Friday’s late day rally in the S&P 500 futures was a short cover due to the Trump administration pulling its health care bill. In all respects it didn’t make sense, but that’s how these markets work now. How is it that pulling the doomed health care bill could be a positive? It really wasn’t a positive as much as it was about facing the reality of the failed bill.

After the late push the S&P 500 futures sold back off on the close and got crushed on the overnight trading session. At its early low the S&P traded down to 2318.00, down 26.80 handles from Friday’s close. The overnight weakness was part of the healthcare debacle and it spread from Asia to Europe.

The S&P 500 futures rallied slightly up to 2327.50 before the 8:30 futures open, saw a fix of buying and selling after the open, then traded down to 2318.25, 1 tick off the globex low. From there the ES traded back up to 2324.00 and then went back down to make a new low by 1 tick at the exact Globex low at 2318.00. Not long before that I was warning the forum:

09:44:29 TRADINGDATA2: (driley) Everyone short and buy stops above, the algos have to do a squeeze job.

Little did I know that the ES would be trading 2340.00, down 2.75 handles, around 12:00 CT. That’s when JohnA reminded me about one of MrTopStep’s top trading rules that ‘it takes days and weeks to knock the S&P down, and only one to bring it back’. After the 2340 high was made the ES pulled back a few handles and then started pushing toward a new high going into the close. The rally was a combination of the (ESM17:CME) being down 6 out of the last 7 sessions, traders selling at low prices, and end of the quarter buying.

The bottom line is, you make money on the event driven sell offs, but you can’t sell the S&P when its been down 6 out of the last 7 days going into the quarter end. Many of the big investment firms have what they call ‘two way flow’. In other words, they may own big blue chip stocks, and buy small cap stocks like the Russell 2000. I have seen this for years, but according to the Stock Trader’s Almanac, the last trading day of March has the Dow down 17 of last 27 and Russell up 16 of the last 23.

After a late day drop down to 2332.00 the ES started moving back up. The MrTopStep MiM went from almost $400 mil to sell to $50 million to buy. Total volume was 1.36 million contracts traded with 280,000 of that volume coming from the globex, pre-8:30 CT open. After last Wednesday’s 2.65 million contracts traded, the volume slipped down to 1.6 million on Friday. The ES made a new daily high by 2 ticks, up to 2341.25, as the MiM turned small to sell.

Technicals

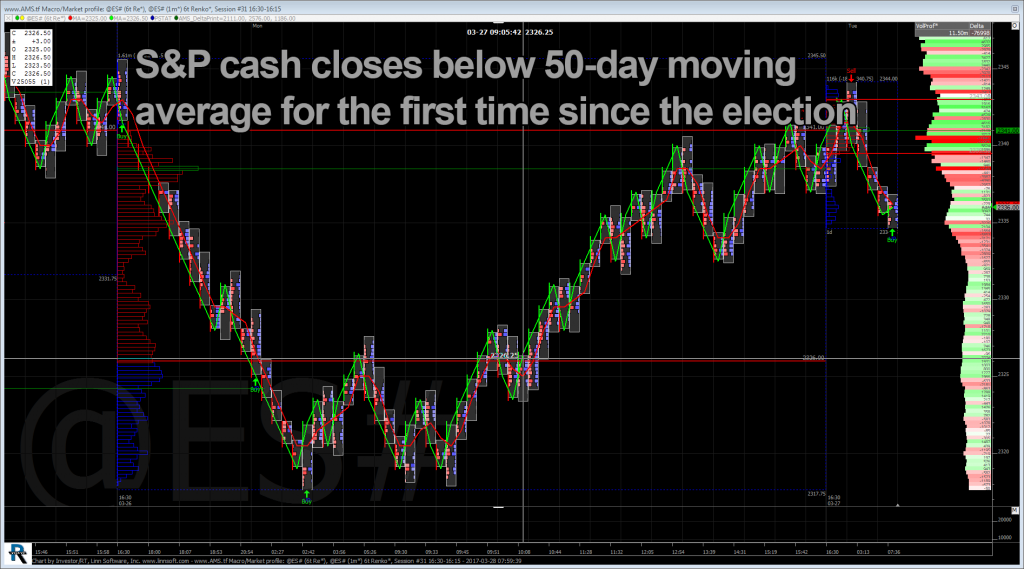

Yesterday the S&P cash (^GSPC:SNP) broke below, rallied back above, and closed below its 50-day moving average at 2332. The cash made its early low at 2322.25 and bounced from there. The S&P rallied up to 2339, but it dipped back below the 50-day moving average on the close.

Yesterday’s close was the first time the S&P cash ended the session below 50-day moving average since the week of the election. Is that significant? Well, it could be… According to Bespoke Investment Group, ‘When the index falls below its 50-day average, it typically means the market is sputtering’. Some technical analysts say it often portends a further short-term decline. The level is made all the more relevant by the fact that the S&P has been on its longest stretch — 93 days — above the 50-day average since March 2011. Some think a hard drop under the 50 moving average could precipitate a 5% to 10% drop. We do not think that’s in the cards right now.

While You Were Sleeping

Overnight, Asian & European saw some rebounds following Wall Street’s rally on Monday. The S&P 500 futures opened the globex session at 2340.50 and pushed up to a high of 2344.00 on the Euro open before falling down to session lows of 2338.75 at 6:12 am cst down a single tick on the session with volume at 90k.

In Asia, 9 out of 10 open markets closed higher (Nikkei +1.14%), and in Europe 9 out of 11 markets are trading higher this morning (DAX +0.61%). Today’s economic calendar includes International Trade in Goods, Redbook, S&P Corelogic Case-Shiller HPI, Consumer Confidence, Richmond Fed Manufacturing Index, State Street Investor Confidence Index, a 4-Week Bill Auction, a 52-Week Bill Auction, Esther George Speaks, Dennis Kaplan Speaks, and a 5-Yr Note Auction.

Say Hello To T+3

Our View: Yesterday’s trade saw a 27 handle drop, and a 24 handle pop, in 22 hours. Everyone that was bearish got run over. Today starts T + 3. While they say the new regulations have shut down the process, we still think the big investment firms and mutual funds mark stocks up and down at the end of the quarter. The way the March quarter end is looking is that there will be some type of buying in Treasury bonds and also in the Russell small caps, while selling the Dow and S&P. It’s all about month end rotations.

Today we have a busy economic schedule, and we also have a ton of Fed speak this week. Our view is that the short squeeze is not over. We lean to selling the early rallies and buying weakness, or just buy weakness when the ES pulls back.