US Stocks recovered strongly yesterday, reclaiming almost all the losses suffered on Wednesday following the FOMC monetary policy announcement. Headlines today seems to attribute the sharp gains to "stronger", "favourable" US economic data that came out yesterday, but that seems a little bit too convenient. If we look at what was released yesterday, we would notice that there isn't really any big event risk - the strongest of which would be the Philly Fed Index which came in at 9.0 versus an expected 3.2. Even though this is definitely a good print, but Philly Fed tended not to inspire change in market direction be it much higher or lower than expected.

The 2nd most important number would be Initial Jobless Claims, and that was also better than analysts forecasts but the difference was a mere 2K, while Continuing Claims was 9K worst than expected. Given this, it is hard to imagine a neutral trader would look at this numbers and think that US economy has improved and hence a good proposition to start buying up stocks. Hence, it is more likely that market is simply discounting the words of Janet Yellen - not an unreasonable assertion when we remember that bullish momentum in US stocks was rather strong prior to FOMC announcement. Also, it should be noted that Yellen's "around 6 month" clarification is not that far off from the original rate hike forecast which is mid 2015, and may only be 3-4 months earlier in the most aggressive scenario. In the bigger scheme of things, this does not change long-term pricing of assets that much and the Yellen's words was never really impactful fundamentally and was only relevant in terms of market sentiment.

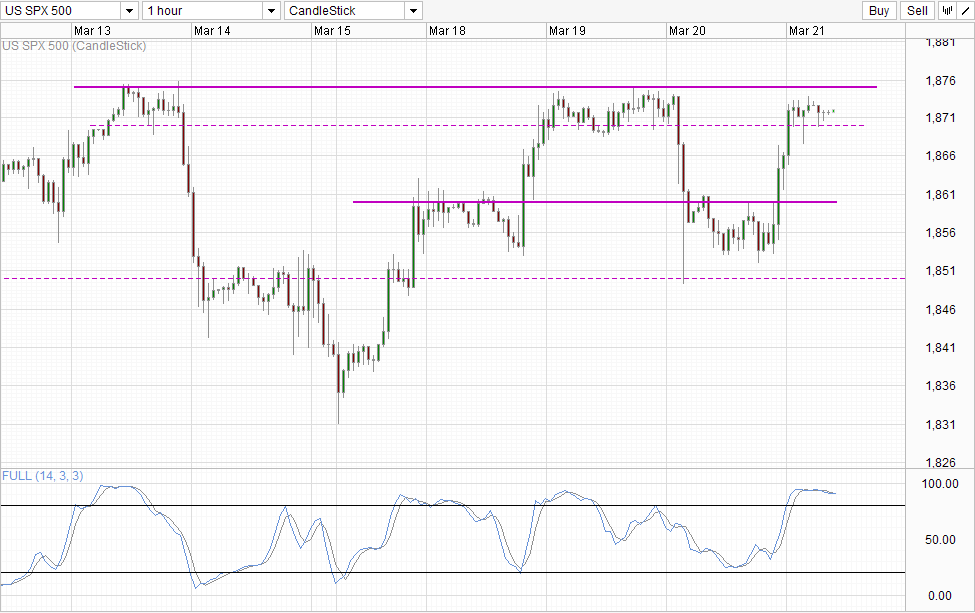

Hourly Chart

With yesterday's rally, it is clear that Yellen's comments are no longer relevant, and that should mean that the previous bullish momentum will be able to climb higher once again. That being said, price is currently back within the consolidation zone seen on Wednesday and a confirmed break is needed for demonstration of strong bullish conviction that can bring us back to previous record highs and potentially even higher. Unfortunately for bulls, Stochastic indicator tells us that momentum is already Overbought in the short-run, and considering that today is the final day of the week the likelihood of a significant breakout occurring is lower. Nonetheless, as long as prices do not dip below 1,870 either today or next Monday, the likelihood of a bullish breakout remains.

Daily Chart

Daily Chart shows that uptrend is fully intact with a bullish engulfing candle. Based on this alone, a move back towards 1,890 and higher objectives is possible. However, given that the closest reasonable stop loss would be below 1,850 and perhaps all the way below 1,830 if more allowance is desired, traders will need to determine if the potential gains is enough for the risk involved.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI