The political circus was in full swing last week, and the S&P 500 futures (ESM17:CME) bore the brunt of it. After a quiet start to the week, the President Tump / former FBI director Comey headlines kicked the ES into high gear. On Wednesday, the S&P took a 1.8% nose dive, the Dow futures (YMM17:CME) were down 1.5%, and the Nasdaq 100 futures fell 2.75%. One of the things I asked my Twitter followers and the PitBull was, ‘did algorithmic trading push the markets further then they should have?’ For the most part, the answer was a unanimous ‘YES’!

After a big rally on Thursday the index futures markets continued higher on Friday. The S&P 500 futures (ESM17:CME) rose 17.9 points, or 0.75%, to 2381.50. The Nasdaq 100 futures (NQM17:CME) climbed 22.75 points, or 0.45%, to 5653.25, and the Dow Jones futures (YMM17:CME) gained 143 points, or 0.55%, to 20787.00. Even with the strong late week rebound, major indexes in the U.S., Europe and Japan ended the week lower on worries about President Donald Trump’s ability to push through proposals, including tax cuts and infrastructure spending.

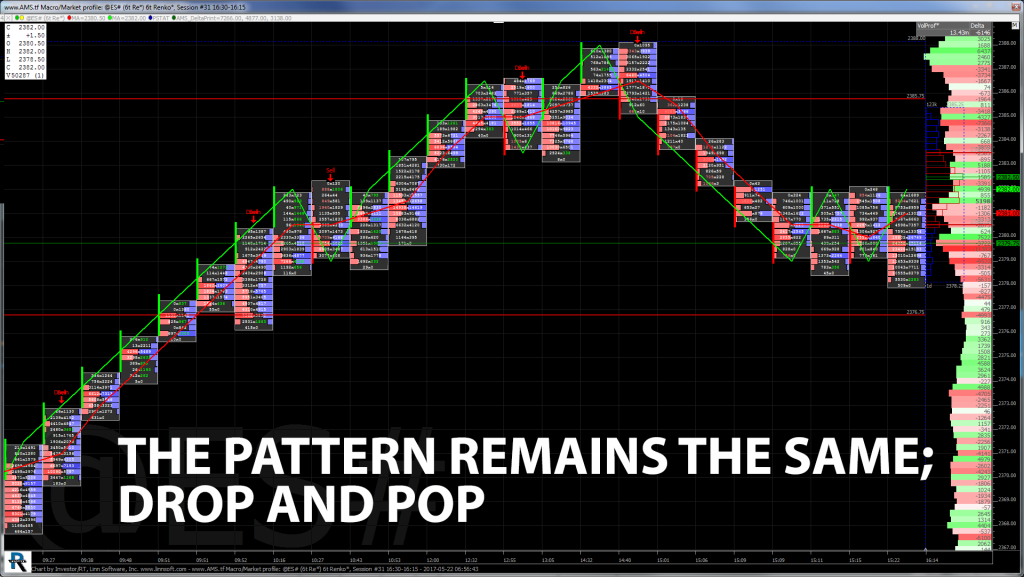

In the end, despite the drop and all the ‘bad news’ out of Washington, the S&P 500 futures, at its high of 2388, was only 16 points off its all time contract high. Yes, the bears got their way, but the overall patterns remain the same; drop and pop. After the dust settled, the S&P 500 fell 0.4% for the week, its worst weekly drop in more than a month. The Dow industrials also fell 0.4% during the week, and the Nasdaq Composite dropped 0.6%.

There is clearly a new sheriff in town, and it’s not Donald Trump… It’s all the different types of algorithmic and high frequency trading programs, and how they whip all the various asset classes around. From currencies, to metals, to commodities and index futures, it’s all part of how the markets move. While many trades brush off this idea, last week was another great example of how the news moves the markets down sharply, and then moves it sharply the other way.

The late week rebound regained much of the weeks losses and showed not only how political strife can rattle the markets, but also how investors focus eventually goes back to corporate earnings and economic growth. I understand that the markets are over extended, and have been for a long time, but I also understand how historically low interest rates have made it impossible to be a seller. It all goes back to that old saying, ‘don’t fight the Fed’. The bounce back showed that as long as the data is improving, the stock market still has more room on the upside.

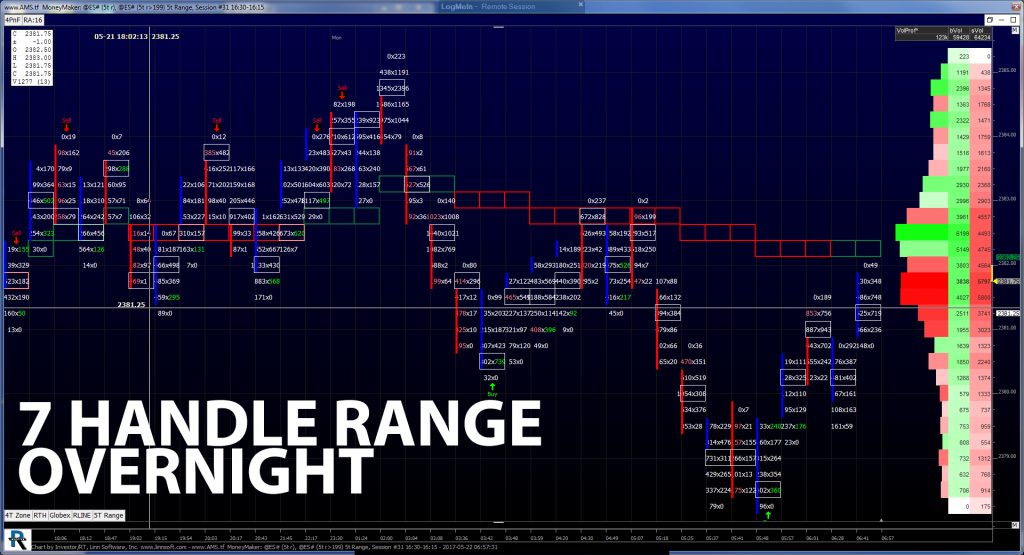

While You Were Sleeping

Overnight, equity markets in Asia and Europe were mixed, quiet, choppy and range bound. In the U.S. the S&P 500 futures opened globex at 2381.75 and made a high of 2385.25 on the Euro open. The session low was made at 2378.25 about three hours after the Euro open, completing a 7 handle range. As of 7:26 am cst the last print is 2382.50, up one handle, with 136k contracts traded.

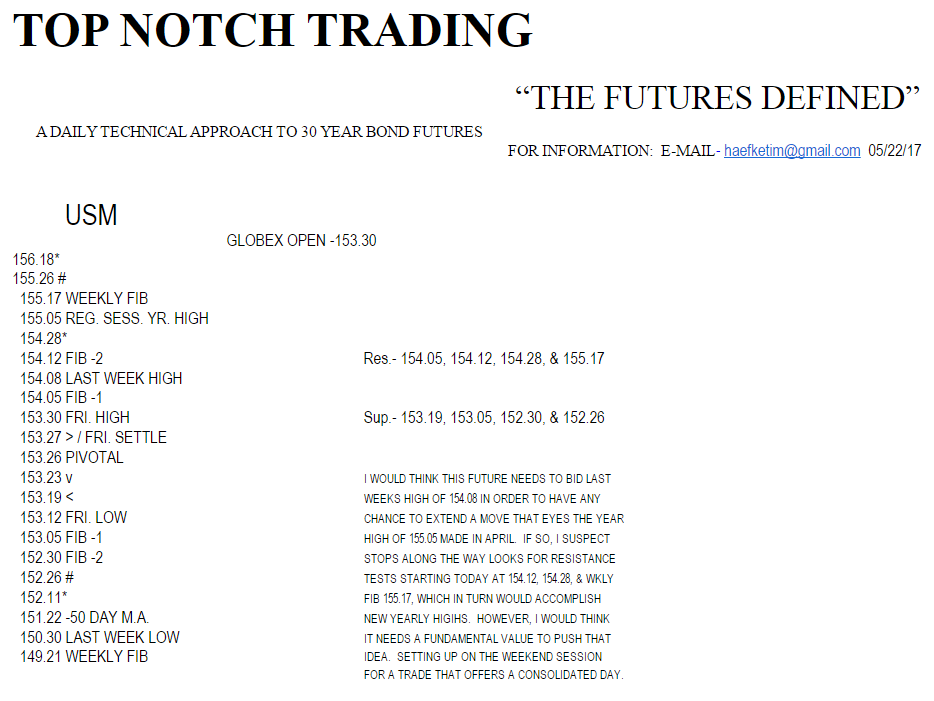

In Asia, 7 out of 11 markets closed higher (Nikkei +0.45%), and in Europe 6 out of 12 markets are trading higher this morning (FTSE -0.30%). This week’s busy economic calendar features Wednesday’s FOMC minutes and 21 other reports, 14 Fed speakers, and 15 U.S. Treasury events. Today’s economic calendar includes Chicago Fed National Activity Index, Neel Kashkari Speaks, Patrick Harker Speaks, 4-Week Bill Announcement, 3-Month Bill Auction, 6-Month Bill Auction, Neel Kashkari Speaks, Lael Brainard Speaks, Lael Brainard Speaks, Charles Evans Speaks.

Our View

All the increased volume / selling on Wednesday only added more buy stops above the market. One of the things I continue to push is what happens after the sellers get off base. It’s all about following the overall price action of the S&P, which has not changed at all. The trend is your friend traders, and as long as interest rates are historically low, you should never forget it. If you are afraid to buy the futures after a big dip, don’t be afraid to buy some cheap calls, or sell some puts.

Our view; the ES is going back up, but after the drop and rally, there needs to be some mending. This means that the ES needs to pull back a little before going back up. I think you can take it from there.

- In Asia 7 out of 11 markets closed higher: Shanghai Comp -0.48%, Hang Seng +0.86%, Nikkei +0.45%

- In Europe 6 out of 12 markets are trading higher: CAC +0.02%, DAX -0.31%, FTSE -0.30%

- Fair Value: S&P -1.49 , NASDAQ +1.76 , Dow -20.14

- Total Volume: 1.66m ESM and 7.3k SPM traded