Asia stocks tread water as tariff concerns persist; Tech eyes TSMC earnings

The markets have responded to the sanctions against Russian officials with the view that near term tensions are unlikely to escalate, with gold and oil lower and the Swiss franc and Japanese yen stable. US Secretary of State John Kerry warned of ‘a serious series of steps’ if the Crimean referendum went ahead, though in the end, the ‘steps’ were a few personal asset freezes against a few Russian oligarchs who are unlikely to be affected by sanctions.

Russian President Vladimir Putin has signed an order recognising Crimea as a sovereign state and there are even reports that he could use a speech today to recommend formal annexation of Crimea. The sanction is so soft that it implies that the US isn’t serious about dealing with Russian incursions and may lead to further moves in Eastern Ukraine. Either way, it’s likely we will continue to see volatility with further announcements of action on either side.

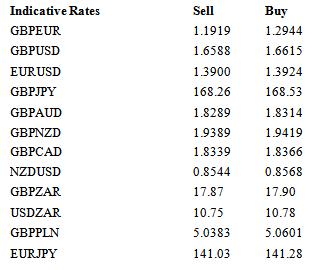

Sterling has been sidelined for the last few days, but continues to press the bottom of recent ranges against the euro. The main event is tomorrow with the MPC minutes, the labour market data and the Budget, with the potential for some sterling positivity – particularly on the labour market side. For today though, we are likely to be caught in the crossfire between the euro and dollar. Any continued euro strength is likely to drag GBPUSD higher ahead of this evening’s speech by Governor Carney at the annual Mais lecture at Cass Business School. According to some reports, Carney may use this speech to reveal his thinking on reforming the Bank’s operational structure.

The main data out this morning is the German ZEW survey for March and will attract attention ahead of next week’s PMI data. The index of expected economic growth – a leading indicator for German and euro area activity – has had a steady recovery since mid-2012. However, the index eased a little last month on the back of a softer outlook for emerging market activity, a strong euro, mounting deflation risks and tensions in Ukraine. These factors are expected to continue to press this month and the index is expected to fall from 55.7 in February to 53.5. That being said, despite a weaker final Eurozone CPI than expected yesterday, EUR remains well supported and given the failure of the euro to back away below 1.39 in recent sessions, we continue to expect a test of 1.40. While this may be seen in the short term, the comments from Draghi at the last press conference made it clear that such EUR strength would reduce inflation projections and consequently could increase the chances of further ECB easing, suggesting anything over 1.40 should be hard to maintain.

The other main data out this afternoon is US CPI inflation for February. The annual rate has been trending down over the past year and this pattern is expected to continue with a further fall from 1.6% in January to 1.2%. However, the core rate, which strips out the effects of food and energy prices, should remain stable at 1.6% year on year. Today will also see housing starts and building permits data for February, which are likely to be weather affected. The underlying US dollar softness has continued to catch many in the markets out but one explanation put forward is a reduction in foreign central banks holding treasuries. Fed custody holdings showed a record $104bn decline (next largest decline was $32bn in mid-2013) which hints at the possibility that foreign central banks sold the securities. Such flow would likely be spread over some time, so this could be one explanation for the continued USD weakness, with events in Crimea being one possible cause and the weakness of the CNY being another. Either way, this weakness does not suggest an imminent rally is likely, especially since today’s US data offers little reason to expect an early rise in US yields.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.