Latest North Korea Provocation Triggers Safe Haven Flows

Financial markets are back in risk aversion mode on Monday after the latest nuclear test from North Korea on Sunday triggered the usual safe haven rush.

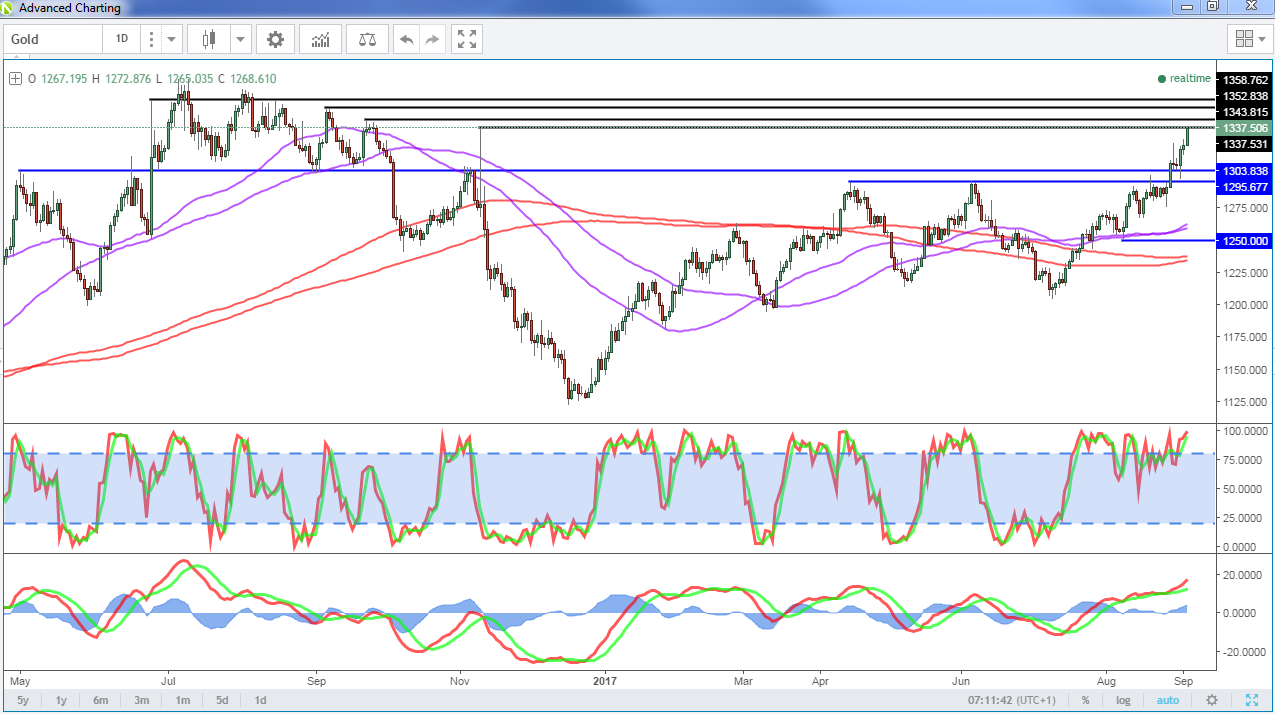

Gold touched new 10-month highs earlier in the session before finding resistance around last November’s peak. The yellow metal is currently around 0.7% higher on the day and continues to hold around the day’s high which suggests safe haven appetite has not waned as the Asian session has progressed.

Often these knee jerk reactions to such provocation don’t last too long but with these tests happening more frequently and the US responding with threats of aggression, these “risk off” periods may last a little longer. Gold has benefited greatly from this heightened geopolitical risk over the last month or two, breaking out of the $1,200-$1,300 range it had spent most of the year trading within in the process. It last traded around these highs throughout the second half of last year and found a lot of technical resistance between here and $1,375, which we may well see again.

With markets in risk off mode, equities are expected to struggle at the open, with futures pointing to losses between a quarter and a half of one percent. The yen and the Swiss franc are also getting their usual safe haven boost to complete the set.

The bank holiday’s in the US and Canada today will likely result in a much quieter session on Monday, particularly given the lack of economic events that typically accompanies them. There are a few pieces of data from around Europe being released this morning including the UK construction PMI, Spanish unemployment and eurozone investor confidence but after that it goes very quiet.

ECB Stages Another Mini Intervention Ahead of Thursday’s Decision

The rest of the week will be anything but quiet though, with numerous central banks scheduled to meet. The most notable of these will be the ECB, which meets on Thursday. This week’s meeting was widely believed to be the one at which the central bank will announce further tapering of its QE program but with policy makers becoming increasingly uncomfortable with the euro exchange rate, they may now hold off on the announcement until later in the year.

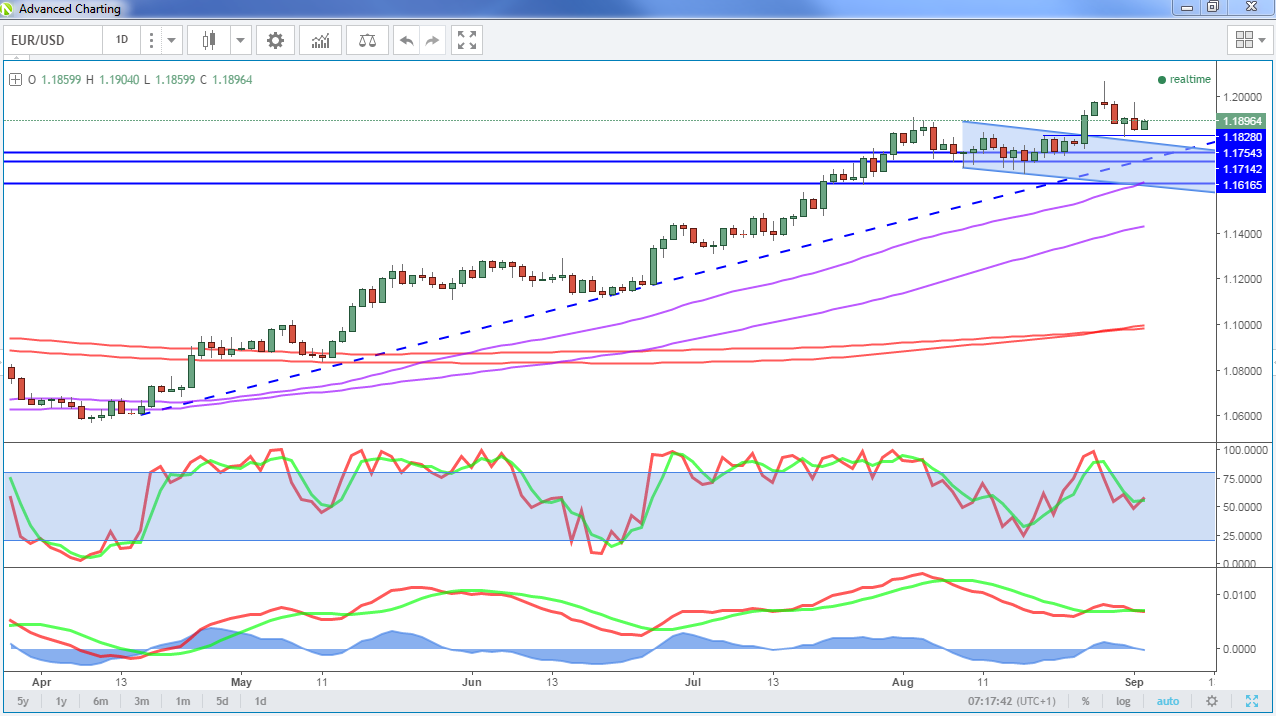

The timing of Friday’s comments from an ECB “source” alluding to a delay in a tapering decision seems far more than a coincidence, coming minutes after the jobs report release which weighed on the dollar and appeared on course to push EUR/USD through 1.20 once again. With these mini interventions from the ECB becoming a bit of a habit, it will be interesting to see if traders start to become nervous around these levels or decide to test the central bank’s resolve.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.