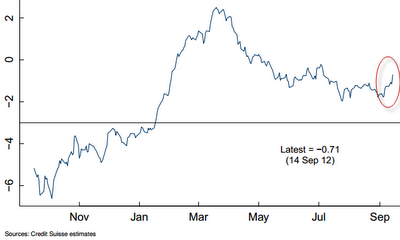

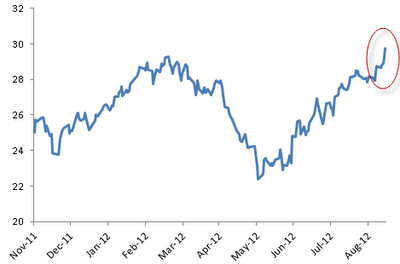

Given the recent demand for "risk-on" assets, it is worth taking another look at the risk indicators to see how much risk appetite is currently in the markets vs. for example in March - after the second 3-y LTRO. The first two indicators to consider are the CS Risk Appetite Index and the Fisher-Gartman Risk-On Index.

Both show a recent "risk-on" spike. However, while the CS index is materially below its March-April peak, the Fisher-Gartman index is at the highest level since the index was launched.

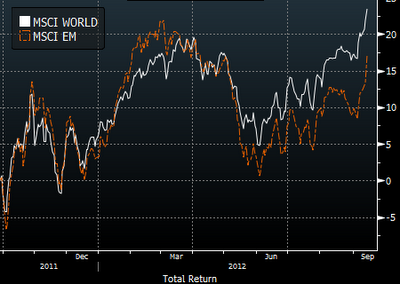

As discussed earlier (see this post), the CS index is sensitive to the global equity and credit markets, while commodities, currencies, as well as equities drive the Fisher-Gartman calculation. The main difference this time however came from emerging market equities, a larger component of the CS indicator than the Fisher-Gartman index. Emerging markets have underperformed the overall global equities index.

Given these subtleties in the risk indicators related to emerging markets equities, let's take a look at a third measure, the Citi Macro Risk Index, to "break the tie." Here is the definition:

The Citi Macro Risk Index measures risk aversion in global financial markets. It is an equally weighted index of emerging market sovereign spreads, US credit spreads, US swap spreads and implied FX, equity and swap rate volatility. The index is expressed in a rolling historical percentile and ranges between 0 (low risk aversion) and 1 (high risk aversion).

This measure is based on credit spreads and implied volatility indicators. Note that the index is inverted relative to the two above, indicating the perceived level of risk in the markets rather than the risk appetite.

Based on this third risk measure, the perception of risk in the system is now the lowest since early 2010, before the Greek sovereign debt issue first moved the markets in a material way.

Other than the underperformance of emerging markets equities, the overall risk aversion seems to be declining toward multi-year lows. Welcome to the new "new normal," where central banks set the level of risk appetite - and right now they simply want risk to be ignored (see discussion).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI