Ethereum price target raised at Standard Chartered. Here’s the new forecast

Don't underestimate the importance of what the Russell 2000 does from here.

About a month ago, small caps found themselves oversold, on support and poised for a rally. I shared why the Power of the Pattern thought they were poised to rally in this post. The very next day, small caps started screaming higher, out performing the S&P 500 by a large percentage. Well, that is now the past.

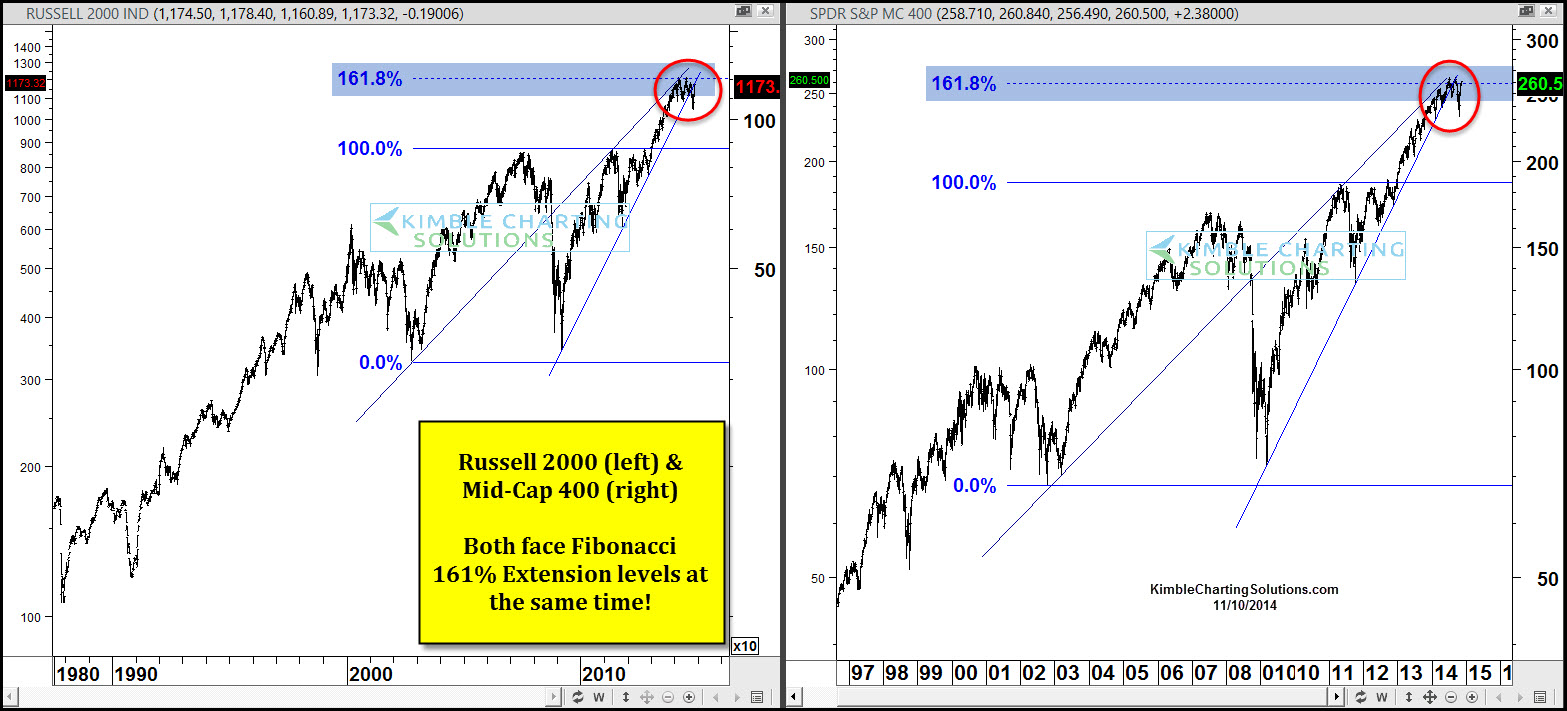

Turning the page forward to current conditions, what does the Russell look like today? In the chart above, I applied Fibonacci to the 2002 lows and the 2011 highs. As you can see, the Fibonacci 161% Extension level seems to be heavy resistance this YEAR, as the Russell has had little success breaking from this level for the past 11 months.

The strong rally of late has taken the index to the underside of old support drawn off the higher lows, coming off the 2009 low. At this time the Russell is kissing the underside of resistance as it created a "Weekly Doji Star" pattern last week at (1) above. Doji Star patterns at resistance can become signs of a top.

Does the phrase "So goes small caps, so goes the broad markets" apply here? Humbly I think it does! What these two do from here, could tell us a ton about where the S&P 500 is at year end.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI