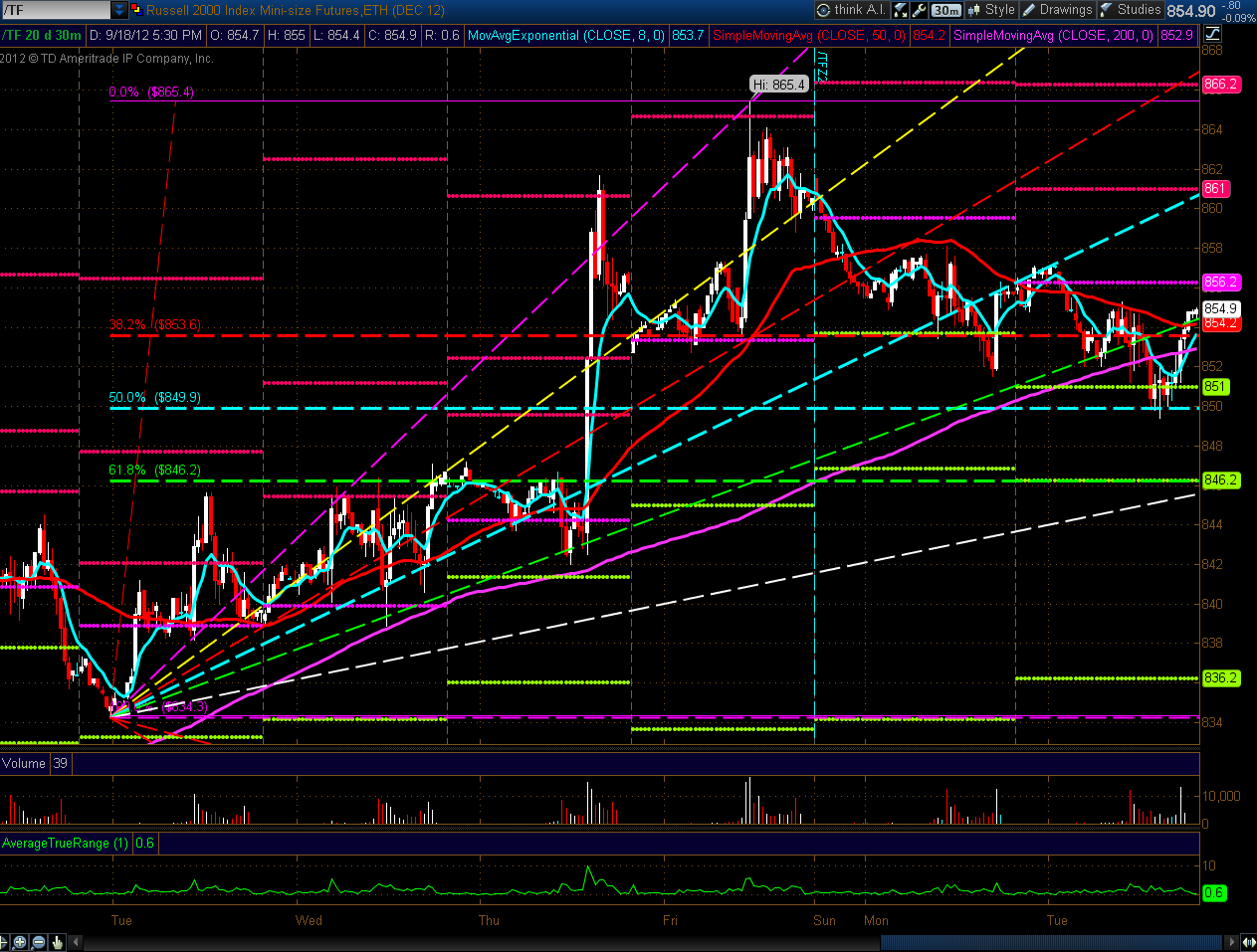

The 30 min chart below of the TF (Russell 2000 E-mini Futures Index) contains a Fibonacci retracement and a Fibonacci fanline drawing. You can see the levels at which buyers have been chipping away at the TF since it rallied last Thursday as price has subsequently dipped on three occasions...853.50, 851.50, and 850.00.

As of today's (Tuesday's) close, the price has bounced back up, once more, and sits just above near-term support at 853.50 (confluence of the 40% Fibonacci retracement level with the 60% Fibonacci fanline, together with the merging 50 and 200 MAs). A break and hold below this level, and particularly 850.00, may signal that a deeper dip is on the way to, potentially, the levels as noted in my post of September 14th for the corresponding Russell 2000 Index. Otherwise, I'd be looking for the rally to resume on a hold above this level. Longer-term upside price projections for the TF are described in my last post.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.