Forex News and Events

The current drama unfolding around Greece and international creditors is the definition of fluid. Greece government 5-yr yields have rallied to 16.26% illustrating the growing unease with the lack of solution. However, absence of contagion into European bond markets indicates that most traders anticipate a deal will be struck (potentially a bridge bailout extension or allowing Greece to issue short-term debt). But we see the situation more balanced. Eurogroup talks in Brussels collapsed after the Greek government rejected a plan that it request an extension to its existing international bailout package. European cannot give into the key Greece demands and current verbiage from officials suggest that they are not backing down from upholding current commitments. FM Yanis Varoufakis has stated they would agree to an extension with current terms (ie a new renegotiated agreement would be needed). EU Dijsselbloem stated, “I hope they (Greece) will ask for an extension to the programme, and once they do that we can allow flexibility, they can put in their political priorities.” Mr Varoufakis, after Greece rejected an EU proposal to extend its current €240bn bailout, called it “absurd” and “unacceptable.” Should Greece fail to accept an extension, ECB would most likely cut the Greek banks from the eurosystem which in turn would probably trigger capital control on Greek banks. Greece might be able to last a few weeks but shortly needs external financing or will default. The deadline on the Emergency Liquidity Assistance (ELA) is on Wednesday and credit extension is on Friday. Considering the ideological divide, we suspect it will come down to conviction. Who will blink first? In our view, this weight falls squarely on Greek Prime Minister Alexis Tsipras in one simple question. Does Tsipra have the courage to risk Greek financial armageddon in order to achieve his political mandate? FX markets will be subject to headline and rumor trading till some resolution is found.

Japan and JGB Vol

The massive surge in JGB volatility has investors concerned. While no change in the BoJ policy meeting this week the focus will be on Koruda’s press conference. While the short dated bonds remains stable the longer end of the curves has seen a destabilizing rally in yields. Pressure has increased since the weak debt auction on Friday. Conjecture and marginal data suggests that the $1.1 trillion government Pension Investment Fund (GPIF) is selling domestic bond and buying local stock and international assets. The Ministry of Finance has expressed concern over the spike in volatility but expect it be a short term phenomena. With the BoJ buying massive quantities of JGB, the liquidity void, has produced excessive volatility. Which in turn has the potential to scare off normal investors. Without natural buyers the ability for the BoJ to hold down rates to conduct monetary policy strategy becoming increasing difficult. Today indications that Japan GDP recovery was slower than anticipated indicates that Abe might turn back to the BoJ for additional stimulus to keep the “miracle” alive. However, with dislocation in JGB becoming an issue further aggressive actions in rate could break the transmission mechanism.

FOMC

With markets focused on Europe this week release of the FOMC meeting minutes will take a back seat. But that is probably what Yellen is hoping for. In addition With Chair Yellen’s semi-annual testimony before Congress in two week, the financial markets will likely be more motivated to put more weight on the imminent comments than the minutiae of last month’s FOMC minutes. The primary driver this week for US rates will be Greece but after then they will take its cue from Yellen’s remarks. With the economic data still performing well, despite some marginal softness in demand, we anticipated the Fed to hike this early summer. US rates will grind higher supporting USD in the mid to long-term.

| Today's Key Issues | Country / GMT |

|---|---|

| Jan Retail Price Index, last 257.5 | GBP / 09:30 |

| Jan RPI MoM, last 0.20% | GBP / 09:30 |

| Jan RPI YoY, last 1.60% | GBP / 09:30 |

| Jan RPI Ex Mort Int.Payments (YoY), last 1.70% | GBP / 09:30 |

| Jan CPI Core YoY, last 1.30% | GBP / 09:30 |

| Jan PPI Input NSA MoM, last -2.40% | GBP / 09:30 |

| Jan PPI Input NSA YoY, last -10.70% | GBP / 09:30 |

| Jan PPI Output NSA MoM, exp -0.40%, last -0.30% | GBP / 09:30 |

| Jan PPI Output NSA YoY, exp -1.50%, last -0.80% | GBP / 09:30 |

| Jan PPI Output Core NSA MoM, last 0.00% | GBP / 09:30 |

| Jan PPI Output Core NSA YoY, last 0.80% | GBP / 09:30 |

| Dec ONS House Price YoY, last 10.00% | GBP / 09:30 |

| Feb ZEW Survey Current Situation, last 22.4 | EUR / 10:00 |

| Feb ZEW Survey Expectations, exp 55, last 48.4 | EUR / 10:00 |

| Feb ZEW Survey Expectations, last 45.2 | EUR / 10:00 |

| Dec Int'l Securities Transactions, last 4.29B | CAD / 13:30 |

| Feb Empire Manufacturing, exp 8.5, last 9.95 | USD / 13:30 |

| Jan Existing Home Sales MoM, last -5.80% | CAD / 14:00 |

| 13.févr. Bloomberg Nanos Confidence, last 54.6 | CAD / 15:00 |

| Feb NAHB Housing Market Index, exp 58, last 57 | USD / 15:00 |

| Swiss National Bank President Jordan Speaks in Brussels | CHF / 17:00 |

| Dec Net Long-term TIC Flows, last $33.5B | USD / 21:00 |

| Dec Total Net TIC Flows, last -$6.3B | USD / 21:00 |

| 4Q MBA Mortgage Foreclosures, last 2.39% | USD / 23:00 |

| 4Q Mortgage Delinquencies, last 5.85% | USD / 23:00 |

The Risk Today

Peter Rosenstreich

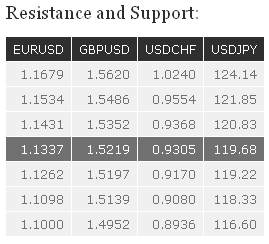

EUR/USD EUR/USD weakened yesterday. However, a move towards the high of the horizontal range between the support at 1.1262 and the resistance at 1.1534 remains favoured. Hourly resistances now lie at 1.1380 and 1.1443 (13/02/2015 high). An hourly support can be found at 1.1320 (16/02/2015 low). In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Key resistances stand at 1.1679 (21/01/2015 high) and 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD GBP/USD has recently weakened, suggesting a potential short-term weakening bullish momentum. Hourly supports are now given by 1.5340 (16/02/2015 low) and by the rising trendline (around 1.5303). Hourly resistances can be found at 1.5440 and 1.5486. In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potentials are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). A strong support stands at 1.4814.

USD/JPY USD/JPY is trying to bounce. An hourly resistance can be found at 119.20 (13/02/2015 high). Hourly supports are now given by 118.18 (16/02/2015 low) and by the rising trendline (around 117.51). A key support stands at 116.66. A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 115.57 (16/12/2014 low).

USD/CHF USD/CHF is challenging the resistance area between 0.9347/0.9368 (15/10/2014 low). The short-term succession of higher lows favours a bullish bias. Hourly supports stand at 0.9257 (12/02/2015 low) and 0.9170 (30/01/2015 low). Another resistance lies at 0.9554 (16/12/2014 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Another key resistance stands at 0.9554 (16/12/2014 low), whereas a strong support can be found at 0.8353 (intraday low).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI