The atmosphere for today's market action was quite friendly: Optimism about Greece, a 0.05% increase in Core Durable Goods, a beat on New Home Sales, and better than forecast Richmond Fed Manufacturing numbers. Despite the external support, the S&P 500 spent the day in tranquilizer mode, its fourth smallest intraday trading range of 2015. The index opened in the green, hit its 0.24% intraday high a couple of minutes after 10 AM housing report and promptly dropped gave back the gains and drifted to its -0.14% noon hour intraday low. It then slowly drifted to its fractional gain of 0.06% at the final bell.

The 10-year yield closed today at 2.42%, up 5 bps from yesterday's close and 8 bps off its 2015 high.

Here is a 15-minute chart of the past five sessions.

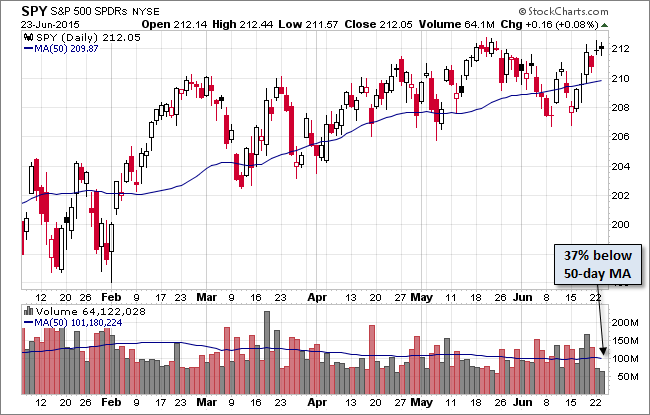

A daily chart of the ARCA:SPY ETF gives a better sense of investor participation, or lack thereof. Trading volume was 37% below its 50-day moving average.

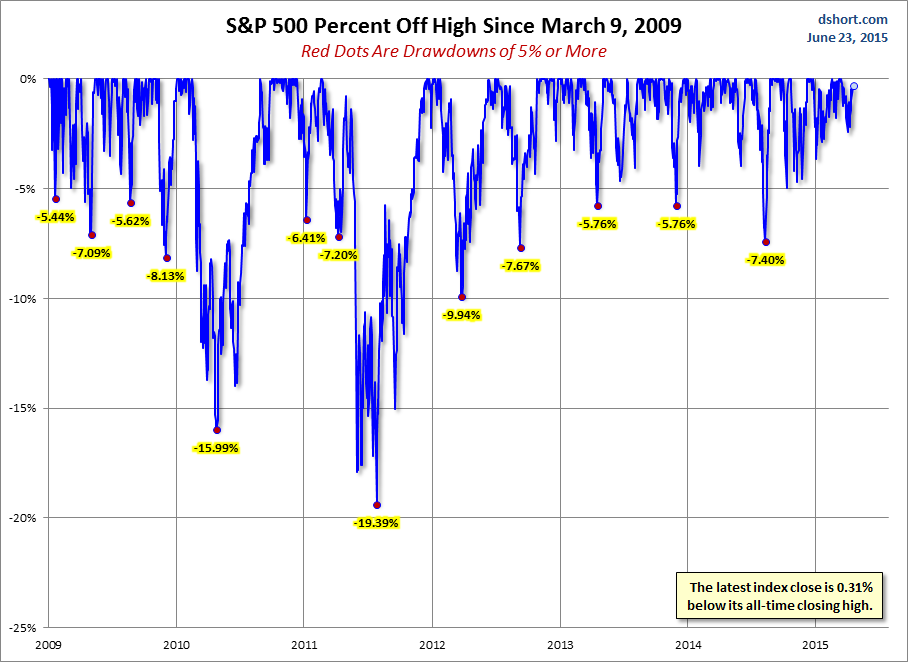

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

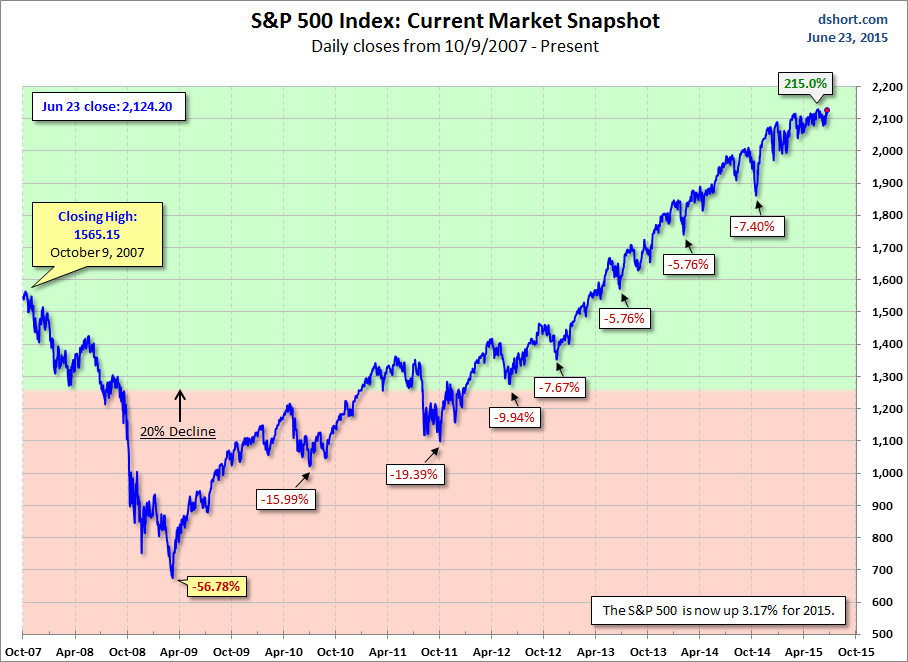

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.