T2108 Status: 70.4%

VIX Status: 14.6

General (Short-term) Trading Call: Hold

Commentary

The S&P 500 made a bullish breakout from the wedge formation I have been following this week.

This breakout is occurring directly ahead of tomorrow’s jobs report and suggests that the market is likely to react well to it. This breakout also means that the bearish divergence I noted yesterday between the S&P 500′s gains and T2108′s losses are now null and void. Instead, the apparent bottoming in the Australian dollar (FXA) won the day.

T2108 is right back in overbought territory, but I am not yet rolling out the standard T2108 trading rules. Typically at this time, I would recommend starting a bearish position. Instead, I am recommending holding onto bullish positions (in my case my remaining SSO calls) to allow the bullish formation to run its course. If the S&P 500 rallies strongly tomorrow, I will most likely sell these remaining calls. I am still avoiding going short until the bears prove they are breaking the market. I may consider a short position if T2108 gets to an extreme overbought position over 80%.

Finally, I am not yet ready to reconsider using the extended overbought strategy because of earnings season and a whole host of negative reports and warnings that I have seen so far.

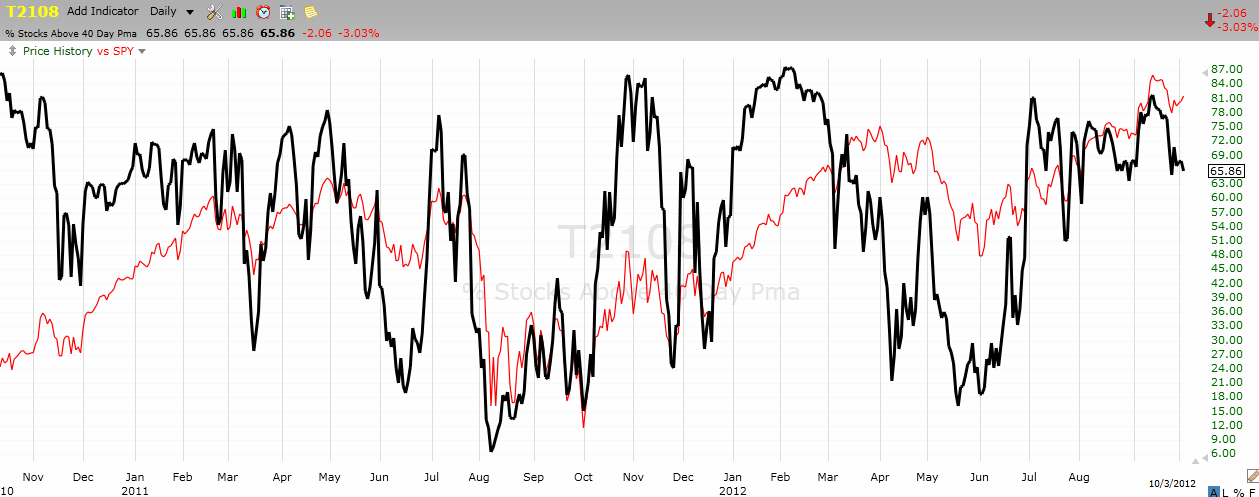

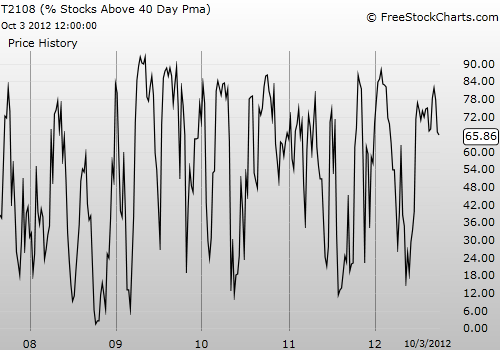

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Be careful out there!

Full disclosure: long SSO calls

VIX Status: 14.6

General (Short-term) Trading Call: Hold

Commentary

The S&P 500 made a bullish breakout from the wedge formation I have been following this week.

This breakout is occurring directly ahead of tomorrow’s jobs report and suggests that the market is likely to react well to it. This breakout also means that the bearish divergence I noted yesterday between the S&P 500′s gains and T2108′s losses are now null and void. Instead, the apparent bottoming in the Australian dollar (FXA) won the day.

T2108 is right back in overbought territory, but I am not yet rolling out the standard T2108 trading rules. Typically at this time, I would recommend starting a bearish position. Instead, I am recommending holding onto bullish positions (in my case my remaining SSO calls) to allow the bullish formation to run its course. If the S&P 500 rallies strongly tomorrow, I will most likely sell these remaining calls. I am still avoiding going short until the bears prove they are breaking the market. I may consider a short position if T2108 gets to an extreme overbought position over 80%.

Finally, I am not yet ready to reconsider using the extended overbought strategy because of earnings season and a whole host of negative reports and warnings that I have seen so far.

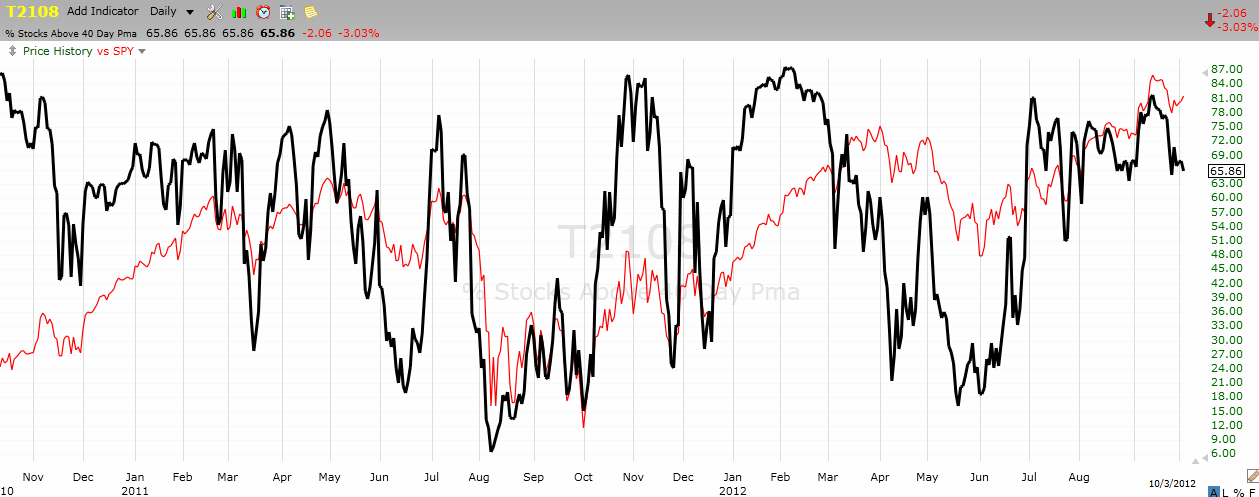

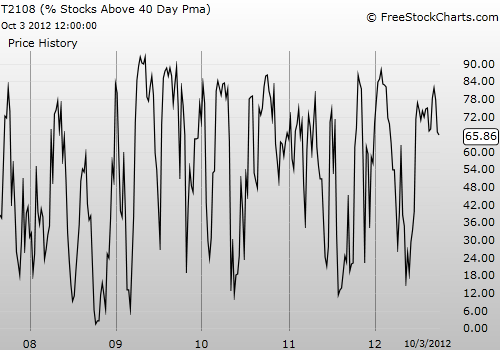

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Be careful out there!

Full disclosure: long SSO calls

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.