TSMC Q2 profit soars 61% to record high; sees AI demand offsetting forex headwinds

We have been discussing for the last couple of months about the weakness that will potentially show up in the economy as the unseasonably warm winter returns to more normalized, and if you live in Texas this means "hot", weather. Yesterday, we got the latest manufacturing release from the Richmond Federal Reserve District which showed growth slowing sharply which underscored the even weaker results in last week's Mid-Atlantic report from the Philly Fed. The Richmond Fed's manufacturing plunged by 10 points to 4.

The internals were weak with shipments flat and new orders showing only minimal growth. The lack of growth in new orders, combined with a big contraction in backlog orders, point to weakness for future shipments. The build in inventories is also concerning and the overall report points to future weakness in the report in the months ahead.

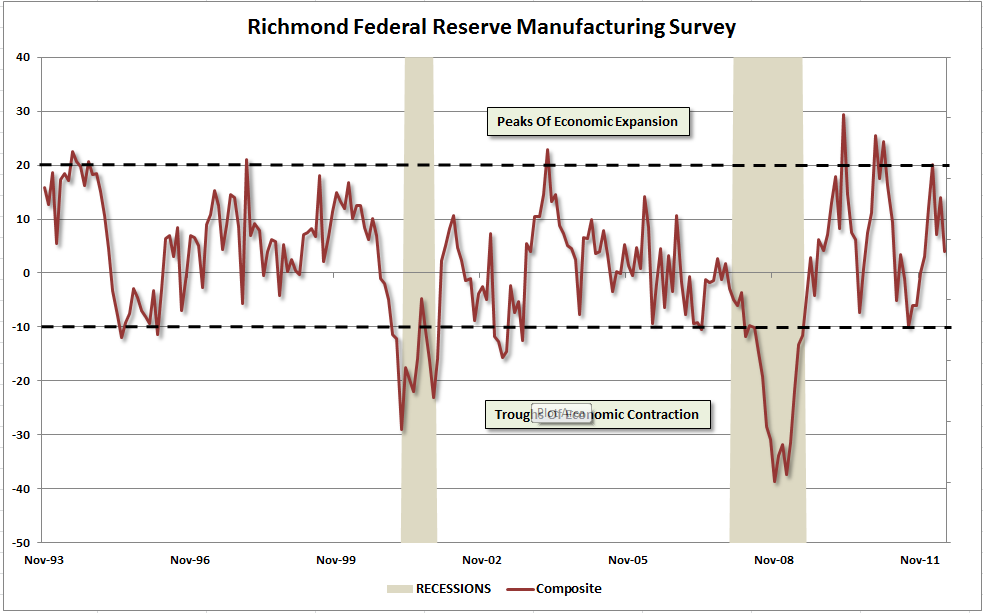

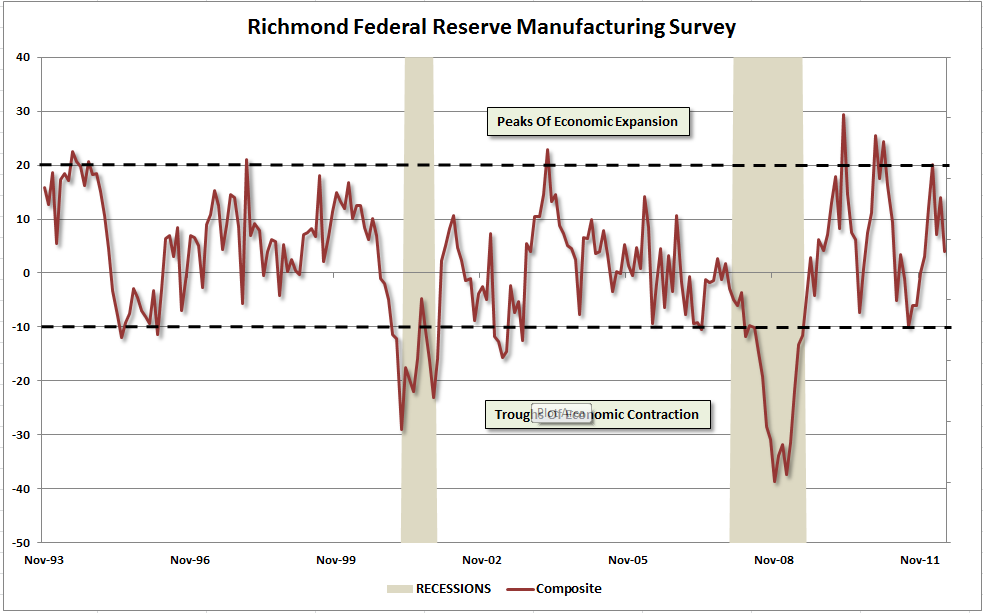

The chart shows the Richmond Fed Index. What is important to note is that the index has peaked three successive times at what has historically been the peak of economic expansions. Those three successive peaks also coincide with the ends of Fed induced liquidity programs (QE 1&2, Operation Twist). With the index falling, and very likely to move into contractionary territory during the next read, the data is piling up on the Fed that economic weakness is beginning to return.

What is more discouraging in this report, and a common theme through all the recent manufacturing reports, has been the marked declines in expectations in the coming six months. In almost every case there has been a decline in expectations of employment, capital expenditures, sales and production. Weaker forecasts translate into a defensive posture by companies which will crimp hiring, cap wages and increase cost cutting measures. All of these actions will have an impact on future economic growth rates negatively.

With the current economic growth trend already below 2% the economy has little room to ward off any economic downturn or shock. The economy faces peril from the Eurozone, the debt ceiling debate and the "fiscal cliff" (the 42 tax provisions that expire at the end of this year — including the Bush tax cuts) which represents a 4% drag on economic growth. Doing some quick math we can see that 2% minus 4% translates to a 2% contraction in GDP.

The likelihood of a recession in 2013 remains very high with the only real offset to that will be subsequent rounds of QE from the Fed in the coming months ahead. We think that this is a very high probability case as the data mounts that the economy is beginning to deteriorate. The Fed needs "permission" to implement further rounds of QE without negatively affecting the current Administration's re-election bid so further deterioration in the economic statistics and decline in the stock market will give the Fed the room they need to maneuver.

The truth is that this will continue to be a bumpy ride.

The internals were weak with shipments flat and new orders showing only minimal growth. The lack of growth in new orders, combined with a big contraction in backlog orders, point to weakness for future shipments. The build in inventories is also concerning and the overall report points to future weakness in the report in the months ahead.

The chart shows the Richmond Fed Index. What is important to note is that the index has peaked three successive times at what has historically been the peak of economic expansions. Those three successive peaks also coincide with the ends of Fed induced liquidity programs (QE 1&2, Operation Twist). With the index falling, and very likely to move into contractionary territory during the next read, the data is piling up on the Fed that economic weakness is beginning to return.

What is more discouraging in this report, and a common theme through all the recent manufacturing reports, has been the marked declines in expectations in the coming six months. In almost every case there has been a decline in expectations of employment, capital expenditures, sales and production. Weaker forecasts translate into a defensive posture by companies which will crimp hiring, cap wages and increase cost cutting measures. All of these actions will have an impact on future economic growth rates negatively.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

With the current economic growth trend already below 2% the economy has little room to ward off any economic downturn or shock. The economy faces peril from the Eurozone, the debt ceiling debate and the "fiscal cliff" (the 42 tax provisions that expire at the end of this year — including the Bush tax cuts) which represents a 4% drag on economic growth. Doing some quick math we can see that 2% minus 4% translates to a 2% contraction in GDP.

The likelihood of a recession in 2013 remains very high with the only real offset to that will be subsequent rounds of QE from the Fed in the coming months ahead. We think that this is a very high probability case as the data mounts that the economy is beginning to deteriorate. The Fed needs "permission" to implement further rounds of QE without negatively affecting the current Administration's re-election bid so further deterioration in the economic statistics and decline in the stock market will give the Fed the room they need to maneuver.

The truth is that this will continue to be a bumpy ride.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.