Stock market today: S&P 500 in weekly loss as trade war fears intensifyy

The SharePlanner Reversal Indicator is out and there is a glimmer of hope for the bulls that is also being reflected in the price action the past three days.

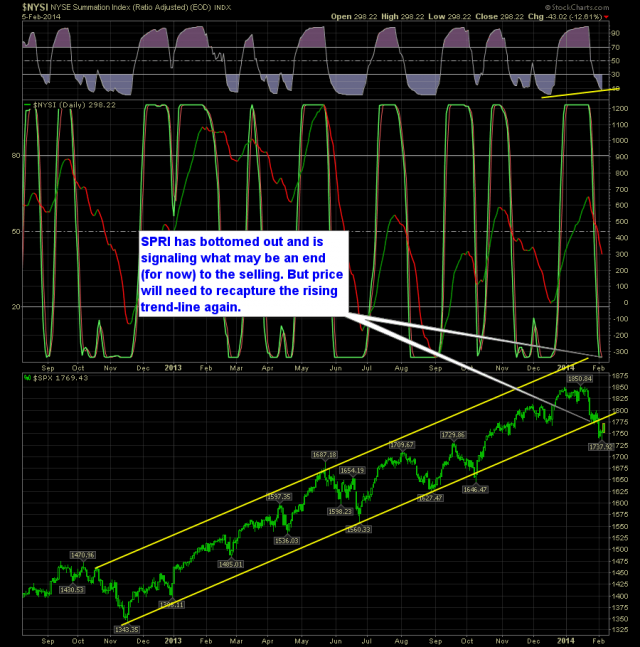

On the Daily SPRI, it has clearly bottomed and looking for a reversal to the upside:

Here's the daily indicator:

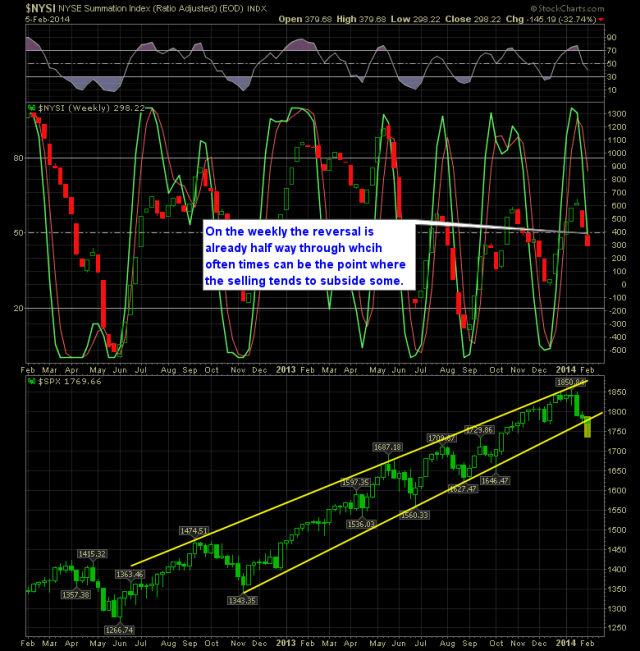

Now on the weekly, the story isn't as rosie, because the indicator is only a little bit halfway to the bottom.

Here's the weekly SPRI:

However, my experience with the SPRI is that it doesn't necessarily mean the market is going to still drop hard from here. Instead, I've seen plenty of instances where previous sell-offs occur in the top half of the SPRI reversal and then consolidate or pop higher in the second half of the SPRI downward move.

I also think that if another move is imminent, in this market it is more likely to occur after February's option expiration as traders are probably content to let this month's options expire with where the market is currently at.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.