Bitcoin price today: gains to $120k, near record high on U.S. regulatory cheer

The Fed's messaging was rightfully interpreted as dovish – full employment is, in effect, its single mandate now. Yes, the central bank will tolerate higher inflation, and has prepped the markets for its advent. Fed Chair Jerome Powell managed to walk the fine line between economic optimism, pushback on the idea of raising rates or taper and yet, implicitly acknowledged the growing liquidity concerns with one little, gentle prod.

Markets naturally liked the tone, overlooking no mention of action on rising yields. Stocks, metals and commodities turned positive on the day – quite strongly so. The U.S. dollar declined visibly as long-term Treasuries recovered intraday losses on high volume.

It was a highly charged finish to the day. But today's analysis will show that little has actually changed in its internals. Rates are rising for the good reason that the economy is improving, and its outlook, reflation (economic growth rising faster than inflation and inflation expectations) hasn't given way to all-out inflation. Meanwhile, stocks with commodities remain in a secular bull market. We're in the decade of real assets outperforming paper ones, but that will become apparent only much later into the 2020s.

So, the central bank confirmed my assessment of its tone and take on Treasuries:

(…) I am not looking for the Fed to act today by adjusting its forward guidance stance or language, or taking a U-turn on inflation. No, they‘ll maintain the transitory stance even though markets are transitioning to a higher inflation environment already. The Fed won't do much this time.

They might not even talk about bringing down rates at the long end through a twist program. I certainly don't look for clues as to increasing the $120-billion monthly pace of monetary injections. Unless the market perceives the Fed as underplaying the threat of inflation and showing tolerance to its palpable overshoot, the overall mix of positions and conference statements might bring gold under renewed pressure as it meanders a little below $1,730 as we speak.

Long-term Treasuries … are weighing heavily on the markets. Stocks have gotten used to their message of rising inflation and economic recovery – but it's the precious metals that are suffering here, showing best in the copper-to-10-year Treasury yield ratio.

For gold, the key question remains whether copper upswings will outpace any yield increases on the long end, which have moderated their increases in March compared to February. That‘s good but not nearly enough given that even gold afficionados have come to expect lower prices lately quite en masse. Sign of capitulation off which the upswing was born? Yes, and the key questions now are whether we're seeing a pause, or a top in the upswing, and whether the next selling pressure would break below the $1,670 zone or not.

And while we got good confidence yesterday, I don't see it as being strong enough to power precious metals higher immediately. It's nice that gold is decoupling from the rising yields, but I view its upswing as demanding on current and future patience. Gold miners are still showing the way, and will be a key barometer in telling whether today's premarket downswing in anti-dollar, risk-on plays is a meaningful turn or not. For now, the renewed long-term Treasury yield increases (and the tech selloff to a degree) point to re-emergence of lingering Fed doubts.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The upper knot in the S&P 500 upswing spells short-term caution. The chart posture would be stronger without it, but at the same time, the volume and candle are not indicating reversal. The most likely outcome of upcoming sessions still appears as resumption of the prior grind higher, which is in line with my message of consolidation followed by new highs as the most likely scenario.

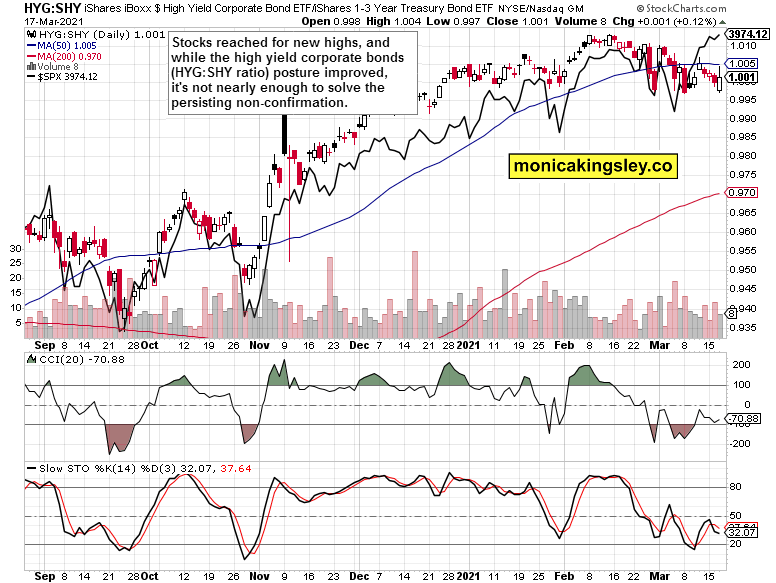

Credit Markets

The long upper knot in the high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio shows that the bond market isn't on board with the Fed – at a time when stocks aren't panicking in the least. Given the big picture in the economy and the combo of monetary and fiscal policy initiatives, I look for this to be a storm in a tea cup when it comes to (higher future) stock prices, and I am keenly on the lookout for possible deterioration in the corporate bond markets as relates to the S&P 500.

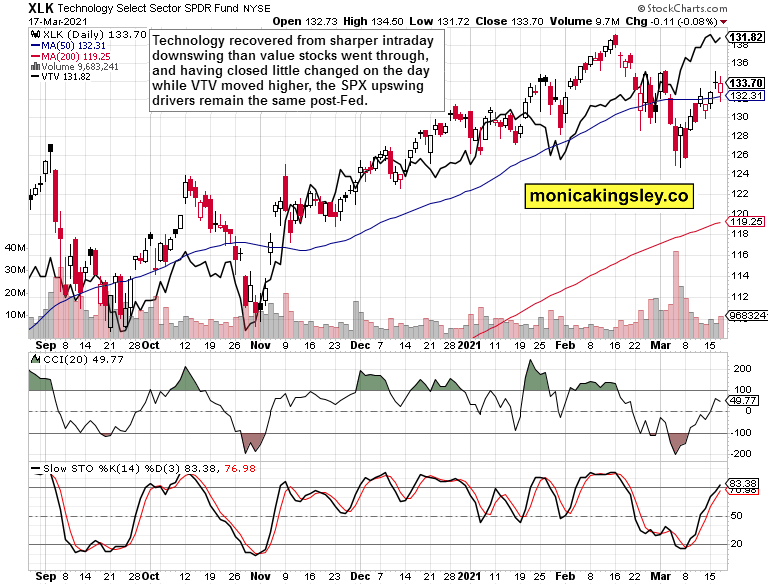

Technology and Value

The tech upswing wasn't really convincing, but it's been value stocks' turn to drive higher S&P 500 prices. No change in dynamic here. It's, however, a weak Russell 2000 or emerging markets that hint at headwinds in stocks for today. A play on patience, again.

Summary

S&P 500 is, in my view, merely testing the buyers' resolve, and doesn't want to turn the consolidation on a declining VIX into a rush to the exit door. Despite the surprisingly early turn against the Fed day move, this doesn‘t represent a trend change or arrival of the dreaded steep correction. The stock market bull is very far from making a top.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI