOMC minutes showed a Fed split over the timing of a rate hike. Who knows? Maybe some central bank indecision is the most effective way to get Mr. Market to cut back on its Fed watching and pay attention to earnings and fundamentals.

Today the yield on the 10-year Note rose 3 bps to 1.92%.

Here is a 15-minute chart of the past five sessions.

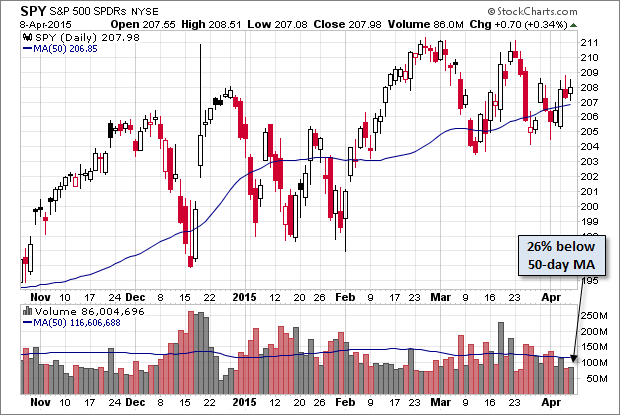

Here is a weekly chart of the ARCA:SPY ETF, which gives a better sense of investor participation. Today's FOMC minutes clearly didn't trigger much trading.

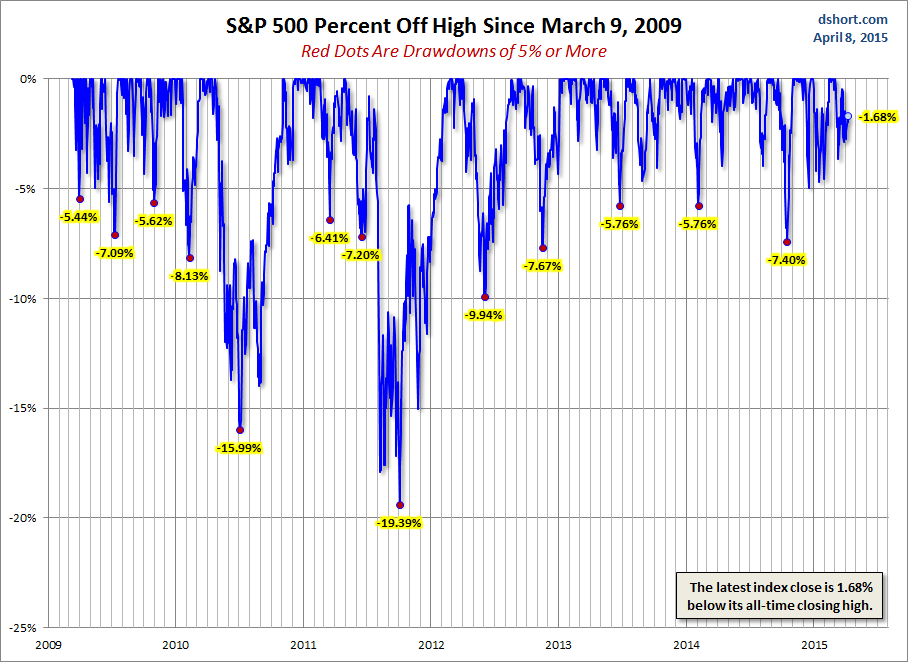

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

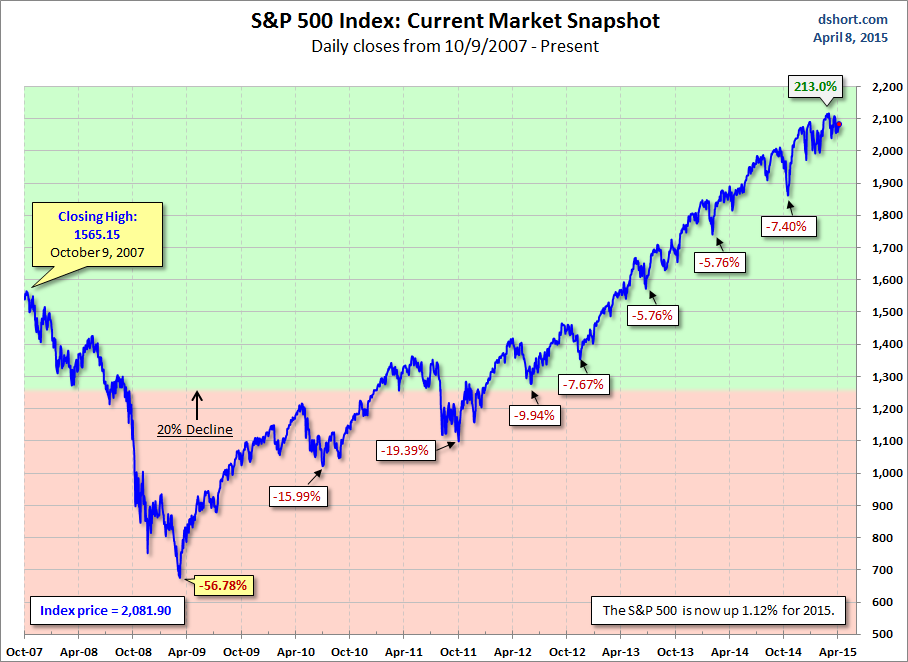

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.