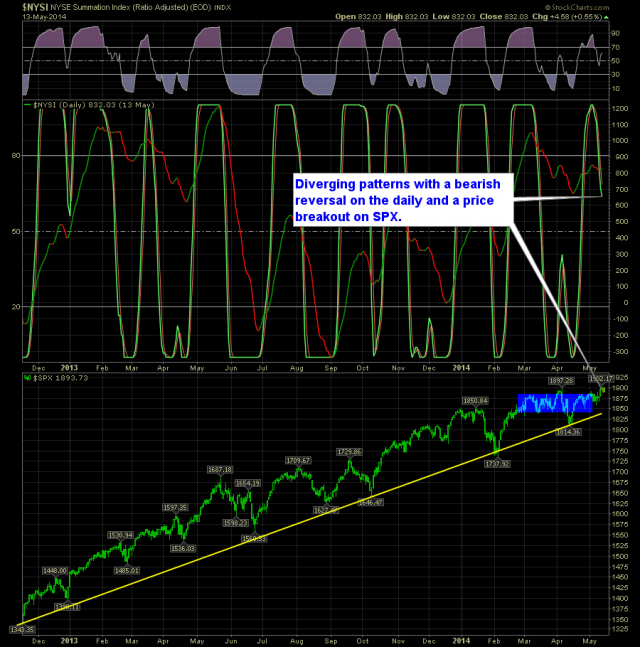

The SharePlanner Reversal Indicator (SPRI) is comprised of two separate view points: a daily and a weekly.

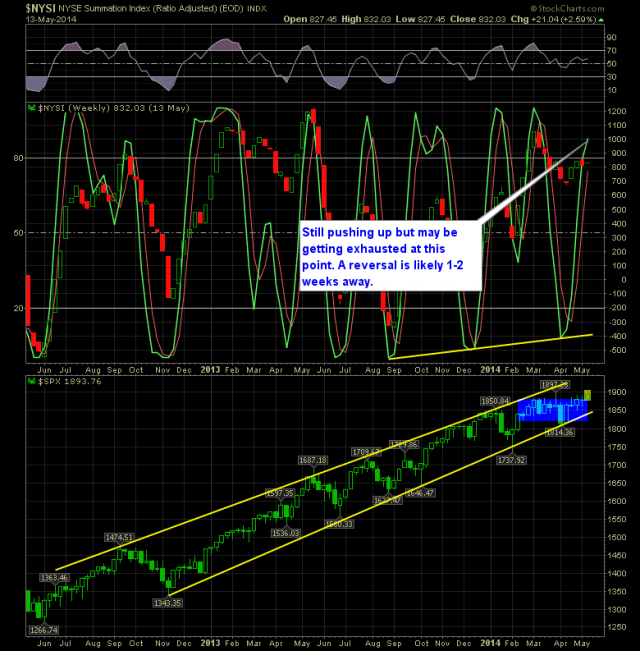

Typically the Weekly is a much stronger measurement of market direction going forward. The daily can be a bit more fickly as it reacts more to the day-to-day machinations of the stock market. As a result, when there is conflict between the two indicators, I will automatically default to the weekly SPRI unless I have overwhelming reasons otherwise.

Ideally it is best when both time frames are in agreement with each other. But that can't always be the case - as is the situation this week.

On the weekly, you can see where the conflict exists with the daily SPRI. The tendency in the past has been for the weekly to top out at extremes before providing us with a bearish reversal signal - which in this case is at least 1-2 weeks away.

Going for the bulls here as well is a significant price breakout that was achieved on Monday and looks to continue in that direction in the short-term. Both of which I think outweighs the bearishness being seen on the Daily SPRI.

I mentioned this in today's Trading Plan, that the one concern I have is whether we could be setting up for another repeat of what started on 4/4/14 after the S&P 500 broke out to new all time highs only to give it all back in very quick fashion.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI