Street Calls of the Week

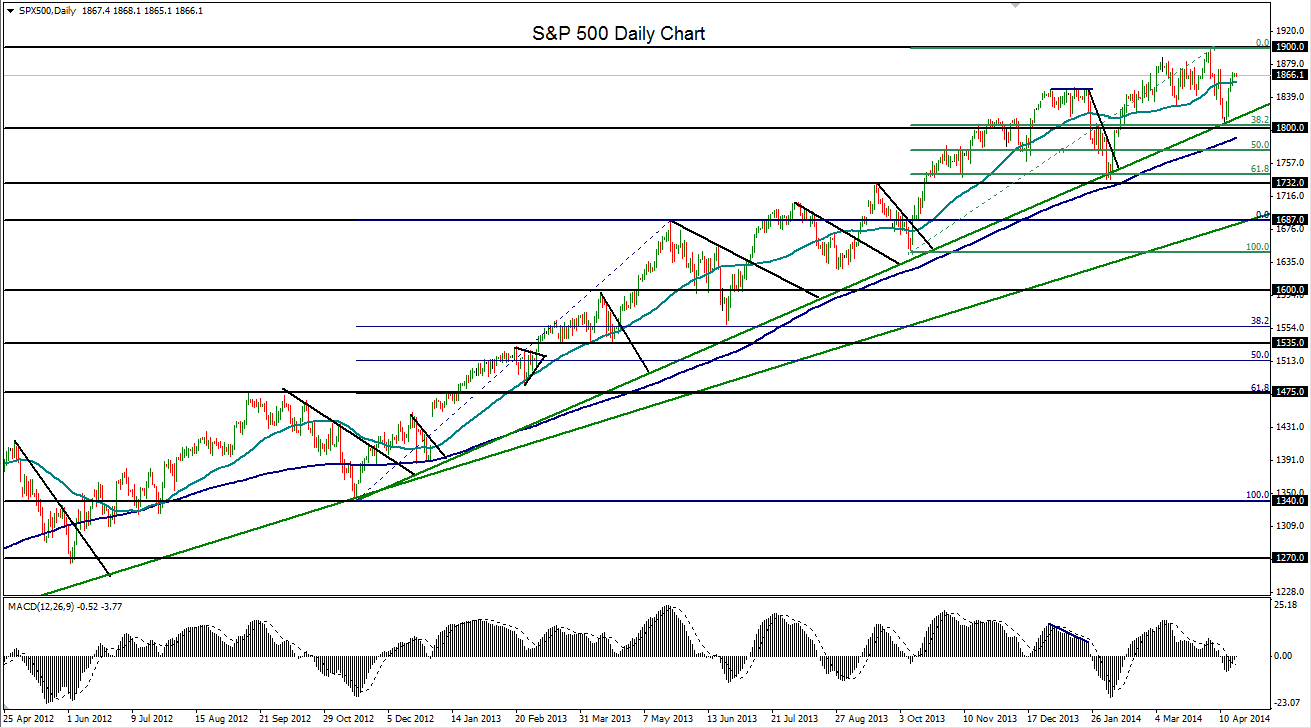

The S&P 500 index (daily chart shown below) has managed to regain well more than half of the 4% loss it experienced earlier in April when it pulled back sharply from the new record high of 1897 down to key support around the mid-April low of 1814.

In the process of this partial recovery, the US equity benchmark index has once again risen above its 50-day moving average.

While momentum stocks fared significantly worse in April month-to-date, the overall equities market as measured by the S&P 500 has registered only a minor setback within the long-term bullish trend.

The last time that the index pulled back significantly was in late January, when it fell from a high of 1850 down to a low of 1737, for a larger 6% decline.

Having just rebounded from major support around the 1815 area early last week, the S&P 500 is on track to retest its record high and upside target around the 1900 psychological resistance level.

A further breakout above 1900 would confirm a continuation of the entrenched bullish trend, pushing the primary target up towards 2000.

Strong downside support continues to reside around the 1800-1815 support zone.

Disclosure: FX Solutions assumes no responsibility for errors, inaccuracies or omissions in these materials. FX Solutions does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FX Solutions shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials.

The products offered by FX Solutions are leveraged products which carry a high level of risk to your capital with the possibility of losing more than your initial investment and may not be suitable for all investors. Ensure you fully understand the risks involved and seek independent advice if necessary.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.